Market Overview

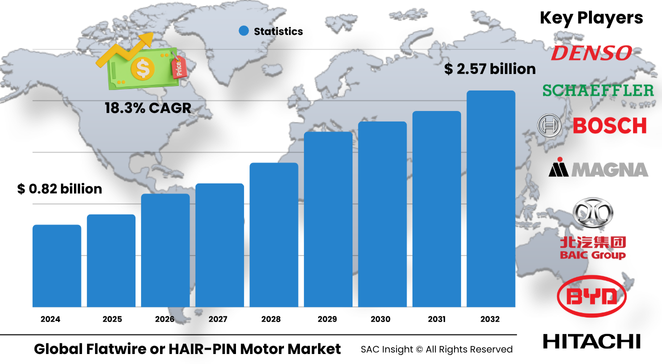

The global flatwire and HAIR-PIN motor market size is estimated at roughly US$ 0.82 billion in 2024 and is set to climb to about US$ 2.57 billion by 2032, reflecting an average 18.3 % CAGR. First-hand industry insights point to three clear growth engines: rapid electrification of passenger cars, steady migration toward space-saving windings in compact electronics, and SAC Insight's deep market evaluation showing OEM demand for higher power density without escalating copper cost. The United States flatwire and HAIR-PIN motor market alone could advance from an estimated US$ 0.2 billion today toward the half-billion mark by 2032 as automakers localize e-drive production.

Summary of Market Trends & Drivers

• Automakers are standardising hairpin winding to raise motor efficiency by up to ten percent while trimming stator assembly time.

• Miniaturised flatwire harnesses in consumer gadgets are shrinking device thickness, fuelling cross-industry technology spill-over and ongoing market growth.

Key Market Players

Global leadership rests with a blend of tier-one suppliers and specialised e-drive producers. Companies such as BorgWarner, Denso, Hitachi, Magna, and Schaeffler integrate hairpin stators into complete traction systems, leveraging vertical manufacturing footprints to secure market share.

Alongside them, Huayu Automotive Systems, HYCET Technology, Tianjin Santroll Electric Technology, Zhejiang Founder Motor, and fast-scaling Chinese EV groups provide regional capacity, while BYD and BAIC internalise motor lines to contain cost and shorten development cycles.

Key Takeaways

• Current global market size (2024): about USD$ 0.82 billion

• Projected global market size (2032): roughly USD$ 2.57 billion at an 18.3 % CAGR

• Asia Pacific captures close to 40 % market share on the back of aggressive EV rollout and manufacturing investments

• Hairpin winding already accounts for roughly 40 % of traction-motor production and is rising fastest

• Battery electric vehicles represent around 60 % of application revenue and will outpace hybrids through 2032

• First wave of automated pin-insertion lines cuts stator cycle time by 30 %, reshaping the industry cost curve

Market Dynamics

Drivers

• Surging EV production targets across China, Europe, and North America demand high-efficiency traction motors.

• Regulatory pressure for energy-efficient appliances pulls flatwire solutions into consumer electronics and industrial drives.

• Continuous advance in automated winding machinery reduces scrap and accelerates market analysis-driven adoption.

Restraints

• Higher upfront tooling and specialised machinery temper uptake among smaller motor makers.

• Supply pressure on high-grade copper flatwire can widen cost spreads versus conventional round wire.

Opportunities

• Renewable-energy inverters and e-axle modules offer white-space for flatwire stators beyond automotive.

• Lightweight hairpin motors in urban air mobility and aerospace prototypes create premium design-in prospects.

Challenges

• Standardisation gaps in testing and repair protocols raise service-life uncertainty for fleet operators.

• Geopolitical trade barriers may disrupt critical flatwire supply chains.

Regional Analysis

Asia Pacific dominates due to scale advantages in EV assembly, robust local toolmakers, and government incentives for high-efficiency motors. North America follows as automakers onshore e-drive capacity, while Europe benefits from stringent efficiency norms and sizeable hybrid programmes.

