Market Overview

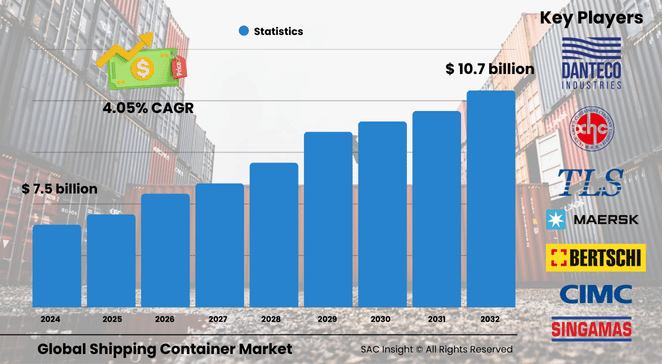

The global shipping container market size stood at USD$ 7.5 billion in 2024 and is projected to reach at USD$ 10.7 billion by 2032, advancing at a 4.05% CAGR during the forecast period. First-hand industry insights highlight three structural drivers: expanding cross-border e-commerce, rising investments in smart port infrastructure, and a steady pivot toward greener logistics. SAC Insight evaluation also shows that demand has normalized after pandemic-era volatility, with fleet utilization stabilizing and freight rates edging toward long-run averages. In the United States, sustained import volumes through West and Gulf Coast hubs suggest robust future growth, supported by ongoing intermodal upgrades.

Summary of Market Trends & Drivers

• Digitalization of boxes—IoT sensors for location, temperature, and vibration—continues to improve asset visibility and reduce dwell times.

• Large 40-foot units are gaining preference among shippers looking to cut per-unit transport costs and carbon intensity.

• Heightened ESG mandates are pushing operators to trial recycled-steel construction and bio-based coatings, signaling an era of low-impact container design.

Key Market Players

The shipping container market competitive landscape is shaped by a handful of integrated manufacturers and leasing giants. Global leaders such as China International Marine Containers, Maersk Container Industry, CXIC Group, Singamas, Dong Fang International Container, and Sea Box focus on scale, diversified product lines, and smart-box retrofits. Mid-sized specialists, including W&K Container and CARU, emphasize niche offerings like modular accommodation units and customized flat racks, adding flexibility to the broader ecosystem.

Key Takeaways

• Market value in 2024: USD$ 7.5 billion

• Projected 2032 value: USD$ 10.7 billion at a 4.05% CAGR

• Asia-Pacific commands 47.1% market share; North America is the fastest-growing region at approximately a 6%-plus pace.

• Dry storage containers represent 64.9% of global demand, while large 40-foot units account for 53.8% of shipments.

• IoT-enabled “smart” boxes are moving from pilot to mainstream, cutting unplanned downtime by up to 20%.

• Sustainability initiatives—recycled steel, solar lids, low-VOC paints—are reshaping procurement criteria.

Market Dynamics

Drivers

• Expansion of global trade corridors and regional free-trade agreements is fueling containerized exports and imports.

• Rapid growth of e-commerce and omnichannel retail requires flexible, reliable sea-borne logistics.

• Technological upgrades—real-time tracking, predictive maintenance—amplify efficiency and lower total cost of ownership.

Restraints

• Persistent equipment imbalances and periodic shortages inflate lease rates and slow order fulfillment.

• Port congestion and aging landside infrastructure create bottlenecks that erode service reliability.

Opportunities

• Sustainable container solutions (recycled alloys, modular refurbishments) align with shippers’ decarbonization goals.

• Conversions into pop-up retail, housing, and disaster-relief units unlock non-traditional revenue streams for operators.

Challenges

• Volatile steel prices pressure margins and complicate long-term supply contracts.

• Regulatory scrutiny on antitrust grounds can stall large M&A plays, limiting rapid consolidation.

Regional Analysis

The shipping container market in Asia-Pacific dominates due to high export-oriented manufacturing and continuous port capacity expansion, while North America delivers the quickest market growth on the back of robust consumer imports and intermodal efficiency projects. Europe shows steady replacement demand, and Latin America plus the Middle East & Africa are emerging as trans-shipment and manufacturing alternatives.

