Market Overview

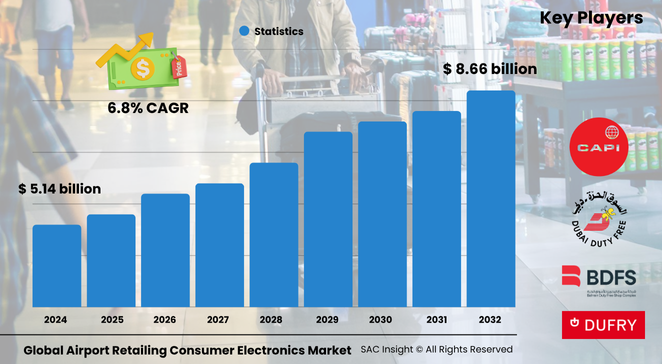

The global airport retailing consumer electronics market size is valued at roughly US$ 5.14 billion in 2024 and is projected to reach about US$ 8.66 billion by 2032, advancing at an average 6.8% CAGR during the 2025-2032 forecast window. SAC Insight's industry insights show that rising passenger traffic, widening disposable income, and a growing preference for on-the-go gadget upgrades are the dominant market growth catalysts.

SAC Insight's deep market evaluation indicates the United States airport retailing consumer electronics market alone could climb from roughly US$ 304.9 million in 2024 to around US$ 526.11 million by 2032 as airports refine duty-free layouts and embrace click-and-collect models.

Summary of Market Trends & Drivers

• Duty-free electronics zones are shifting from impulse stands to immersive showrooms that let travelers test devices, compare specs, and pay with touchless options.

• Medium and secondary hubs are diversifying revenue beyond airline fees by curating travel-friendly tech—noise-canceling headphones, power banks, smartwatches—boosting per-passenger spend.

• Hybrid retail that links e-commerce pre-order with airside pickup shortens dwell time and taps into growing online-first buying habits.

Key Market Players

Leading operators such as Crystal Media, InMotion, Dubai Duty-Free, Gebr. Heinemann, Lagardere Travel Retail, and China Duty-Free Group command significant market share through prime terminal locations, exclusive brand tie-ups, and rapid product-turnover strategies. Their competitive edge lies in blending premium gadget assortments with frictionless payment, localisation of accessory bundles, and data-driven merchandising that targets high-yield passenger segments.

Specialist newcomers—including Smartseller’s hybrid convenience-plus-electronics format and Regstaer Duty-Free’s focus on regional hubs—are widening the field. These firms leverage flexible store footprints and dynamic pricing engines to capture unmet demand in mid-traffic airports, heightening competitive intensity and accelerating product refresh cycles.

Key Takeaways

• Current global market size (2024): USD$ 5.14 billion

• Projected global market size (2032): USD$ 8.66 billion at a 6.8 % CAGR

• The U.S. market could top USD$ 526 million by 2032, driven by business-travel electronics upgrades

• Medium airports generate over USD$ 1.1 billion in 2024 revenue and outpace larger hubs at an 8.3 % CAGR

• Electronic devices account for approximately 36 % market share, led by smartphones, tablets, and headphones

• East Asia holds about 23.5 % market share, propelled by tech-savvy leisure travelers and expanding duty-free footprints

Market Dynamics

Drivers

• Rising global air travel volumes and longer layovers boost in-terminal retail footfall.

• Travelers value convenience and immediacy; replacing chargers or upgrading accessories in-transit fits modern lifestyles.

• Integration of mobile pre-order platforms with airside pickup reduces cart abandonment and lifts average ticket size.

Restraints

• Carry-on size limits and strict security checks deter purchases of bulkier devices.

• Price-sensitive passengers may postpone buys in favor of online deals outside airport environments.

Opportunities

• Eco-friendly gadgets and recyclable packaging can attract sustainability-minded flyers and justify premium pricing.

• Collaborations with leading tech brands for airport-exclusive SKUs drive differentiation and higher margins.

Challenges

• Exchange-rate volatility impacts perceived value of duty-free electronics.

• Supply-chain disruptions for key components (chips, batteries) can lead to out-of-stock situations and missed sales.

Regional Analysis

North America dominates revenue thanks to dense flight frequencies, high average income, and a culture of frequent device upgrades. East Asia follows closely, benefiting from gadget-oriented consumer behaviour and aggressive airport expansion programs. Europe leverages luxury positioning and strong intra-EU travel flows, while the Middle East capitalises on mega-hubs that pitch duty-free electronics as part of a broader premium travel experience.

• North America – Strongest revenue base, powered by business travel and quick-turn gadget needs

• Europe – Luxury-oriented merchandising and tech-forward airports sustain steady demand

• Asia-Pacific – Fastest percentage growth, underpinned by expanding middle-class tourism and digital-first consumers

• Latin America – Emerging growth as regional carriers add routes and airports upgrade retail space

• Middle East & Africa – Hub-and-spoke traffic funnels high-spend passengers through large-format duty-free stores

Segmentation Analysis

By Product Type

• Electronic Devices – Core revenue driver.

