Market Overview

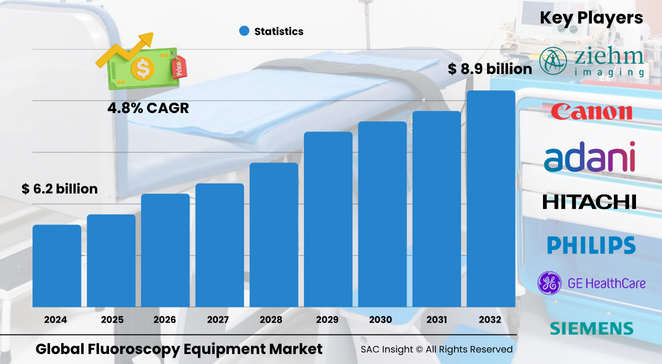

The global fluoroscopy equipment market size sits at roughly US$ 6.28 billion in 2024 and is expected to climb to about US$ 8.95 billion by 2032, representing a steady 4.825 % CAGR. First-hand industry insights reveal that rising volumes of minimally invasive surgeries, fast-tracked digital upgrades across radiology suites, and the growing appeal of multipurpose C-arms are the core engines behind this market growth.

SAC Insight’s deep market evaluation shows the U.S. fluoroscopy equipment market alone could expand from around USD$ 1.05 billion in 2024 to nearly US$ 1.46 billion by 2032 as hospitals replace aging analog systems and outpatient centers widen service offerings.

Summary of Market Trends & Drivers

• Multipurpose flat-panel C-arms that combine fluoroscopy, digital radiography, and cone-beam CT are boosting room utilisation and procedure throughput.

• AI-driven dose-management, variable frame-rate imaging, and automatic beam filtration are lowering radiation exposure while sharpening image quality.

• Portable full-size and mini C-arms are enabling point-of-care imaging in emergency departments, sports medicine, and ambulatory surgery centres, accelerating market adoption.

Key Market Players

Industry leadership rests with established imaging giants such as GE Healthcare, Siemens Healthineers, Philips, Shimadzu, and Canon Medical as well as focused specialists including Ziehm Imaging, Hologic, and Carestream Health. These firms command significant market share through broad product portfolios, deep service networks, and continual software upgrades that embed 3D reconstruction and real-time guidance.

Competitive dynamics increasingly revolve around partnerships and smart-device integration. Vendors are collaborating with surgical-navigation software houses, adopting augmented-reality overlays, and bundling maintenance contracts to lock in lifecycle revenue. The top five suppliers control about 40 % of global sales, but nimble regional players are gaining ground with cost-effective mobile units tailored to emerging markets.

Key Takeaways

• Current global market size (2024): roughly USD$ 6.28 billion

• Projected global market size (2032): about USD$ 8.95 billion at a 4.825 % CAGR

• The U.S. market could rise to nearly USD$ 2.9 billion by 2032 as replacement cycles accelerate

• C-arms systems capture the largest revenue slice, holding more than one-third of the market

• North America commands close to 50 % market share, but Asia-Pacific records the fastest percentage gains

• AI-enabled dose-reduction, flat-panel detectors, and portable form factors anchor near-term product roadmaps

Market Dynamics

Drivers

• Growing preference for minimally invasive, image-guided procedures across cardiology, orthopedics, and gastroenterology

• Continuous digital upgrades in hospitals seeking lower radiation doses and sharper images

• Rapid adoption of mobile C-arms in outpatient and sports-injury settings

Restraints

• High upfront cost of next-generation systems strains budgets for smaller facilities

• Radiation-related safety concerns push some clinicians toward ultrasound or MRI alternatives

• Complex regulatory reviews can slow product launches in certain regions

Opportunities

• Integration of AR headsets and cloud-based image analytics can create new service revenue streams

• Emerging economies investing in universal healthcare present untapped equipment demand

• Hybrid OR build-outs drive need for multipurpose imaging suites

Challenges

• Supply-chain bottlenecks for flat-panel detectors and high-voltage generators can delay deliveries

• Shortage of trained radiographers in low- and middle-income regions limits utilisation rates

• Intense price competition among mid-tier vendors pressures margins

Regional Analysis

North America remains the reference market thanks to high procedure volumes, strong reimbursement, and an accelerated switch to digital detectors. Europe follows closely with advanced imaging standards and robust orthopedic demand, while Asia-Pacific posts the quickest CAGR on the back of large population bases and expanding private hospital chains.

