Market Overview

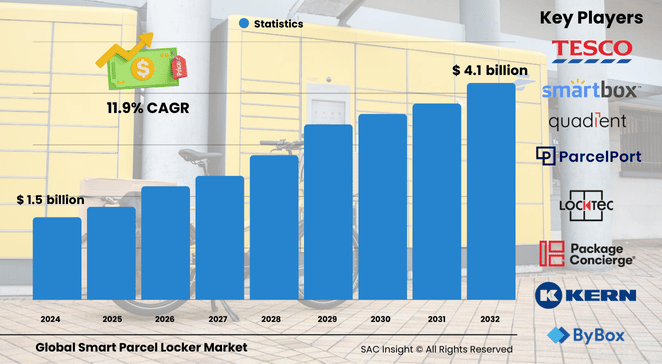

The Global smart parcel locker market size was approximately US$ 1.501 billion in 2024 and is projected to reach US$ 4.153 billion by 2032, advancing at an 11.95% CAGR. This expansion is underpinned by three converging forces: an e-commerce-fueled last-mile crunch, the post-pandemic shift toward contact-free collection, and steady upgrades in IoT-enabled asset tracking. SAC Insight evaluation confirms that indoor, networked locker banks are now table-stakes in new residential and commercial developments, while retailers use lockers to keep click-and-collect queues short. The U.S. smart parcel locker market alone is on track to pass US$ 421 million by 2032, supported by parcel densities that exceed pre-COVID peaks and by consumer expectations for secure, unattended pickup.

Summary of Market Trends & Drivers

• E-commerce acceleration is stretching legacy delivery models, making automated lockers an essential buffer against failed deliveries and porch piracy.

• Integration of RFID, real-time analytics, and AI-based predictive maintenance is raising uptime and lowering the cost per drop.

• Sustainability mandates and urban congestion charges are pushing logistics providers toward consolidated locker drop-offs that cut van miles and emissions.

Key Market Players

The Global smart parcel locker market Leading manufacturers and service providers set the competitive tempo through heavy R&D and partnerships with postal operators, property managers, and big-box retailers. Global names such as Ricoh Group, Quadient, TZ Limited, Pitney Bowes, KEBA Group, Cleveron, and LUXER Corporation dominate the installed base with modular platforms that scale from ten to several hundred compartments. A vibrant second tier—including ParcelPort Solutions, Hollman, and Shenzhen Zhilai Sci & Tech—focuses on niche needs like temperature-controlled grocery lockers or rugged outdoor units, often winning share through local customization and responsive after-sales support.

Key Takeaways

• Current global market size (2024): US$ 1.501 billion

• Projected market value (2025): Estimated through historical data trends (US$ 1.881 billion)

• Projected market value (2032): US$ 4.153 billion at an 11.95% CAGR

• North America holds roughly 34% market share, led by dense delivery networks and high porch-piracy concerns

• Modular parcel lockers are the leading type, praised for scalability and flexible layouts

• Indoor deployments outpace outdoor units because of lower capital cost and easier maintenance

• AI-driven locker management platforms are emerging as a key differentiator in new tenders

Market Dynamics

Drivers

• Surge in online shopping volumes and same-day delivery promises

• Growing preference for contactless, 24/7 pickup that reduces carrier redelivery attempts

• Smart-city initiatives funding digital parcel infrastructure

Restraints

• Locker capacity limits for oversize or overweight parcels

• High upfront cost of outdoor, weather-proof units and site preparation

• Limited floor space in older multi-tenant buildings

Opportunities

• Expansion into emerging markets where e-commerce penetration is climbing double-digits

• Roll-out of green lockers powered by solar panels and recyclable materials

• Cross-selling of value-added services such as returns processing and click-and-collect for fresh groceries

Challenges

• Complex integration with legacy carrier software and building access systems

• Regulatory hurdles around data privacy and biometric authentication in certain jurisdictions

• Ensuring consistent user experience across fragmented public and private locker networks

Regional Analysis

The smart parcel locker market in North America commands the largest market share thanks to high parcel volumes, advanced logistics IT, and aggressive rollout plans by postal operators and retailers. Europe follows, driven by investment in urban micro-hubs and strict emission zones that favor consolidated locker delivery. Asia Pacific is the fastest-growing region as China, India, and Southeast Asian nations twin smart-city funding with booming online retail.

