Market Overview

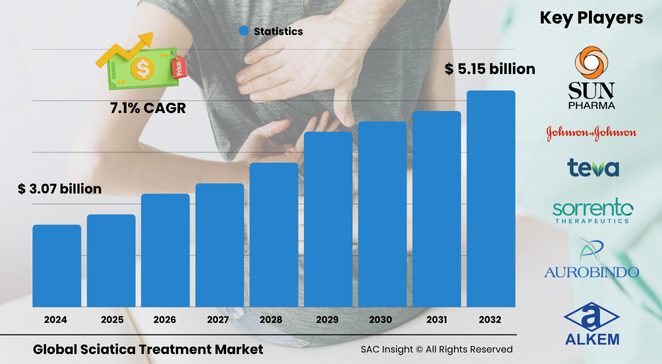

The global sciatica treatment market size is valued at roughly US$ 3.07 billion in 2024 and is on track to climb to around US$ 5.15 billion by 2032, expanding at an average 7.1 % CAGR. First-hand industry insights highlight three forces behind this steady market growth: the ageing global population susceptible to lumbar disorders, rising awareness of non-surgical pain management, and a shift toward convenient retail and e-commerce drug fulfilment. SAC Insight's deep market evaluation shows the United States sciatica treatment market alone could advance from about US$ 2.49 billion in 2024 to nearly US$ 4.18 billion by 2032 as clinicians broaden prescriptions of extended-release NSAIDs and epidural injectables.

Summary of Market Trends & Drivers

• Sedentary workstyles and obesity rates continue to lift sciatica prevalence, fuelling demand for both preventive physiotherapy and pharmacological relief.

• Hospital backlogs during the pandemic pushed patients toward retail and online channels, a habit that is accelerating direct-to-consumer sales of topical sprays and oral NSAIDs.

• Ongoing clinical trials for long-acting corticosteroid injectables and regenerative biologics signal a pipeline shift from short-term analgesia to durable pain modulation.

Key Market Players

The competitive landscape blends diversified pharma majors and focused pain-therapy innovators. Companies such as Abbott, Johnson & Johnson, Pfizer, Bayer, and GSK leverage broad neurology portfolios and global supply chains to command significant market share. Alongside them, speciality manufacturers including Sun Pharmaceutical, Teva, Amneal, Alkem, Aurobindo, Sinfonia Biotherapeutics, Sorrento Therapeutics, and Zydus intensify competition by releasing cost-effective generics and targeted injectables.

Competitive dynamics revolve around lifecycle management and channel reach. Large brands are reformulating flagship NSAIDs into once-daily doses, while mid-tier players secure exclusive pharmacy partnerships to capture the fast-growing online segment.

Key Takeaways

• Current global sciatica treatment market size (2024): about USD$ 3.07 billion

• Projected global market size (2032): USD$ 5.15 billion at a 7.1 % CAGR

• United States maintains the largest country market share and could exceed US$ 4 billion by 2032

• Chronic sciatica accounts for the bulk of prescriptions because symptoms persist for months or years without intervention

• NSAIDs dominate drug class revenue and remain the first-line therapy in most treatment guidelines

• Retail & online pharmacies are the fastest-growing distribution channel thanks to home-delivery convenience and transparent pricing

Market Dynamics

Drivers

• Growing geriatric population prone to degenerative spine disorders

• Surge in over-the-counter analgesic adoption and self-medication culture

• Advancements in long-acting injectables that reduce hospital visits

Restraints

• Side-effect profile of systemic steroids and opioids limits long-term use

• High cost of biologic candidates may restrict uptake in price-sensitive regions

• Limited awareness of guideline-based care in low-income settings

Opportunities

• Digital therapeutics that combine exercise coaching with medication reminders

• Partnerships between drug makers and telehealth platforms for chronic pain management

• Expansion of specialty compounding services for personalised dosing

Challenges

• Regulatory scrutiny on opioid dispensing and steroid safety slows approvals

• Fragmented reimbursement policies for newer regenerative treatments

• Supply-chain disruptions of active pharmaceutical ingredients can delay product launches

Regional Analysis

The North America sciatica treatment market leads due to advanced healthcare infrastructure, strong insurance coverage, and high consumer willingness to pay for innovative pain solutions. Asia-Pacific is the fastest-growing region as urbanisation drives sedentary lifestyles and governments scale chronic-pain awareness campaigns.