• North America – Dominant revenue base, driven by hybrid OR investments and stringent quality mandates

• Europe – Stable replacement demand and growing preference for remote-controlled systems

• Asia-Pacific – Fastest growth as China and India upgrade tertiary-care hospitals

• Latin America – Rising orthopedic surgery volumes underpin moderate uptake

• Middle East & Africa – Steady demand from trauma centres and government health initiatives

Segmentation Analysis

By Product Type

• C-Arms Systems – Workhorse modality, commanding the largest share.

These versatile systems cover everything from vascular interventions to pain-management shots, and flat-panel upgrades keep image clarity high while reducing dose.

• Remote-Controlled Systems – High-precision, low-staff-exposure option.

Motorised tables and joystick controls let radiologists stay shielded, a feature gaining traction in busy European and Middle-Eastern centres.

• Conventional Fluoroscopy Systems – Cost-conscious choice for routine studies.

Though growth is modest, budget-sensitive facilities still value these robust units for barium swallow, GI, and myelography exams.

• Other Advanced Form Factors – FPD fluoroscopes, mobile full-size, and mini C-arms.

Lightweight builds and battery-powered options push imaging out of the radiology department and into ORs, ICUs, and sports-injury clinics.

By Application

• Cardiology – Core demand engine.

Real-time guidance during stent placements and electrophysiology ablations keeps cardiology the top revenue contributor.

• Orthopedic & Trauma Surgeries – Rising fracture and sports-injury volumes.

Mini and full-size C-arms provide instant alignment checks, cutting OR time and revision rates.

• Gastrointestinal – Steady bariatric and ERCP workload.

Dynamic contrast studies rely on fluoroscopy for valve-free swallow analyses and biliary interventions.

• Urology & Nephrology – Stone-removal and stent procedures.

Low-dose, high-contrast imaging supports percutaneous nephrolithotomy and ureteric stent placements.

• Neurovascular – High-precision interventions.

Advanced imaging chains with 3D road-mapping enable aneurysm coiling and stroke thrombectomy with minimal contrast use.

By End User

• Hospitals – Account for the majority of installations.

Comprehensive procedure mix and 24/7 imaging needs justify investment in premium systems with service agreements.

• Diagnostic Centers – Fastest relative growth.

As outpatient imaging proliferates, standalone centres opt for compact, versatile units to maximise throughput.

• Others (ambulatory surgery centres, sports clinics) – Niche but accelerating.

Portable and mini C-arms give small facilities high-quality imaging without full radiology builds.

Industry Developments & Instances

• March 2025 – A leading vendor unveiled an AI-guided C-arm that auto-optimises dose and collimation in real time.

• December 2024 – Major hospital network in India ordered 150 mobile C-arms to equip new day-surgery hubs.

• August 2024 – Collaboration between an imaging OEM and a cloud-PACS provider launched predictive maintenance analytics across 500 U.S. sites.

• May 2023 – European regulatory approval granted for a remote-controlled system with voice-assistant integration, cutting staff exposure further.

Facts & Figures

• Top five suppliers hold roughly 40 % of global sales.

• Mobile C-arm shipments grew by nearly 12 % year-on-year in 2024.

• Cardiology applications contribute about 28 % of total market revenue.

• Flat-panel detector prices have dropped almost 15 % since 2021, spurring upgrades.

• Dose-monitoring software adoption now covers roughly 70 % of newly installed units.

Analyst Review & Recommendations

Market analysis underscores a clear pivot toward digital, dose-efficient systems that integrate seamlessly with surgical workflows. Vendors that pair flat-panel detectors with AI-based optimisation and cloud analytics will outperform average market growth. Buyers should prioritise platforms offering modular upgrades, robust remote-service capability, and proven dose-reduction features to safeguard investment and comply with tightening radiation standards.