Market Overview

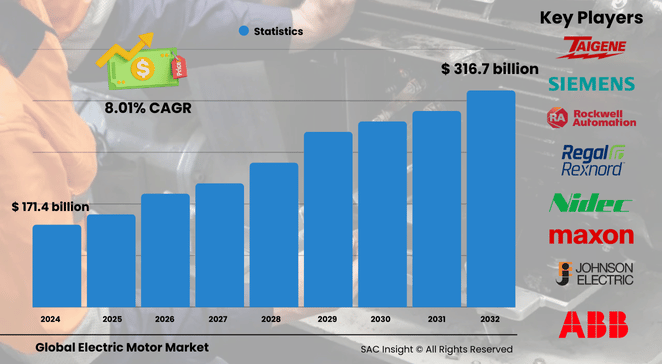

The global electric motor market size was valued at roughly US$ 171.47 billion in 2024 and is on track to reach about US$ 316.70 billion by 2032, registering a steady 8.01% CAGR over the 2025-2032 forecast window. First-hand industry insights indicate that accelerating electrification across vehicles, factories, and buildings, together with stringent carbon-reduction mandates, are reshaping demand patterns.

The U.S. electric motor market alone is poised to top US$ 51.30 billion by 2032 as domestic automakers ramp production of hybrid and battery-electric models.

Summary of Market Trends & Drivers

• Surging electric vehicle output and a widening charging ecosystem are pushing motor adoption well beyond legacy industrial domains.

• Smart buildings and retrofitted HVAC systems are specifying premium-efficiency AC drives to curb electricity bills and meet ESG targets.

• Manufacturers in Asia are automating assembly lines at a record pace, boosting orders for fractional-horsepower motors that power cobots, conveyors, and small pumps.

Key Market Players

Global leadership rests with diversified motion specialists such as ABB, Siemens, Schneider Electric, and Johnson Electric Holdings, each leveraging broad portfolios that span low-voltage AC units to high-voltage traction drives. Close behind, AMETEK, Nidec Motor Corporation, Franklin Electric, and Regal Rexnord are carving out share through targeted acquisitions, region-specific product tweaks, and fast rollouts of brushless DC platforms for e-mobility and HVAC. Collectively, these companies dictate technology roadmaps and pricing discipline while fostering cross-industry standards for efficiency and reliability.

Key Takeaways

• 2024 global market value: USD$ 171.47 billion

• 2032 forecast value: USD$ 316.70 billion at an 8.01% CAGR

• AC motors capture roughly 71.2% market share thanks to broad suitability and falling electronics costs.

• Asia Pacific commands nearly 46% of 2024 revenue, led by China’s EV export boom and rapid factory automation.

• Fractional-horsepower units dominate household and light-industrial uses, while integral-horsepower motors are the fastest-growing class in heavy processing and utilities.

• Government incentives tied to net-zero goals are accelerating the replacement of low-efficiency legacy stock.

Market Dynamics

Drivers

• Intensifying policy pressure to decarbonize transport and industry fuels demand for high-efficiency motors.

• Ongoing advances in permanent-magnet materials and power electronics are boosting torque density and reducing system footprints.

• Rising automation of small and medium enterprises spurs steady motor growth at the sub-1 HP level.

Restraints

• Volatile rare-earth prices add cost pressure to premium brushless designs.

• Skilled-labor shortages slow adoption of advanced drive systems in some emerging markets.

Opportunities

• Retrofitting aging HVAC fleets in commercial real estate presents a multibillion-dollar service and replacement opportunity.

• Smart, IoT-enabled motors with embedded condition monitoring unlock new recurring-revenue service models.

Challenges

• Fragmented efficiency standards across regions complicate global product harmonization.

• Supply-chain disruptions for power semiconductors and magnets can delay OEM launch schedules.

Regional Analysis

Asia Pacific remains the growth engine, driven by EV assembly clusters, robust government subsidies, and aggressive factory modernization programs. Europe follows, underpinned by stringent energy-efficiency mandates and fast-growing heat-pump installations, while North America benefits from reshoring incentives and pervasive warehouse automation.

• Asia Pacific – Largest revenue contributor; EV exports and automation lift demand.

• Europe – Strong regulatory push for high-efficiency motors and renewable integration.

• North America – Healthy uptake in automotive, food processing, and logistics.

• Latin America – Gradual adoption in mining and agriculture; currency stability will shape volumes.