• Asia Pacific – Largest production base, fastest CAPEX expansion

• North America – Rising demand from pickup and SUV electrification, supportive industrial policy

• Europe – Tight CO2 standards sustain hairpin adoption in premium brands

• Latin America – Early-stage, linked to localised bus electrification

• Middle East & Africa – Niche industrial drives and renewable projects drive gradual uptake

Segmentation Analysis

By Type

• Hairpin winding – Efficiency leader, 40 % share.

Hairpin designs pack more copper, cut resistance, and simplify automated insertion, driving rapid OEM conversion.

• Rectangular winding – Cost-effective upgrade path.

Retains flat conductor benefits with simpler slot geometry, appealing to mid-volume manufacturers.

• Distributed winding – Smooth torque for low-noise drives.

Favoured in appliances where acoustic comfort outweighs peak power.

• Concentrated winding – Compact, high-torque bursts.

Delivers strong flux in starter-generator and robotics modules seeking small footprints.

• Wave winding – Emerging for ultra-power-dense niches.

Offers superior end-turn cooling, under evaluation in performance EVs.

By Application

• Battery Electric Vehicle – Core demand engine.

Accounts for about 60 % of market revenue; drivetrain electrification and longer range targets make high-fill-factor windings indispensable.

• Hybrid Electric Vehicle – Steady, regulation-driven uptake.

Hairpin motors help hybrids meet tightening fuel-economy rules without enlarging engine bays.

• Consumer Electronics – Thin form-factor adoption.

Flatwire harnesses reduce board height in wearables and laptops, a fast-growing secondary outlet.

By Motor Type

• Permanent Magnet – Dominant due to high power density.

Hairpin coils complement rare-earth rotors by lowering stator losses, extending EV range.

• Induction – Cost-sensitive alternative.

Flatwire improves copper utilisation and partially closes efficiency gap with PM machines.

• Brushless DC – Niche precision drives.

Concentrated flatwire coils enable compact hobby drones and medical pumps.

By End-Use Industry

• Automotive – Commands more than three-quarters of total market size.

Platform electrification roadmaps lock in multi-year volume visibility.

• Industrial Automation – Rising retrofit opportunity.

Gearless conveyors and robotics seek low-loss motors to trim operating expenses.

• Aerospace & Others – Emerging high-value stream.

Lightweight flatwire machines support e-VTOL thrust-vectoring and auxiliary power units.

Industry Developments & Instances

• May 2025 – A major tier-one supplier commissioned a fully automated hairpin stator line in Germany, lifting annual capacity by 300 000 units.

• February 2025 – Chinese OEM secured long-term flatwire contract to hedge copper volatility and ensure supply for next-gen SUVs.

• November 2024 – Start-up unveiled inverter-integrated hairpin motor achieving 6 kW/kg power density for urban air-taxi prototypes.

• August 2024 – Joint venture in North America broke ground on plant dedicated to wave-winding research for high-performance EVs.

• April 2024 – Appliance maker switched premium washer line to flatwire drives, citing 15 % energy savings.

Facts & Figures

• Hairpin stators can raise slot fill factor to 70 % versus roughly 50 % for round wire.

• Automated pin-welding cuts labour hours per stator from 45 minutes to under 20 minutes.

• Flatwire harness weight savings reach 20 % in smartphones, enabling slimmer device profiles.

• Asia Pacific’s 2023 market share stood near 40 %, with North America at 25 %, Europe at 20 %.

• Global BEV production surpassed 14 million units in 2024, underpinning sustained motor demand.

Analyst Review & Recommendations

Market analysis underscores a decisive pivot from hand-laid coils to automated flat-conductor architectures. Suppliers that combine high-throughput winding lines with robust insulation systems will capture outsized market share. We recommend prioritising copper-use optimisation, expanding regional coil-forming capacity to buffer trade risk, and partnering with inverter makers to deliver drop-in integrated e-drive modules. With an 18.3 % CAGR on the horizon, proactive investment in manufacturing agility will be crucial to outpace competitors and secure long-term market growth."