Market Overview

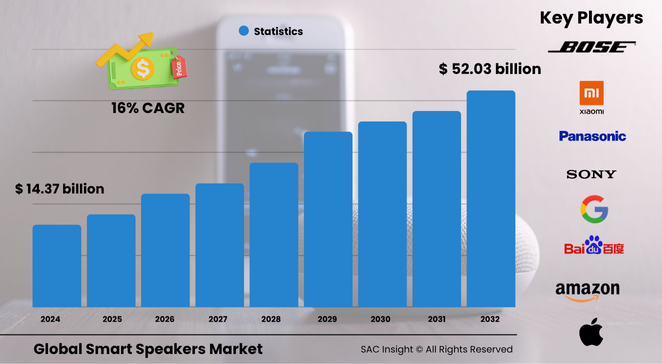

The global smart speakers market size is currently valued at about US$ 14.37 billion in 2024 and, according to SAC Insight's deep market evaluation, is on track to surge to roughly US$ 52.03 billion by 2032. That trajectory implies a healthy 16% CAGR across the 2025-2032 forecast window.

SAC Insight industry insights highlight three structural drivers: mainstream adoption of connected-home ecosystems, rapid integration of generative AI that makes voice assistants more conversational, and a post-pandemic boost in contact-free commerce. Within North America, the United States smart speakers market alone accounts for just under US$ 5.9 billion today and could top US$ 18 billion by 2032 as consumers layer voice control onto existing IoT devices.

Summary of Market Trends & Drivers

Voice commerce, multi-room audio, and AI-powered personalisation are the headline market trends lifting demand. Brands are embedding larger language models to turn speakers into proactive digital concierges, while falling price points enable multi-device households—together fuelling sustained market growth.

Key Market Players

Amazon, Google, Apple, Samsung, Sonos, Bose, Xiaomi, and Harman set the competitive tempo. They continuously refresh product lines with tighter smart-home integration, hi-res audio, and subscription-based AI services.

Challengers such as Lenovo, Panasonic, Ultimate Ears, and SK Telecom focus on regional language support, niche form factors, and bundled content to capture incremental market share and diversify revenue away from commoditised hardware.

Key Takeaways

• Current global smart speakers market size (2024): roughly US$ 14.37 billion

• Projected global market size (2032): around US$ 52.03 billion at a 16% CAGR

• U.S. smart speakers market: approaching US$ 5.9 billion in 2024 with double-digit growth ahead

• Wireless, Bluetooth/Wi-Fi-enabled models hold the largest market share and continue to outpace wired units

• Residential application exceeds 70 % of revenue, but commercial use cases—hotels, offices, quick-service retail—are the fastest-growing niche

• Generative-AI subscriptions such as “Remarkable Alexa” and upgraded Google Assistant set a new monetisation layer for vendors

Market Dynamics

Drivers

• Rising smart-home penetration and multi-device ecosystems that favour voice as the default control layer

• Advancements in far-field microphones and on-device neural processing that improve privacy and accuracy

• E-commerce partnerships enabling voice-based ordering, payments, and customer service

Restraints

• Ongoing concerns over data privacy, always-listening microphones, and cloud storage of voice recordings

• Security vulnerabilities that expose connected devices to hacking or unauthorised network access

Opportunities

• Integration with home energy management, elder-care monitoring, and in-car infotainment broadens addressable demand

• Local-language AI models in emerging economies unlock new user bases and content ecosystems

Challenges

• Price competition compresses hardware margins, forcing vendors to rely on services revenue

• Fragmented standards (Matter, Thread, proprietary protocols) complicate seamless interoperability

Regional Analysis

North America leads thanks to early-mover tech firms, high disposable income, and mature broadband coverage. Asia Pacific, however, delivers the quickest percentage gains as Chinese, Indian, and Korean consumers embrace affordable voice-AI devices and local-language skills. Europe shows steady uptake aided by government smart-city initiatives, while Latin America and the Middle East & Africa see rising demand linked to mobile-first digital lifestyles.

