Market Overview

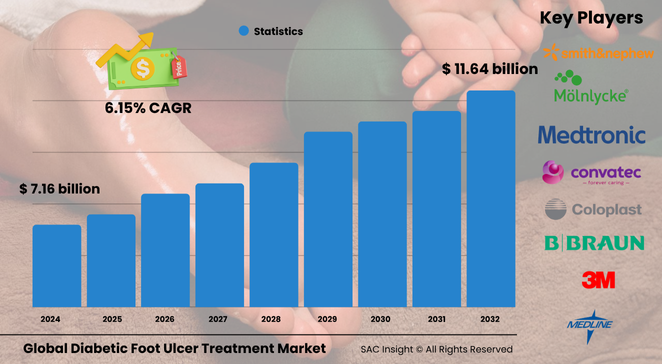

The global diabetic foot ulcer treatment market size is valued at roughly US$ 7.16 billion in 2024 and is projected to climb to about US$ 11.64 billion by 2032, expanding at a steady 6.15% CAGR. SAC Insight industry insights highlight three decisive forces behind this market growth: the rising global diabetes burden, rapid adoption of advanced biologics and negative-pressure devices, and a pronounced shift toward home-based wound care.

SAC Insight's deep market evaluation shows the United States diabetic foot ulcer treatment market alone could progress from approximately US$ 3.45 billion in 2024 to around US$ 5.61 billion by 2032 as payers reward early intervention and hospitals push to cut amputation rates.

Summary of Market Trends & Drivers

• Providers are moving from traditional gauze to antimicrobial foams, hydrocolloids, and single-use negative-pressure systems, trimming healing times and readmissions.

• Biologics—especially growth-factor gels and stem-cell matrices—are gaining traction for neuro-ischemic ulcers that resist standard dressings.

• Telemedicine follow-ups, smartphone imaging, and reimbursement for remote monitoring are reshaping patient pathways and underpinning future market trends.

Key Market Players

A handful of diversified wound-care specialists anchor the competitive landscape. Firms such as 3M, Smith + Nephew, Mölnlycke Health Care, Coloplast, and ConvaTec supply broad portfolios spanning dressings, therapy devices, and active biologics. Their strategies revolve around FDA clearances for single-use NPWT canisters, iterative upgrades to oxygen therapy kits, and clinical education programs that reinforce brand loyalty among podiatrists and vascular surgeons.

Mid-tier contenders—including Medline Industries, B. Braun, Integra LifeSciences, and Essity—leverage focused product lines and strong distributor networks to win share in regional tenders. Partnerships with community clinics and home-health agencies help these companies penetrate the fast-growing outpatient segment.

Key Takeaways

• Current global market size (2024): about USD$ 7.16 billion

• Projected global market size (2032): roughly USD$ 11.64 billion at a 6.15 % CAGR

• Neuro-ischemic ulcers command the largest ulcer-type market share due to higher infection and amputation risk

• Wound-care dressings remain the revenue workhorse, while therapy devices post the fastest growth

• Homecare settings already account for more than half of treated cases and will widen their lead through 2032

Market Dynamics

Drivers

• Escalating diabetes prevalence, obesity, and aging populations worldwide

• Strong clinical evidence supporting advanced dressings, NPWT, and hyperbaric oxygen in reducing healing time

• Reimbursement reforms rewarding limb-preservation programs and multidisciplinary foot clinics

Restraints

• High material costs for growth-factor gels and stem-cell therapies

• Long healing cycles—often exceeding six months—strain patient adherence and payer budgets

• Patchy access to podiatric care in low-income regions

Opportunities

• Artificial-intelligence wound imaging that flags early deterioration and optimises dressing changes

• 3D-printed skin substitutes tailored to patient morphology

• Expansion of ambulatory wound centres in Asia and Latin America

Challenges

• Rising antimicrobial resistance complicates infection control

• Supply-chain pressure on specialized foams, sensors, and medical-grade oxygen cylinders

• Need for rigorous real-world data to support premium-priced biologics

Regional Analysis

North America dominates owing to high diagnosis rates, technology uptake, and established insurance coverage. Europe follows closely with robust limb-salvage programs, while Asia Pacific exhibits the fastest pace as China and India invest in diabetes management infrastructure.

• North America – Largest revenue base; strong hospital budgets and home-health penetration

• Europe – Mature reimbursement, growing geriatric pool

• Asia Pacific – Quickest CAGR driven by surging diabetic population and urban lifestyles

• Latin America – Momentum from government foot-care initiatives and private wound clinics

• Middle East & Africa – Early-stage adoption hindered by limited specialist centres, yet improving

Segmentation Analysis

By Ulcer Type

• Neuro-Ischemic – Highest incidence and cost burden.

These ulcers combine neuropathy with poor circulation, complicating healing and driving demand for NPWT and oxygen therapy.

• Neuropathic – Significant but more manageable.

Loss of sensation leads to unnoticed trauma; off-loading footwear and foam dressings are standard of care.

• Ischemic – Smaller segment yet critical.

Peripheral artery disease limits tissue oxygenation, making revascularisation and growth factors pivotal.

By Product

• Wound-Care Dressings – Cornerstone of daily management.

Antimicrobial foams, alginates, and hydrogels maintain moisture balance and curb infection, explaining their dominant share.

• Devices – Fastest-growing slice.

Single-use NPWT pumps, ultrasound therapy, and portable hyperbaric units shorten inpatient stays and enable home treatment.

• Active Therapies – High-value niche.

Skin substitutes, stem-cell sheets, and recombinant growth factors command premium pricing for refractory ulcers.

By End User

• Homecare – More than half of current procedures.

Remote nursing visits, tele-consults, and compact NPWT devices let patients avoid lengthy hospital stays.

• Hospitals – Core hub for complex cases and amputations.

Integrated vascular and infectious-disease teams drive adoption of cutting-edge biologics.

• Clinics and ASCs – Growing as payers steer routine debridement and dressing changes to lower-cost sites.

Industry Developments & Instances

• April 2024 – Smith + Nephew’s PICO sNPWT system received a favourable U.K. technology appraisal for reducing surgical-site infections in high-risk foot surgeries.

• March 2023 – 3M secured FDA 510(k) clearance for next-generation Veraflo therapy dressings aimed at infected diabetic ulcers.

• January 2022 – Smith + Nephew obtained U.S. clearance for PICO 7 and PICO 14 single-use devices, expanding outpatient NPWT options.

• March 2022 – Advanced Oxygen Therapy gained Chinese approval for its TWO2 cyclic wound-oxygen platform, opening the world’s largest diabetic population.

• December 2023 – Varco Leg Care launched Ulsr Soothe Max hydrogel, targeting chronic venous and diabetic ulcers.

Facts & Figures

• About 15 % of people with diabetes will develop a foot ulcer during their lifetime.

• Neuro-ischemic ulcers account for roughly 53 % of global DFU cases.

• Hospital admissions linked to diabetic foot complications have risen elevenfold in the past decade.

• Negative-pressure wound therapy can reduce healing time by up to 40 % compared with moist dressings alone.

• The average inpatient cost of a major-amputation episode exceeds USD$ 45 000, underscoring the value of early ulcer management.

Analyst Review & Recommendations

Market analysis indicates a clear pivot from hospital-centric care to technology-enabled home management. Vendors that pair evidence-backed dressings with easy-to-use NPWT or oxygen systems will outpace average market share gains. Stakeholders should prioritise data analytics for remote monitoring, invest in cost-effective biologics that withstand payer scrutiny, and forge training partnerships with community podiatrists to expand reach while containing costs.