• North America – Dominant revenue share; robust R&D spending and early biologic adoption

• Europe – Stable market size; emphasis on physiotherapy and guideline compliance

• Asia-Pacific – Highest CAGR; rising disposable income and local manufacturing incentives

• Latin America – Moderate growth; increasing availability of generic NSAIDs

• Middle East & Africa – Emerging potential; improving healthcare access and e-pharmacy proliferation

Segmentation Analysis

By Type

• Acute Sciatica – Short-term flare-ups, quick-relief focus.

Most acute cases resolve within weeks, so demand centres on fast-acting oral NSAIDs and muscle relaxants.

Pain episodes linked to lifting injuries or pregnancy typically drive a spike in over-the-counter purchases and short physiotherapy programmes.

• Chronic Sciatica – Long-duration pain, dominant share.

Persistent nerve compression in ageing populations sustains repeat prescriptions of epidural steroids, antidepressants, and nerve-pain modulators.

Clinicians increasingly opt for combination therapy—exercise, imaging-guided injections, and extended-release NSAIDs—to minimise surgery referrals.

By Drug Class

• Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) – First-line therapy, widest reach.

Brufen-power sprays and modified-release tablets remain go-to options for mild-to-moderate pain, thanks to familiar safety profiles and low cost.

Growing preference for topical formulations is limiting gastrointestinal side effects, keeping NSAIDs at the forefront of market analysis.

• Steroids – Potent anti-inflammatory, episodic use.

Epidural and oral corticosteroids deliver quick relief for severe flare-ups but carry metabolic risks, prompting a move toward lower doses and image-guided delivery.

Innovators are trialling biodegradable steroid micropellets that provide sustained local action while reducing systemic exposure.

• Antidepressants – Neuropathic modulation, niche yet rising.

Tricyclics and SNRIs target nerve pain pathways, offering an option when NSAIDs fail.

Wider recognition of neuropathic mechanisms is broadening their use, especially in chronic sciatica with sleep disturbance and mood comorbidities.

• Others – Opioids, biologics, regenerative injectables.

Opioids fill last-resort roles under strict monitoring, while autologous platelet-rich plasma and stem-cell candidates aim to address underlying disc degeneration.

Early-stage clinical data suggest these biologics could reshape future market trends if cost and safety hurdles are cleared.

By Distribution Channel

• Hospital Pharmacies – Specialist oversight, complex cases.

Patients with severe or refractory pain receive injectable therapies and imaging services within hospital settings, sustaining steady demand for formulary products.

Integrated pain clinics boost adherence by coupling medication with physiotherapy and counselling.

• Retail & Online Pharmacies – Rapidly expanding, convenience-driven.

Home delivery and price comparison tools attract tech-savvy consumers managing chronic symptoms.

E-pharmacy platforms bundle virtual consultations with doorstep drug supply, driving double-digit market growth in this channel.

Industry Developments & Instances

• October 2023 – Sollis Therapeutics launched a phase 3 trial of clonidine micropellets aimed at lumbosacral radiculopathy.

• November 2022 – Cassowary Pharmaceuticals unveiled hyper-targeted non-opioid candidates for chronic sciatic pain.

• August 2022 – Oliceridine received regulatory clearance for acute moderate-to-severe pain, expanding hospital analgesic options.

• July 2022 – Vertex advanced NaV1.8 inhibitor VX-548 into late-stage studies targeting neuropathic components of sciatica.

• March 2022 – Scilex reported positive phase 3 data for SEMDEXA, a dexamethasone gel designed for sustained epidural relief.

Facts & Figures

• Chronic cases represent roughly two-thirds of total sciatica prescriptions worldwide.

• Retail & online pharmacies captured nearly 40 % of global sales in 2024 and are pacing above 10 % annual growth.

• More than 3.5 million epidural steroid injections are performed each year in the United States.

• NSAIDs account for about 55 % of drug class revenue, with topical formats growing fastest at 12 % CAGR.

• Average hospital stay for surgical sciatica correction exceeds four days, driving demand for non-invasive alternatives.

Analyst Review & Recommendations

SAC Insight market analysis indicates a clear pivot toward outpatient and home-based pain management. Players that combine proven NSAID chemistry with patient-friendly delivery—think sprays, patches, and once-daily tablets—will secure outsized market share. To stay ahead, invest in real-world evidence for long-acting injectables, expand telehealth partnerships that streamline prescription refills, and develop educational tools that guide patients through exercise regimens alongside medication.