• North America – Largest revenue base; strong upgrade cycle from entry-level dots to premium hi-fi models

• Europe – Multilingual support and privacy-centric designs drive adoption, especially in Germany and the U.K.

• Asia Pacific – Fastest CAGR; local giants leverage super-app ecosystems to bundle music and payments

• Latin America – Growing middle class and e-commerce expansion stimulate online channel sales

• Middle East & Africa – Smart-city roll-outs, high smartphone penetration, and voice-first Arabic skills lift demand

Segmentation Analysis

By OS Type

• Android-based – Broadest ecosystem, cost-effective.

Android dominates market share because it allows flexible pricing and quick integrations with third-party skills, making it the go-to choice for volume-driven players like Amazon and Xiaomi.

• iOS-based – Premium, privacy-led.

Apple’s HomePod family appeals to users who prioritise sound fidelity and seamless tie-ins with other Apple devices, sustaining higher margins despite lower unit volume.

• webOS-based – Niche, TV-centric.

webOS extensions target living-room entertainment hubs, giving LG a foothold in voice-controlled home theatre setups.

By Technology

• Bluetooth/Wi-Fi – Core connectivity, highest market share.

These protocols provide quick pairing, multi-room streaming, and firmware updates, keeping them central to product roadmaps.

• Near Field Communication – Simple tap-to-connect convenience.

NFC remains a differentiator for brands courting users who want frictionless set-up, although range limits its broader utility.

• Others (Zigbee, Z-Wave) – Smart-home mesh backbone.

Support for low-power mesh networks positions speakers as central controllers for lights, locks, and sensors.

By Application

• Residential – Main demand engine.

Households use voice assistants for music, timers, weather, and now AI-powered homework help, ensuring sticky daily engagement.

• Commercial – Rapidly scaling.

Hotels, offices, and healthcare facilities deploy speakers for concierge services, meeting-room booking, and hands-free information kiosks.

By Distribution Channel

• Online – Dominant, fastest-growing.

E-commerce platforms provide flash deals, voice-assistant bundles, and one-day shipping that encourage impulse upgrades.

• Offline – Experience-driven.

Brick-and-mortar electronics stores offer sound demos and smart-home vignettes, boosting premium-model sales.

By Power Source

• Wireless – Portability and clean aesthetics.

Rechargeable batteries and Wi-Fi mesh compatibility let users scatter devices around the home without power-outlet constraints.

• Wired – Budget-friendly reliability.

Lower upfront cost appeals to cost-sensitive buyers and fixed installations such as kitchen counters or office desks.

Industry Developments & Instances

• July 2024 – Amazon unveiled subscription-based “Remarkable Alexa,” adding generative-AI dialogue and high-res audio playback

• July 2024 – Apple introduced HomePod mini in three new colours to widen décor matching options

• April 2024 – Google began testing next-gen Nest Hub Max with upgraded vision-based gesture control

• January 2024 – Sonos released an 8-inch in-ceiling speaker optimised for seamless hand-off from voice-controlled sources

• November 2022 – Defunc and Salora launched multi-room Wi-Fi speakers and earbuds targeted at India’s growing smart-home audience

Facts & Figures

• Wireless models capture over 68 % of current unit shipments

• Household penetration reached 16.1 % in 2022 and is forecast to cross 30 % by 2025

• Roughly 70 % of voice commands relate to music playback, while 47 % involve general online search

• Multi-room audio capability now features in more than 60 % of new product launches

• Requests to Alexa for controlling compatible smart-home devices have doubled in the past three years

Analyst Review & Recommendations

Smart speakers are shifting from novelty gadgets to core smart-home infrastructure. Vendors that marry high-quality audio with robust privacy controls and AI-driven personalisation will outperform average market growth. Expanding local-language skills, bundling voice commerce, and positioning speakers as central hubs for energy management and elder care stand out as strategic moves for 2025-2032."