Market Overview

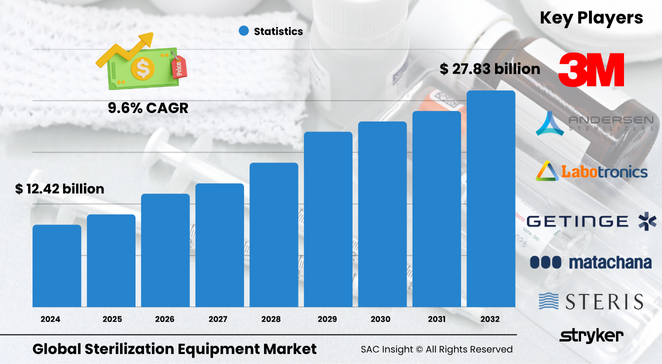

The global sterilization equipment market size is valued at roughly US$ 12.42 billion in 2024 and is projected to reach about US$ 27.83 billion by 2032, expanding at an average 9.6% CAGR. SAC Insight industry insights highlight three structural growth engines: stricter infection-control regulations, expanding procedure volumes in outpatient centers, and rapid adoption of low-temperature systems that safeguard heat-sensitive devices.

SAC Insight's deep market evaluation shows the United States sterilization equipment market alone could advance from about US$ 4.35 billion in 2024 to nearly USD$ 9.74 billion by 2032 as hospitals, labs, and contract sterilizers invest in modern, automated fleets.

Summary of Market Trends & Drivers

• Hospitals are migrating from legacy ethylene-oxide chambers to hydrogen-peroxide and nitrogen-dioxide units that cut cycle times and emissions.

• Disposable surgical kits and pre-filled syringes are multiplying, pushing demand for high-throughput terminal sterilization lines in pharma and med-tech plants.

• Outsourcing of sterilization services is rising among small device firms that lack in-house capacity, underpinning steady market growth.

Key Market Players

Industry leadership rests with a blend of diversified conglomerates and focused specialists. Firms such as STERIS, Getinge, and Fortive’s ASP command significant market share through broad portfolios spanning heat, gas-plasma, and monitoring products. Alongside them, companies like Steelco, Shinva, and MATACHANA emphasize modular, energy-efficient autoclaves, while 3M and TDK supply critical filtration and sensing components. Their competitive strategies center on smart controls, consumable ecosystems, and region-specific service hubs that shorten turnaround for healthcare clients.

Key Takeaways

• Current global market size (2024): about USD$ 12.42 billion

• Projected global market size (2032): roughly USD$ 27.83 billion at a 9.6 % CAGR

• North America holds close to 36 % market share, propelled by mandatory HAI-reduction programs

• Sterile membrane filters contribute the largest product revenue, exceeding 30 % of 2024 sales

• Heat sterilizers are the fastest-growing segment thanks to cost-effective steam autoclaves for instrument reprocessing

• Low-temperature NO2 and hydrogen-peroxide systems are reshaping market trends toward greener, material-friendly solutions

Market Dynamics

Drivers

• Rising surgical volumes, particularly minimally invasive and orthopedic procedures, require frequent reprocessing of complex instruments.

• Heightened awareness of healthcare-associated infections fuels investment in advanced sterilization monitoring and validation technologies.

• Expansion of biopharmaceutical manufacturing boosts demand for clean-room compatible filtration and radiation devices.

Restraints

• High capital cost of large autoclave installations can delay upgrades in smaller clinics.

• Material compatibility challenges with cutting-edge polymers restrict the universal adoption of certain sterilants.

Opportunities

• Emerging economies are scaling healthcare infrastructure, opening white-space for mid-capacity steam and gas units.

• Integration of IoT-enabled sensors offers predictive maintenance and real-time cycle analytics, creating value-added service revenue.

Challenges

• Regulatory scrutiny over ethylene-oxide emissions tightens operating permits and raises compliance costs.

• Supply-chain disruptions in stainless steel and specialty valves can extend delivery times for custom systems.

Regional Analysis

The North America sterilization equipment market dominates the market due to well-developed healthcare systems, rigorous sterilization standards, and an early-adopter mindset for low-temperature innovations. Europe follows with accelerated uptake in food and beverage sterilization, while Asia-Pacific registers the quickest percentage gains as biopharma and contract research facilities proliferate.

