Market Overview

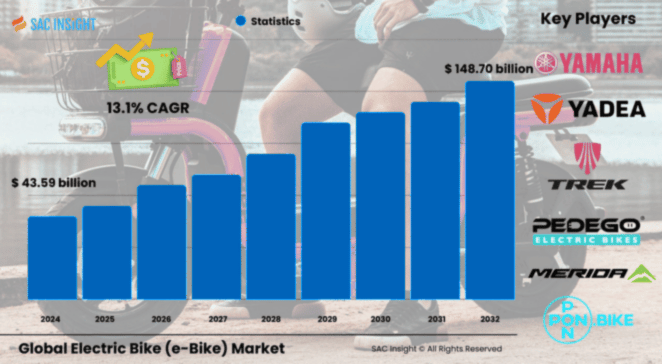

The electric bike market size was valued at US$ 43.59 billion in 2024 and is projected to reach about US$ 148.70 billion by 2032, expanding at a 13.1% CAGR during the 2025‑2032 forecast window. This robust market growth is powered by first-hand industry insights pointing to three clear factors: urban commuters seeking affordable, low-emission mobility; governments rolling out purchase incentives and cycling-lane networks; and steady advances in lightweight batteries and connected-bike systems. SAC Insight evaluation also shows the U.S. ebike market heading toward roughly US$ 2.83 billion by 2032 as fitness-oriented riders, delivery fleets, and micromobility apps converge on two-wheel electrification.

Summary of Market Trends & Drivers

• City riders are trading cars for e‑bikes to dodge congestion and fuel costs, pushing pedal-assist models into the mainstream.

• Connectivity, over-the-air firmware updates, and smartphone dashboards are shaping the next wave of product differentiation.

• Shared micromobility programs are exposing millions of first-time users to e‑bikes, converting trials into personal and corporate fleet sales.

Key Market Players

Global e‑bike industry leadership sits with a mix of established cycle houses and power-train innovators. Accell Group, Giant Manufacturing, Pon.Bike, Yadea, and Yamaha Motor anchor the high-volume, multi-brand end of the market, leveraging broad distribution and continuous product refreshes. U.S. specialists such as Pedego and Trek, along with performance players like Specialized, set the competitive tempo in premium city, cargo, and mountain segments, while Bafang, Bosch, and Brose dominate the mid- and hub-motor supply chain that underpins many OEM line-ups.

Key Takeaways

• Current global e-bike market size (2024): USD$ 43.59 billion

• Projected value (2032): USD$ 148.70 billion at a 13.1% CAGR

• Asia Pacific commands about 59% market share and will remain the core manufacturing and consumption hub.

• Lithium‑ion batteries hold the lion’s share thanks to falling costs and superior energy density.

• City/Urban e‑bikes are the dominant and fastest-growing application segment, followed closely by cargo models in North America.

• Mid‑drive motors are the fastest-growing motor type, while hub motors still supply the bulk of volume for entry-level bikes.

Market Dynamics

Drivers

• Rising fuel prices and urban congestion are steering commuters toward clean, affordable two‑wheelers.

• Government subsidies, tax credits, and cycling-infrastructure projects are accelerating consumer adoption and fleet electrification.

• Fitness and recreational appeal—especially among older riders—broadens the addressable customer base beyond daily commuters.

Restraints

• The upfront price premium versus conventional bicycles remains a hurdle, especially in price-sensitive Asia‑Pacific sub‑markets.

• Patchwork regulations on speed classes, motor wattage, and helmet laws complicate product standardization across borders.

• Limited dedicated bike lanes in emerging economies hinder full‑scale uptake.

Opportunities

• Connected‑bike platforms offering theft protection, predictive maintenance, and ride analytics can create sticky, recurring revenue streams.

• Replacement of lead‑acid batteries with lightweight lithium‑ion packs opens a sizable aftermarket upgrade business.

• Corporates and municipalities adopting cargo e‑bikes for last‑mile deliveries present fertile ground for fleet‑specific designs and leasing models.

Challenges

• Volatile lithium, cobalt, and nickel prices can squeeze margins and disrupt battery supply.

• Cybersecurity and data‑privacy concerns rise as e‑bikes become rolling IoT devices.

• Skilled service networks must scale quickly to handle warranty work on complex drive trains and electronics.

Regional Analysis

e-Bike market in Asia Pacific leads the market on the back of dense urban centers, strong domestic manufacturing, and supportive e-mobility policies, while Europe remains the technology trendsetter in mountain and trekking categories. North America shows the fastest unit-growth trajectory as state incentives, bike-lane expansions, and cargo-bike pilots gain traction.

Asia Pacific – Manufacturing powerhouse and largest consumer base; government e-mobility pushes boost sales in China, India, and Southeast Asia

Europe – Mature market with 63% share in mountain/trekking e-bikes; strict emission goals and cycling culture sustain demand

North America – Highest CAGR; rapid cargo-bike adoption for logistics and a growing wellness movement among commuters

Latin America – Early-stage growth helped by city-center congestion and budding shared-mobility operators

Middle East & Africa – Niche uptake focused on tourism hubs and urban pilot programs

Segmentation Analysis

By Class

• Class I – Pedal assist up to 25 km/h, mainstream share

Class I bikes appeal to daily commuters and entry-level riders looking for a natural cycling feel without licensing hurdles.

