Market Overview

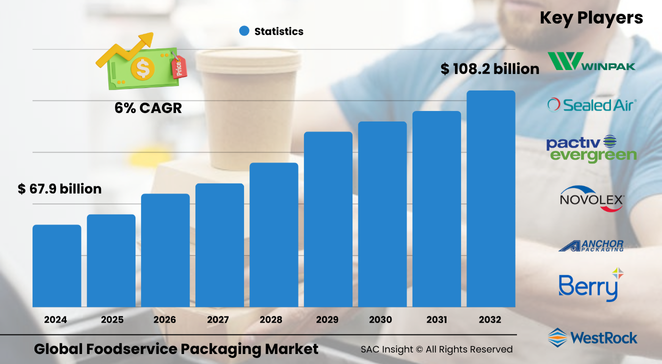

The global foodservice packaging market size is valued at roughly US$ 67.9 billion in 2024 and is set to climb to about US$ 108.2 billion by 2032, reflecting an average 6 % CAGR. First-hand industry insights highlight three structural growth engines: soaring demand for takeaway and delivery, rapid shifts toward recyclable materials, and technology-enabled smart packs that reassure consumers on food safety.

SAC Insight's deep market evaluation shows the United States alone could advance from about US$ 14.4 billion in 2024 to roughly US$ 22.6 billion by 2032 as quick-service chains double down on branded, compliance-ready designs.

Summary of Market Trends & Drivers

• Sustainability dominates market trends, with brand owners racing to cut single-use plastics and showcase circular credentials.

• Custom shapes, tamper-evident lids, and QR-enabled traceability are turning packaging into a marketing and data asset, accelerating market growth in premium segments.

Key Market Players

Established converters such as Pactiv, Berry Global, Novolex, Winpak, and Westrock command significant market share through broad portfolios and nationwide distribution. They leverage scale to invest in lightweight resins, high-barrier laminates, and closed-loop recycling pilots.

A second tier—Anchor Packaging, Gold Plast, Sealed Air, and regional specialists—focuses on niche formats like dual-oven-able trays or upscale reusable tableware, winning contracts with airlines, caterers, and gourmet meal-kit brands by offering short lead times and design agility.

Key Takeaways

• Current global market size (2024): USD$ 67.9 billion

• Projected global market size (2032): USD$ 108.2 billion at a 6 % CAGR

• North America holds about 23.6 % market share; East Asia is the fastest-growing hub for on-the-go formats

• Polyethylene terephthalate leads the material mix thanks to superior clarity and easy recyclability

• Thermoforming accounts for the largest fabrication share, offering cost-effective, high-volume runs

• Smart labels and freshness indicators are emerging as high-value add-ons, enhancing market analysis accuracy for waste reduction

Market Dynamics

Drivers

• Explosive growth of online food ordering demands leak-proof, temperature-resistant packs that travel well.

• Government bans on certain single-use plastics push converters toward bio-based substrates, unlocking new revenue streams.

• Investments in automated forming and printing lines cut unit costs and speed product roll-outs.

Restraints

• Volatile resin prices squeeze margins for small converters.

• Recycling infrastructure gaps in emerging markets slow adoption of mono-material designs.

• Strict food-contact certification timelines delay innovation cycles.

Opportunities

• Compostable coatings for paperboard open premium pricing windows with eco-conscious consumers.

• Partnerships with waste-management firms to pilot closed-loop collection can differentiate brands.

• IoT-enabled cold-chain monitors create upsell potential with high-value perishables.

Challenges

• Harmonizing labeling standards across jurisdictions raises compliance complexity.

• Balancing barrier performance with recyclability remains a materials-science hurdle.

• Labor shortages in skilled machine operation slow capacity expansion.

Regional Analysis

North America leads revenue owing to mature quick-service networks, stringent safety standards, and a vibrant start-up ecosystem for sustainable materials. Asia-Pacific delivers the steepest volume lifts as rising urban incomes spur takeaway culture and governments tighten food-hygiene rules.