• Middle East & Africa – Infrastructure projects and desalination plants create niche high-horsepower demand.

Segmentation Analysis

By Motor Type

• AC Motors – Cost-effective workhorse with dominant share

AC motors pair easily with variable-frequency drives and deliver reliable performance across fans, pumps, and EV powertrains.

• DC Motors – Growing in mobility and robotics

Brushless DC designs gain ground in e-scooters, drones, and warehouse robots, valued for high power density and precise speed control.

• Hermetic Motors – Fastest CAGR in cooling applications

Sealed designs thrive in commercial chillers, cold-chain logistics, and residential refrigeration where leak-free operation matters.

By Power Output

• Fractional Horsepower (Up to 1 HP) – Core of household and light-industrial demand

These compact units power everything from mixers to desktop CNC routers, and their efficiency gains translate directly into lower utility bills.

• Integral Horsepower (Above 1 HP) – Rising on plant automation

As factories digitize, demand for 10–500 HP motors in conveyors, compressors, and large pumps is climbing, supported by stricter utility rebates tied to premium-efficiency ratings.

By Voltage

• Up to 1 kV – Dominant in consumer appliances and light commercial gear

Low-voltage motors stay favored for safety and ease of integration in residential and office settings.

• 1 kV–6.6 kV – Backbone of heavy industry

Steel mills, water utilities, and chemical plants rely on this class to drive large compressors, blowers, and mixers under harsh conditions.

• Above 6.6 kV – Niche but critical for grid-scale pumps and pipelines

Utilities and large-scale infrastructure projects specify these units for reliability in high-duty cycles.

By Application

• Industrial Machinery – Largest slice as factories seek uptime and energy savings

High-efficiency retrofits lower operating costs and ease ESG reporting pressure.

• Motor Vehicles – Fastest growth on electrification wave

Passenger EVs, mild hybrids, and electric buses require multiple traction and auxiliary motors per vehicle, multiplying unit demand.

• HVAC Equipment – Significant growth as offices go smart and governments push green building codes

Premium-efficiency motors slash cooling costs and qualify for tax incentives.

• Electrical Appliances – Stable backbone segment

Continued urbanization keeps demand firm for washer, dryer, and refrigerator motors, even as unit efficiencies climb.

• Others – Aerospace actuation, medical devices, and marine propulsion offer specialized, high-margin niches.

By End-User

• Industrial – Drives bulk revenue through 24/7 operations and rapid modernization.

• Commercial – Office complexes and data centers weigh in with sophisticated climate-control loads.

• Residential – Volume-driven, especially in Asia’s expanding middle class.

• Agriculture – Pumps and irrigation systems increasingly shift to variable-speed drives for water efficiency.

• Transportation – Rail, marine, and new-energy vehicles widen the addressable base for high-torque designs.

Industry Developments & Recent Market Developments

• October 2024 – A leading European group acquired a vertical-pump specialist to deepen its high-horsepower portfolio.

• September 2024 – A Brazilian manufacturer snapped up a Turkish motor maker, adding 290,000 sq ft of capacity to serve European and Asian customers.

• May 2024 – A global motion company launched a compact permanent-magnet motor-inverter package tailored for city buses and last-mile delivery vans.

• August 2023 – A multinational opened a 7,000 m² service and assembly hub in Türkiye to trim lead times across Eastern Europe and Southwest Asia.

• February 2021 – A German ship-propulsion supplier secured an order for permanent-magnet motors on a new Canadian coastal ferry, highlighting marine electrification momentum.

Facts & Figures

• AC motors account for about 71.2% of 2024 global revenue.

• Asia Pacific captured nearly 46% market share in 2024.

• Brushless DC motor installations in logistics robotics grew roughly 30% year-on-year in 2023.

• High-efficiency motor retrofits can slash industrial power bills by up to 25% within one payback cycle.

• Plug-in and hybrid vehicle sales expanded their share of new-car registrations from 17.8% to 18.7% in the first half of 2024.

Analyst Review & Recommendations

Rising electrification across transport, industry, and buildings keeps the electric motor arena on a clear upward trajectory. Players that couple premium-efficiency hardware with digital monitoring and region-specific service packages will secure outsized margins. In the near term, reinforcing supply-chain resilience for magnets and semiconductors is vital. Over the long haul, embedding AI-driven condition monitoring and offering retrofit-ready kits for aging HVAC and industrial systems present the most attractive growth paths as sustainability budgets unlock fresh capex.