• Class II – Throttle enabled, regulated region‑by‑region

Throttle control attracts delivery riders and casual users but faces tougher road-use rules in Europe and parts of Asia.

• Class III – Speed pedelecs up to 45 km/h, performance niche

These high-speed units suit experienced riders and suburban commuters seeking car-like travel times, provided local laws permit their use.

By Speed

• Up to 25 km/h – Dominant volume contributor

Widely accepted for bike-lane use and covered by most incentive programs.

• 25–45 km/h – Premium growth pocket

Favored in Switzerland, the Netherlands, and select U.S. states for long-distance commutes.

By Mode

• Pedal Assist – Larger market share

Lower servicing needs and better battery life drive popularity among commuters.

• Throttle – Fastest CAGR in North America

Reduced pedaling effort appeals to delivery fleets and recreational off-road users.

By Motor Type

• Hub Motor – Workhorse solution

Cost-effective, low-maintenance, and suitable for city, folding, and cargo bikes.

• Mid‑Drive Motor – Fastest-growing segment

Centered weight distribution and higher torque win favor in mountain, trekking, and premium commuter models.

By Battery Type

• Lithium‑ion – Largest share, double-digit growth

High energy density, falling cell prices, and extended cycle life make Li-ion the default choice for OEMs.

• Lithium‑ion Polymer – Lightweight variant

Popular in compact city bikes where weight saving is critical.

• Lead Acid – Budget segment

Shrinking share as new regulations and weight penalties push fleets toward modern chemistries.

• Others (Nickel Metal Hydride, solid-state prototypes)

Remain niche but could gain traction as next-generation chemistries mature.

By Battery Capacity

• Below 250 W – Entry-level urban mobility

Suits short city hops and shared-fleet duty cycles.

• 251–450 W – Balanced price-to-range option

Addresses mainstream commuting and fitness uses.

• 451–650 W – Leading capacity band

Offers longer range for trekking and cargo applications without excessive weight.

• Above 650 W – High-power endurance class

Targets premium touring and off-road enthusiasts demanding extended range and faster climbs.

By Application/Usage

• City/Urban – Core demand engine

Government infrastructure and lifestyle shifts make this the largest and fastest-growing segment.

• Mountain/Trekking – Performance upgrade path

63% European share underscores strong appetite for assisted trail riding.

• Cargo/Luggage – Rapid growth in North America

Logistics firms and retailers adopt e-cargo bikes for cost-efficient last-mile delivery.

• Others – Folding and specialty models

Serve commuters with storage constraints and niche leisure activities.

By Component

• Battery – Largest revenue slice

Continuous R&D investments focus on higher density and rapid-charge chemistries.

• Electric Motors – Second-largest share

Mid-drive innovations and higher torque ratings lift average selling prices.

• Motor Controller – Critical for efficiency

Smart algorithms optimize power delivery and extend range.

• Frame with Forks – Integration hub

OEMs integrate cables, sensors, and battery housings for sleeker designs.

• Others (Brake systems, wheels, gears) – Safety and performance anchors

Hydraulic discs and automatic gear hubs improve ride confidence and reduce maintenance.

By Ownership

• Personal – Mainstay of unit sales

Consumers seek flexible commuting and fitness options.

• Shared – Fleet segment on the rise

Micromobility operators and corporate campuses deploy connected bikes to cut transport costs.

Industry Developments & Instances

• January 2025 – AIMA Technology debuted four city and trekking models at CES, signaling heavier R&D investment in export-ready designs.

• October 2024 – Accell Group rolled out full-suspension urban models and won a value-for-money award for an ABS-equipped SUV bike.

• July 2024 – Yamaha Motor merged its electronics subsidiary to fast-track electrification across two-wheel portfolios.

• May 2024 – Yadea introduced a compact folding model aimed at Asia’s dense urban commuters.

• January 2024 – AIMA partnered with Bafang to co-develop a high-efficiency motor platform tailored for long-range beach-cruiser variants.

• April 2022 – Independent retailers broadened service footprints in key U.S. corridors, improving after-sales support and brand visibility.

Facts & Figures

• 59.26% – Asia Pacific’s share of global e-bike revenue in 2023.

• 63% – Europe’s slice of mountain/trekking e-bike sales by value.

• 40% – Prospective buyers citing price as the primary barrier, highlighting room for subsidy-driven conversions.

• 90% – Decline in lithium-ion battery costs over the past decade, underpinning affordability gains.

• 157 million – Micro-mobility trips taken in North America in 2022, matching pre-pandemic levels and boosting exposure to e-bikes.

• ≥2,000 – Charge cycles achievable by modern lithium-ion packs, extending average battery lifetimes beyond five years of daily commuting.

Analyst Review & Recommendations

The electric bike market is moving from early-adopter novelty toward mass-market mobility tool. Brands that combine mid-drive torque, connected security, and transparent total-cost-of-ownership messaging will outpace rivals. Investors should watch battery-supply partnerships and software-defined service platforms, as these capabilities underpin recurring revenues and regulatory compliance. For new entrants, the fastest route to scale lies in city-bike fleets and cargo-bike contracts where immediate cost savings and emission cuts offer clear ROI. Mature players should double down on data privacy, after-sales service, and modular battery upgrades to lock in customer loyalty through 2032.