• Asia-Pacific: Nearly half of global market share driven by China, Korea, Japan, India, and ASEAN trade flows.

• North America: 6%-plus CAGR, buoyed by modern rail links and automation at key U.S. gateways.

• Europe: Mature market focused on fleet renewal and stricter CO₂ compliance.

• Latin America: Rising agricultural exports and near-shoring strategies spur container demand.

• Middle East & Africa: Strategic investment in deep-water ports positions the region as a logistics bridge between East and West.

Segmentation Analysis

By Size

• Small Containers (20 ft) – Core unit for niche, high-density cargo

These compact boxes remain crucial for heavier commodities and ports with draft restrictions, offering easy handling and lower slot costs when weight, not volume, is the limiting factor.

• Large Containers (40 ft) – 53.8% share and climbing

Shippers favor 40-foot units for superior economies of scale, squeezing 50% more volume into a slot and reducing emissions per tonne-kilometer. Expect further uptake as carriers incentivize high-cube variants.

• High Cube Containers (40 ft HC) – Growth segment for voluminous goods

With an extra foot of internal height, HC boxes accommodate light, bulky items and enable high-stack warehouse conversions, making logistics chains more space-efficient.

By Type

• Dry Storage Containers – 64.9% share, backbone of global trade

Universally versatile, these boxes move consumer goods, machinery, and packaged foods without refrigeration, remaining the default choice for non-perishable freight. Their standardized build speeds transfers between ship, rail, and truck, keeping logistics costs in check for most shippers.

• Refrigerated Containers – Rising for pharmaceuticals and perishables

As cold-chain demand soars, reefers with embedded telemetry help protect food and vaccine quality, expanding their footprint on north–south routes.

• Tank Containers – Niche, safety-critical market

Purpose-built for chemicals and liquefied gases, tanks leverage ISO standards to offer safer, more efficient alternatives to drums and flexi-bags.

• Flat Rack & Special-Purpose Containers – Heavy and oversized cargo solution

Detachable walls and reinforced floors suit machinery, vehicles, and project cargo, supporting sectors such as renewables and mining.

Industry Developments & Instances

• September 2024: A smart-container pioneer rolled out domestic IoT-enabled boxes in the Philippines, creating the country’s first real-time cargo visibility network.

• August 2024: A battery maker unveiled a 3 MWh zinc-chloride energy-storage unit housed in retired containers, extending asset life while powering micro-grids.

• August 2022: A planned merger between two top reefer suppliers was abandoned amid regulatory concerns over cold-chain concentration.

• May 2022: An Indian shipbuilder secured an order for 2,500 locally produced 12-foot containers, boosting indigenous capacity and easing equipment shortages.

Facts & Figures

• ~226 million TEU of box capacity circulates globally, up 3% year-on-year.

• IoT integration can cut annual maintenance costs by 15% through predictive analytics.

• Deploying one 40-foot high-cube container rather than two 20-foot units saves roughly 350 kg of CO₂ on a Shanghai-to-Rotterdam voyage.

• Dry bulk represented 62% of UK port dry-bulk tonnage in 2021, highlighting containerization’s encroachment on traditional break-bulk segments.

• Smart-reefers trimmed temperature excursions by 70% in recent pharmaceutical trials, reducing spoilage claims.

Analyst Review & Recommendations

Container demand is settling into a mid-single-digit growth trajectory as trade normalizes and capacity additions catch up. Operators that pair robust manufacturing scale with digital retrofit packages will preserve pricing power despite cyclical swings. Sustainability remains the fastest-opening door: recycled-steel builds, life-extension refurbishments, and modular reuse concepts can lift margins while meeting customer ESG targets. Lean into smart-box data monetization—predictive maintenance, utilization analytics, and cargo condition reports—to unlock new recurring revenue streams and stay ahead in this evolving market.