• North America – Early adopter of parcel automation, strong security standards, rising corporate campus installations

• Europe – Rapid locker densification to meet sustainability goals; Germany and the U.K. lead deployments

• Asia Pacific – Highest market growth, propelled by mega-e-commerce platforms and government smart-city grants

• Latin America – Locker rollouts curb cargo theft and support expanding cross-border retail

• Middle East & Africa – Moderate uptake tied to new mixed-use developments and logistics free zones

Segmentation Analysis

By Component

• Hardware – Core revenue engine

Hardware—locker bodies, sensors, and access controllers—captured the lion’s share in 2024 as operators race to add physical capacity.

• Software – High-margin, recurring slice

Cloud dashboards, user apps, and API integrations convert raw lockers into connected ecosystems.

By Deployment

• Indoor – Lower cost of ownership Indoor lockers enjoy longer lifespans and minimal weatherproofing expense, making them popular with property managers and retailers alike.

• Outdoor – Critical for 24/7 public access

Although outdoor units cost up to three times more, they extend parcel reach to transit hubs and curbside locations that operate round the clock.

By Type

• Modular Parcel Lockers – Scalability leader

The ability to add or remove columns lets carriers right-size capacity as parcel flows fluctuate seasonally.

• Cooling Lockers for Fresh Food – Fastest-growing niche

Temperature-controlled modules protect perishables and pharmaceuticals, unlocking new revenue streams for grocery chains and clinics.

• Postal Lockers – Backbone for national operators

Postal agencies deploy branded lockers to cut door-to-door costs and keep parcel volumes in-house. They act as community collection points that reduce failed delivery attempts and align with universal-service mandates.

• Laundry Lockers – Service diversification

Laundry lockers offer concierge drop-off and pickup for dry-cleaning, tapping urban lifestyle shifts toward outsourced services.

By Application

• Commercial Buildings – Primary adopter Large offices and business parks install lockers to handle employee deliveries securely and reduce mailroom workload.

• Condos & Apartments – Security upgrade Multi-family properties rely on smart lockers to safeguard resident parcels and reduce concierge overhead.

• Retail BOPIS – Click-and-collect enabler Lockers streamline buy-online-pick-up-in-store workflows, trimming queue times and freeing staff for value-adding tasks.

• Universities & Colleges – Campus logistics hub Academic institutions deploy lockers to manage student packages and internal mail cost-effectively across sprawling campuses.

• Others (Post Offices, Parking Areas) – Supplemental reach Public-space lockers extend service coverage into transit stations, parking garages, and suburban post offices, completing the delivery web.

Industry Developments & Instances

• November 2023: Blue Dart Express rolled out digital parcel lockers in select Indian post offices, enabling OTP-based, paperless pickup.

• September 2023: SwipBox launched Bluetooth-connected lockers, surpassing 35,000 installations globally.

• June 2023: A leading U.S. grocer adopted Bell and Howell’s robotic GO! Pod locker, accelerating curbside pickup throughput.

• September 2022: Quadient partnered with a major parcel carrier to install more than 500 new outdoor locker stations across the U.K.

• April 2022: TZ Limited secured a 3,000-unit smart-locker contract with an Australian government department, updating legacy systems with cloud management.

Facts & Figures

• Roughly 78% year-on-year rise in locker-based deliveries was recorded at a leading European operator during the pandemic’s peak.

• Indoor lockers typically cost 50-70% less to maintain annually than outdoor equivalents.

• Modular locker banks can be expanded by up to 30% within the same footprint, reducing capex per additional door.

• A single urban locker can eliminate up to 200 failed delivery attempts per month, cutting CO₂ emissions by an estimated 40 kg.

• North American consumers report package theft concerns at work and home; 53% list lockers as their preferred preventive measure.

Analyst Review & Recommendations

First-hand industry insights indicate that smart parcel lockers are shifting from a convenience add-on to critical last-mile infrastructure. Operators that couple robust hardware with AI-driven locker management stand to capture stickier, service-based revenue. For new entrants, mid-sized modular systems targeting mixed-use developments in Asia Pacific offer a fast-growth beachhead. Incumbents should prioritize open API ecosystems and sustainable materials to stay ahead of tightening urban logistics regulations and rising ESG scrutiny.