Market Overview

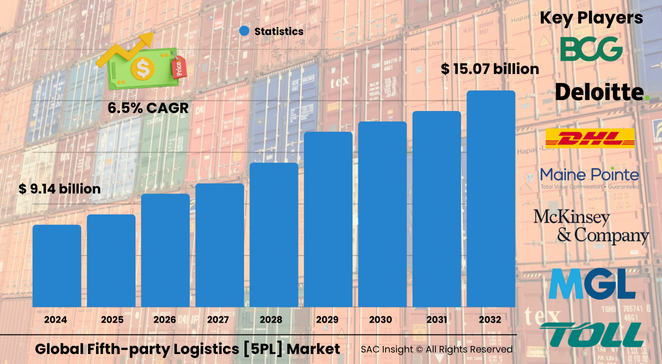

The global fifth-party logistics [5PL] market is valued at US$ 9.145 billion in 2024 and is projected to reach US$ 15.075 billion by 2032, expanding at an average 6.5 % CAGR over the 2025-2032 forecast window. First-hand industry insights reveal three clear growth engines: relentless e-commerce expansion, mounting demand for end-to-end supply-chain visibility, and rapid adoption of data-rich orchestration platforms that cut hand-offs and boost asset utilization. SAC Insight’s deep market evaluation shows the United States fifth-party logistics [5PL] market could advance from just over USD$ 2.6 billion in 2024 to nearly US$ 4.1 billion by 2032 as retailers and manufacturers shift to outcome-based logistics contracts for omnichannel fulfillment.

Summary of Market Trends & Drivers

• Blockchain-enabled control towers and AI-driven demand sensing are turning 5PL operations into predictive, rather than reactive, supply networks.

• Shippers are pooling freight across multiple 3PL partners to secure scale pricing and lower emissions, a core value proposition of every major 5PL Solution Market platform.

• Tight labor markets and last-mile congestion push companies toward automation-heavy distribution hubs run by specialist 5PL providers.

Key Market Players

The global fifth-party logistics [5PL] market competitive landscape blends consulting giants and pure-play logistics aggregators. Deloitte, Bain & Company, McKinsey, and Boston Consulting Group are leveraging strategy expertise to design bespoke digital control towers, while DHL International, Toll Holdings, MGL Global Logistics, and 5PL Logistics Solutions focus on execution depth. Renaissance Network Reinvent and Maine Pointe specialize in network re-engineering, and each is expanding cloud-based orchestration tools to capture greater market share as the 5PL Solution Market matures.

Key Takeaways

• Current global market size (2024): roughly US$ 9.145 billion

• Projected global market size (2032): US$ 15.075 billion at a 6.5 % CAGR

• Europe remains the revenue leader today; Asia-Pacific shows the fastest market growth through 2032

• Transportation services hold the largest segment share, but warehousing is climbing as cross-border inventory buffers gain favor

• E-commerce applications account for almost 40 % of total revenue and will stay the primary demand catalyst

• Real-time visibility and carbon-intensity reporting are emerging must-haves in every new 5PL contract

Market Dynamics

Drivers

• Boom in online retail volumes, with omnichannel models requiring unified network control.

• Rising preference for asset-light strategies that convert fixed logistics costs into variable fees.

• Proliferation of IoT devices and 5G connectivity enabling live tracking and performance benchmarking.

Restraints

• Complex multi-stakeholder data integration can slow onboarding and inflate initial project costs.

• Fragmented regulatory frameworks and customs rules hamper seamless global execution.

Opportunities

• Collaborative freight corridors designed around shared sustainability targets open fresh revenue streams.

• Advanced scenario-planning engines that model geopolitical shocks and weather-driven disruptions.

Challenges

• Cyber-security risks escalate as more partners connect to a common data spine.

• Talent shortages in data science and control-tower operations could cap service quality during peak seasons.

Regional Analysis

Europe currently dominates due to high technology adoption and stringent carbon reporting rules, while Asia-Pacific is set for the quickest acceleration thanks to manufacturing diversification and retail digitization. North America follows closely, propelled by large-scale warehousing automation and near-shoring trends.

• Europe – Technology-driven supply-chain redesigns keep outsourcing demand strong.

• North America – Robust e-commerce and cold-chain build-outs stimulate new 5PL contracts.

• Asia-Pacific – Highest CAGR as India and Southeast Asia scale digital retail and cross-border trade lanes.

• Latin America – Trade-agreement upgrades spark interest in regional consolidation hubs.

• Middle East & Africa – Free-zone logistics investments and port expansions attract niche 5PL services.

Segmentation Analysis

By Type

• Transportation – Core revenue engine.

High-capacity route optimization and multimodal orchestration keep transportation on top; control-tower algorithms continually re-route freight to skirt bottlenecks and trim dwell times.

• Warehousing – Fastest-rising slice.

IoT-enabled, high-bay fulfillment centers provide buffer capacity for volatile demand, driving increased reliance on 5PL providers for inventory balancing and returns processing.

• Other Services – Value-added edge.

Payment gateways, call-center support, and reverse-logistics programs deepen customer loyalty and create margin-rich ancillary earnings for providers.

By Application

• E-commerce – Principal demand pillar.

Flash-sale peaks and same-day delivery promises make aggregated network capacity indispensable; 5PL firms bundle multiple 3PL fleets to guarantee service levels.

• Traders – Growing niche.

Import-export houses use 5PL expertise to navigate tariffs, manage bonded storage, and consolidate less-than-container loads into cost-efficient shipments.

• Logistics Company – Integration play.

4PL and large 3PL players outsource orchestration layers to 5PL specialists to focus on core assets while unlocking broader market access.

• Others – Custom projects.

Sectors such as pharma and aerospace adopt 5PL control for temperature-sensitive or high-value cargo requiring end-to-end chain of custody.

Industry Developments & Instances

• April 2024 – XPO Logistics expanded French warehousing footprint by 42 %, adding integrated AI route-planning.

• October 2023 – DHL committed over US$ 350 million to new Southeast Asian distribution hubs with embedded blockchain visibility.

• April 2023 – Toll Group launched a pharma-grade warehouse in Melbourne featuring automated cold-chain robotics.

• November 2022 – A leading online marketplace activated its own branded 5PL service, bundling last-mile fleets with predictive analytics.

• December 2020 – A global retailer adopted a digital twin of its European supply network, cutting lead times by 18 % within twelve months.

Facts & Figures

• Transportation accounts for about 44 % of total 5PL Market revenue.

• E-commerce volumes handled by 5PL providers grew nearly 25 % year on year during 2023-2024.

• AI-based demand-sensing reduces safety-stock levels by up to 12 %.

• Integrated blockchain platforms can shave paperwork cycle times from days to minutes, saving roughly 3 % of shipment value.

• Warehousing robotics adoption within 5PL facilities topped 35 % in 2024 and is climbing steadily.

Analyst Review & Recommendations

Our market analysis underscores a decisive pivot toward data-centric orchestration that converts fragmented logistics chains into unified networks. Providers that embed predictive analytics, carbon-footprint dashboards, and responsive contract models will outpace average market growth. To secure market share, invest in cyber-resilient control towers, cultivate partnerships with tech start-ups for last-mile automation, and build flexible commercial terms that reward continuous improvement across the entire 5PL Solution Market.