High-value items such as smartphones, tablets, and noise-canceling headphones dominate purchase intent, especially among frequent flyers needing performance upgrades before long-haul flights.

These premium devices command the largest ticket sizes, making them vital for hitting revenue targets despite lower unit volumes.

• Accessories – Volume engine.

Power banks, charging cables, and travel adapters sell briskly as last-minute essentials, driving steady turnover and impulse buys.

Their lower price points encourage multi-item baskets, cushioning sales in periods of softer big-device demand.

• Others – Niche smart gadgets.

Wearables, mini-drones, and VR viewers attract tech enthusiasts seeking novelty gifts or duty-free exclusives.

While smaller in market share, they create buzz and encourage repeat footfall.

By Airport Size

• Medium Airports – Fastest-growing tier.

These hubs aim to offset airline-fee reliance by curating compact yet experience-rich electronics corners.

Control over merchandising and community partnerships give them flexibility to tailor assortments to regional traveler profiles.

• Large Airports – High absolute sales.

Flagship stores with expansive inventories appeal to long-haul and luxury segments.

Integrated marketing campaigns and high-traffic gate locations assure consistent footfall.

• Small Airports – Opportunistic.

Pop-up kiosks and vending-machine electronics meet essential needs where space is limited.

Growth hinges on seasonal traffic spikes and charter operations.

By Sales Channel

• Duty-Free Shops – Price advantage anchor.

Tax-free pricing remains a primary pull, especially for premium headphones and flagship smartphones.

Strategic placement after security maximises dwell time and browsing.

• Specialty Retail Stores – Experience centres.

Hands-on demos, multilingual staff, and accessory bundling drive up-sell opportunities and customer loyalty.

These outlets often pilot new retail technologies such as AR product visualization.

• Online Pre-Order & Click-and-Collect – Rising convenience play.

Mobile-first passengers secure inventory and promotions before arrival, then collect airside.

This omni-channel approach trims queue times and captures digitally savvy shoppers who might otherwise bypass physical stores.

By Customer Type

• Business Travelers – High-margin segment.

They prioritise reliable laptops and audio devices for productivity, often expensing purchases.

Store layouts featuring quick-grab power accessories cater directly to their tight schedules.

• Leisure Travelers – Value seekers.

Vacationers hunt for special offers and souvenir gadgets, boosting accessory sales and limited-edition device uptake.

Family travel drives demand for tablets and portable gaming consoles.

• Frequent Flyers – Innovation adopters.

Elite passengers look for the newest wearables and smart-luggage trackers, underpinning repeat high-value transactions.

Loyalty-program integration enhances retention and upsell potential.

By Price Range

• Budget – Essential replacements.

Basic chargers and entry-level earbuds address emergency needs without straining wallets.

High turnover offsets lower margins.

• Mid-Range – Balanced performance.

Mainstream smartphones and branded headphones offer quality upgrades at moderate prices, appealing to broad demographics.

This tier captures the bulk of incremental revenue growth.

• Premium – Brand-led desirability.

Flagship phones, high-fidelity audio, and luxury smartwatches cater to affluent travelers and gift buyers.

Limited editions and airport-only bundles support premium positioning and margin expansion.

Industry Developments & Instances

• May 2025 – Smartseller extended its hybrid retail concept into two additional European regional hubs, blending grab-and-go F&B with curated electronics.

• February 2025 – A leading duty-free operator renewed a multiyear concession at a major U.K. airport, adding interactive demo zones for wearables.

• September 2024 – A Middle Eastern mega-hub introduced a mobile pre-order platform that links online catalogues with real-time stock visibility and gate-side pickup.

• May 2024 – InMotion partnered with a global audio brand to launch airport-exclusive limited-edition headphones, generating double-digit sales uplifts in launch month.

Facts & Figures

• East Asia captures roughly 23.5 % of current market share.

• Medium airports generated about USD$ 1.14 billion in electronics sales in 2024.

• Electronic devices segment is valued near USD$ 747.5 million in 2024 and could exceed USD$ 1.61 billion by 2032.

• Average passenger spends 7-10 minutes browsing electronics stores during layovers longer than 90 minutes.

• Touchless payment adoption in U.S. airport electronics outlets surpassed 65 % in 2024, cutting checkout times by up to 30 %.

Analyst Review & Recommendations

Airport electronics retail sits at the intersection of convenience and experience. Operators that fuse omni-channel pre-order, immersive in-store demos, and agile inventory management are best placed to outpace average market growth. We recommend prioritising medium-hub expansion, forging exclusive product launches with top tech brands, and deploying data analytics to tailor accessory bundles to flight profiles. Proactive supply-chain partnerships for fast-moving items—chargers, headphones, power banks—will mitigate stock-out risk and sustain momentum through 2032.