• North America – Largest revenue base, strong demand for child-resistant lids and microwavable bowls

• Europe – High recovery targets accelerate fiber-based alternatives and molded pulp lids

• Asia-Pacific – Fastest CAGR driven by China’s single-use crackdowns and booming delivery apps

• Latin America – Expanding middle class fuels pizza-box and cup-lid orders; local sourcing mitigates currency swings

• Middle East & Africa – Tourism rebound and cloud kitchens boost disposable cutlery and portion packs

Segmentation Analysis

By Product Type

• Cups – Core volume driver.

Cups dominate because beverage orders ride the same delivery wave as meals, and embossing or color-coding offers low-cost brand visibility.

• Clamshells – Prime for burgers and combos.

Hinged designs keep food intact and heat-vented; sugarcane fiber variants are gaining traction in green procurement programs.

• Pizza Boxes – High surface area for branding.

Lightweight E-flute boards cut fiber usage while retaining stack strength, aligning with cost and sustainability goals.

• Cutlery & Stirrers – Growing toward bio-resin.

Compostable PLA and wooden options replace polystyrene, meeting emerging regional bans and reducing landfill burden.

• Single-Serve Portion Packs – Precision control on sauces.

They curb waste and enable hygienic, contact-free service in cafeterias and airlines.

By Material

• Polyethylene Terephthalate – Clear front-runner.

Its excellent barrier qualities and recyclability score make it a first choice for salads, cold drinks, and deli trays.

• Paperboard – Renewable appeal.

Coated grades withstand grease and moisture, supporting bakery and snack boxes while showcasing eco symbolism.

• Aluminum – Heat endurance niche.

Foil trays excel in oven-to-table convenience services, though higher cost limits use to premium and institutional channels.

• Molded Fiber – Rapid-rise substitute.

Bagasse and bamboo pulp formats tick both compostability and sturdiness boxes, catching the eye of zero-waste cafés.

• Polystyrene & Polypropylene – Cost-effective mainstays.

Despite regulatory scrutiny, they retain share where insulation and price trump recyclability.

By Fabrication Process

• Thermoforming – Scale king.

High-speed inline lines churn out lids and containers with minimal trim waste, keeping per-unit cost low.

• Die Cutting – Print-ready flexibility.

Ideal for pizza boxes and cup sleeves that need crisp graphics and quick tool changeovers.

• Injection Molding – Precision parts.

Used for cutlery and high-impact lids where dimensional stability and tight tolerances matter.

By End Use

• Foodservice Outlets – Anchor channel.

Quick-service and casual-dining brands rely on packaging to maintain product integrity and upsell combo meals.

• Institutional Foodservice – Steady baseline.

Hospitals and schools demand portion-controlled, tamper-evident packs to meet safety audits.

• Online Food Ordering – Fastest-growing slice.

Aggregator apps elevate demand for spill-proof designs that survive the last-mile ride without flavor loss.

Industry Developments & Instances

• 2023 – Huhtamaki launched Nature Stretch, a fiber-based stretch-wrap alternative targeting produce and catering trays.

• 2023 – Westrock unveiled DuraShield leak-proof paperboard bowls and cups for both hot and cold menus.

• 2024 – Leading QSR chain committed to 100 % recyclable or compostable consumer packaging by 2030, spurring supplier innovation sprints.

• 2024 – Major resin producer announced pilot plant for bio-based PET, aiming at commercial runs by 2025.

Facts & Figures

• East Asia is projected to command about 20.3 % of global revenue by 2034.

• Polyethylene Terephthalate segment could top USD$ 35.4 billion by 2034 at a 5.7 % CAGR.

• Thermoforming output represented roughly USD$ 22.8 billion in 2024.

• China’s market is poised to reach approximately USD$ 18.1 billion by 2034.

• Average weight reduction in clamshells has fallen 12 % since 2020 thanks to advanced sheet extrusion.

Analyst Review & Recommendations

Market analysis signals a decisive pivot toward circular, data-rich formats. Converters that marry lightweight thermoformed PET with post-consumer content and integrate scannable freshness cues will seize outsized market growth. We advise investing in multi-layer monomaterial structures for easier recycling, forging closed-loop alliances with delivery giants, and upskilling teams on emerging certification schemes to stay ahead of tightening environmental rules.