• North America – Largest revenue base; widespread disposable device use and outpatient surgery centers drive upgrades

• Europe – Rapid growth tied to stringent food-safety and MDR requirements

• Asia-Pacific – Highest CAGR as China and India build new hospitals and vaccine plants

• Latin America – Steady demand supported by public-health initiatives targeting HAIs

• Middle East & Africa – Gradual adoption as tertiary care capacity expands

Segmentation Analysis

By Product

• Sterile Membrane Filters – Market-leading share.

Membrane filters are indispensable across pharma, biotech, and beverage lines for endotoxin-free fluids, solidifying their top slot.

Their ease of integration, low per-cycle cost, and broad chemical compatibility continue to win specification in new filling suites.

• Heat Sterilizers – Fastest-growing product.

Modern steam autoclaves and dry-heat depyrogenation ovens eliminate microorganisms without chemical residues, aligning with sustainability goals.

Hospitals value their proven lethality and straightforward validation, while OEMs appreciate lower operating costs versus gas systems.

• Low-Temperature Sterilizers – Expanding niche.

Hydrogen-peroxide plasma, NO2, and ozone units cater to delicate endoscopes and polymer devices that cannot tolerate high heat.

Short cycles and low emissions make them a preferred upgrade path for busy reprocessing departments.

• Radiation Devices – Specialized demand.

Gamma and e-beam lines treat bulk, pre-packaged goods for contract sterilization firms.

Although capital intensive, they offer unmatched penetration for high-density loads and retain a loyal user base in single-use device production.

By Service

• On-site Sterilization Services – Core hospital function.

Central sterile departments rely on facility-based autoclaves and washers to maintain instrument availability.

Digital tracking and barcoding are enhancing throughput and traceability.

• Off-site Contract Sterilization – Rising outsourcing trend.

Small and virtual device manufacturers offload compliance to third-party providers with multi-modal capacity, lowering investment risk.

Regional hub expansion shortens turnaround and meets just-in-time production schedules.

By End-user

• Hospitals & Clinics – Command the lion’s share.

Continuous procedure flow mandates reliable, high-volume reprocessing cycles.

Capital budgets increasingly favor automated loading, closed-door cycles, and integrated biological indicators.

• Pharmaceutical & Biotech – High-growth vertical.

A surge in vaccine, biologic, and cell-therapy plants lifts demand for Grade-A clean-steam systems and validated sterile filtration.

Regulatory audits push adoption of 21 CFR Part 11 compliant data logging.

• Food & Beverage – Emerging adopter.

Stringent shelf-life and contamination standards propel uptake of filtration and UV-C chambers in dairy and bottled-drink operations.

Producers leverage equipment to cut preservative use and meet clean-label trends.

Industry Developments & Instances

• January 2024 – A global sterilization leader broadened its steam monitoring line with rapid-read indicators that cut release time by 70 %.

• June 2024 – A Scandinavia-based manufacturer launched a low-temperature chamber using cross-contamination barrier technology for orthopedic sets.

• December 2023 – A major acquisition of surgical instrumentation assets enhanced integration between washer-disinfectors and container systems, streamlining workflow for OR staff.

Facts & Figures

• Over 310 million surgeries are performed worldwide each year, driving constant instrument turnover.

• Disposable medical devices account for more than 40 % of contract radiation-sterilization volumes.

• Heat sterilizers can process loads at up to 11.5 % CAGR between 2025 and 2032, outpacing overall market growth.

• North American facilities operate roughly 35,000 hospital-grade autoclaves, with average replacement cycles of seven to ten years.

• IoT-enabled sterilizers can reduce unplanned downtime by up to 25 % through predictive alerts.

Analyst Review & Recommendations

Market analysis indicates a decisive shift toward versatile, eco-friendly sterilants and connected equipment that delivers actionable cycle data. Vendors that couple modular steam units with smart low-temperature lines and wrap them in preventive-maintenance subscriptions are poised to capture outsized market share. We recommend prioritizing R&D in material-compatible gases, expanding service networks in fast-growing Asia-Pacific corridors, and investing in emission-mitigation retrofits to navigate tightening regulations while sustaining long-term market growth.