Market Overview

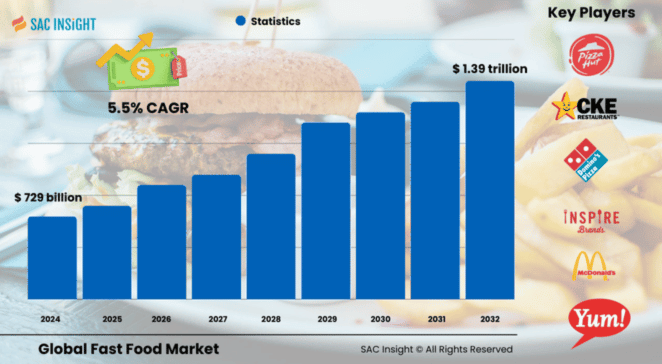

The global fast food market size is valued at approximately US$ 729 billion in 2024 and is projected to reach around US$ 1.39 trillion by 2032, advancing at a steady 5.5% CAGR over the 2026-2032 forecast window. First-hand industry insights highlight three structural forces behind this market growth: the rebound of out-of-home dining post-pandemic, the relentless expansion of delivery apps, and the rising influence of dual-income households seeking convenient meal solutions. SAC Insight analysis also shows a full recovery from lockdown lows, with order volumes in most major economies now well above 2019 levels. The U.S. fast food market is on track to top US$ 580 billion by 2032, driven by an expanding network of quick-service restaurants (QSRs) and aggressive digital loyalty programs.

Summary of Market Trends & Drivers

• Consumers are embracing hybrid consumption—on-premise breakfast, app-based lunch, and snack-size dinners—fueling all-day traffic for chains.

• Plant-based protein lines and limited-time “global flavor” menus are widening appeal while supporting premium pricing.

• Franchisees are upgrading to AI-enabled drive-thru and kitchen automation, trimming service times and labor costs.

Key Market Players

The fast food market report profiles global and regional leaders such as the largest burger, pizza, and sandwich brands alongside a rising cohort of delivery-first “virtual restaurant” operators. Established giants leverage vast marketing budgets and sophisticated supply chains, while insurgent cloud-kitchen specialists test niche menus at low capital outlay. Together, these firms set the competitive tempo through rapid menu refreshes, digital loyalty rollouts, and multi-brand co-location strategies.

Key Takeaways

• 2024 market value: ~USD$ 729 billion

• 2032 projection: ~USD$ 1.39 trillion at a 5.5% CAGR

• Burgers & sandwiches retain the largest product market share, but Asian & Latin American offerings post the fastest gains.

• QSRs capture over 44% of global revenue, with drive-thru formats outpacing dine-in recovery.

• North America leads in absolute spending; Asia-Pacific delivers the quickest incremental market growth.

• AI-driven kitchen automation can cut order-to-pickup times by up to 30%, lifting throughput and margins.

Market Dynamics

Drivers

• Rapid urbanization and larger working-age populations boost demand for quick, affordable meals.

• Proliferation of delivery platforms and subscription-based loyalty programs sustains high order frequency.

• Franchise-friendly financing supports accelerated outlet rollout in emerging markets.

Restraints

• Rising health awareness and obesity concerns prompt some consumers to limit high-calorie options.

• Supply-chain volatility—particularly meat and cooking oil prices—pressures operator margins.

Opportunities

• Expansion of plant-forward and “better-for-you” menus can attract health-conscious segments without sacrificing convenience.

• Automation (voice-AI ordering, robotic fry stations) offers cost savings and consistent service quality.

Challenges

• Intensifying regulatory scrutiny on sodium, trans-fats, and marketing to children may necessitate recipe reformulation.

• Labor shortages in key regions raise wage bills and complicate scaling plans.

Regional Analysis

• North America maintains the largest market share thanks to high per-capita spending and mature delivery ecosystems. Asia-Pacific, however, delivers double-digit gains on the back of rising disposable incomes, smartphone penetration, and the localization of Western chains’ menus. Europe shows steady recovery, supported by tourism and a flourishing café culture, while Latin America and the Middle East & Africa record medium-pace expansion as global brands enter tier-two cities.

• North America: High drive-thru density, strong digital loyalty uptake

• Europe: Tourism rebound, growing demand for ready-to-make breakfast items

• Asia-Pacific: Fastest growth, propelled by online delivery and urban middle class

• Latin America: Franchise expansion and youthful demographics support volume gains

• Middle East & Africa: Gradual adoption amid improving cold-chain logistics

Segmentation Analysis

By Product

• Burgers & Sandwiches – Core revenue engine.

These staples command the broadest consumer base and benefit from continuous menu innovation—think plant-based patties and breakfast variants—that keep traffic high.

• Pizza & Pasta – Delivery-friendly favorites.

Pizza’s share grows steadily as bundled family meals and app-exclusive deals boost basket size, while pasta concepts gain traction in fast-casual formats.

• Chicken – Protein-centric and portable.

Spicy coatings, boneless bites, and premium dipping sauces drive strong repeat sales, especially at dinner.

• Seafood – Niche yet resilient.

Shrimp and fish sandwiches find loyal followings in coastal markets, aided by seasonal promotions.

• Others – Desserts, salads, and sides.

Value-priced add-ons lift average ticket value and support cross-daypart sales.

By End User

• Quick Service Restaurants (QSRs) – Scale and speed.

Drive-thru lanes, kiosk ordering, and delivery partnerships make QSRs the dominant channel.

• Fast-Casual Restaurants – Premium ingredients, limited table service.

Higher price points and transparent sourcing resonate with health-minded diners.

• Others (food trucks, convenience stores) – Flexible formats.

These outlets capitalize on impulse purchases and event-based foot traffic.

By Service Type

• On-Premise – Dining room and drive-thru.

Remodels emphasize digital menu boards and curbside pickup lanes, shrinking legacy dining areas.

• Delivery & Take-Away – App-centric convenience.

Ghost kitchens and third-party couriers extend brand reach without heavy real-estate costs.

Industry Developments & Instances

• Oct 2024: A major burger chain launched AI-powered drive-thru voice ordering across 500 U.S. sites, reporting a 15% throughput boost.

• Sep 2024: A global pizza leader partnered with a robotics firm to pilot automated dough stretching in flagship stores.

• Jul 2024: A cloud-kitchen operator opened 250 delivery-only outlets in India under a long-term franchise agreement with an American sandwich brand.

• Jan 2024: Leading fried-chicken chain introduced plant-based nuggets nationwide after a successful regional test.

Facts & Figures

• Consumers worldwide order ~50 billion burgers each year.

• Drive-thru lanes account for over 60% of QSR transactions in North America.

• Digital orders represent nearly 35% of total fast food sales globally, up from 20% pre-pandemic.

• AI-enabled kitchen automation can reduce average labor hours per store by 8-10%.

• In the U.S., counties with rapid urbanization saw QSR outlet growth exceeding 30% over the last decade.

Analyst Review & Recommendations

SAC Insight evaluation indicates that convenience will remain the sector’s north star, but health-savvy consumers and rising input costs demand smarter execution. Brands that pair bold flavor innovation with transparent nutrition data, invest in automation to tame labor expenses, and localize menus for regional palates will outpace the pack. Over the next seven years, expect heightened competition for breakfast and late-night occasions, while partnerships with delivery platforms will stay central to capturing incremental market share.