Market Overview

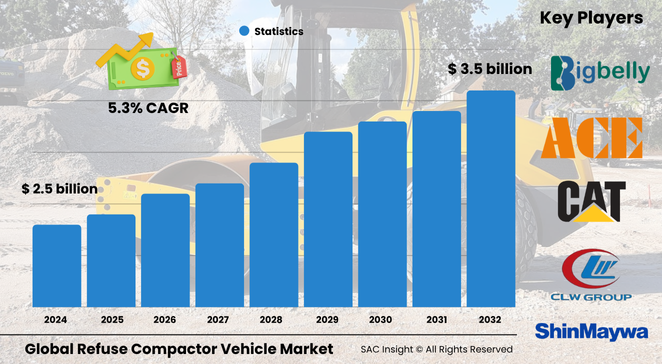

The global refuse compactor vehicle market size is valued at about US$ 2.5 billion in 2024 and is projected to climb to roughly US$ 3.58 billion by 2032, reflecting an average 5.35 % CAGR. SAC Insight's industry insights link this steady market growth to accelerating urban waste volumes, tighter emissions mandates, and the shift toward smart, fuel-efficient fleets. SAC Insight's deep market evaluation indicates North America commands close to 35 % market share, while the U.S. refuse compactor vehicle market alone could reach around US$ 1.7 billion by 2032 as municipalities modernize aging collection fleets and invest in lower-carbon vehicles.

Summary of Market Trends & Drivers

• Municipal contracts increasingly bundle collection, compaction, and digital route management, favoring vendors that deliver turnkey solutions.

• Battery-electric and hybrid drivetrains are moving from pilot projects to full-scale rollouts, trimming noise and operating costs while meeting zero-emission zones.

• Smart compaction, GPS, and telematics are becoming standard, enabling real-time fleet optimization and predictive maintenance that cut downtime.

Key Market Players

Industry leadership rests with a mix of heavy-duty truck manufacturers and specialist body builders. Global names such as Heil Environmental, McNeilus, Dennis Eagle, Volvo, and Iveco anchor the segment with wide product portfolios and established dealer networks. Alongside them, regional challengers—ShinMaywa Industries, Superior Pak, and Dongfeng Motor—leverage localized production and after-sales service to gain share in Asia-Pacific and emerging markets.

Competitive dynamics center on electrification roadmaps, lightweight body designs, and IoT integration. Market leaders are forging partnerships with battery suppliers, municipal authorities, and telematics providers to speed up deployment of next-gen vehicles and secure long-term service contracts.

Key Takeaways

• Current global market size (2024): about USD$ 2.5 billion

• Projected global market size (2032): roughly USD$ 3.58 billion at a 5.35 % CAGR

• North America holds nearly 35 % market share; Asia-Pacific is the fastest-growing region

• Rear loaders dominate residential routes, but side loaders show the quickest adoption in automated collection programs

• Electric and hybrid drivetrains could capture more than 20 % of new-build demand by 2032

• Smart compaction and GPS tracking are now critical differentiators in bid evaluations

Market Dynamics

Drivers

• Rapid urbanization and higher waste generation per capita require larger, more efficient fleets.

• Stricter emissions and noise regulations push municipalities toward low-carbon, low-noise vehicles.

• Integrated telematics and route optimization deliver measurable cost savings and service-level gains.

Restraints

• High upfront costs for battery-electric and hybrid trucks constrain budgets in smaller cities.

• Limited charging infrastructure and grid capacity delays widescale electric adoption in developing regions.

• Fleet-wide transition periods can stretch training and maintenance resources.

Opportunities

• Government green-fleet incentives open funding channels for accelerated electrification.

• Retrofitting legacy diesel chassis with electric PTO or hybrid modules offers a cost-effective bridge solution.

• Data-driven waste analytics from connected vehicles enable new service models and premium contracts.

Challenges

• Supply-chain volatility in batteries, semiconductors, and hydraulic parts extends lead times.

• Talent shortages for high-voltage maintenance and telematics diagnostics slow rollout schedules.

• Competitive tendering compresses margins, intensifying the need for lifecycle service revenues.

Regional Analysis

Europe and North America currently set the technology tempo thanks to stringent environmental rules and well-funded municipal budgets, while Asia-Pacific supplies the bulk of future volume growth as urbanization drives massive fleet expansions.

• North America – Largest revenue base, rapid fleet replacement and early electric pilots

• Europe – High regulatory pressure accelerates hybrid and electric adoption

• Asia-Pacific – Fastest market growth on back of megacity infrastructure upgrades

• Latin America – Steady demand from commercial corridors, focused on medium-capacity diesel units

• Middle East & Africa – Niche but rising investment in smart compaction to combat illegal dumping

Segmentation Analysis

By Product Type

• Front Loaders – Preferred for commercial bulk pickup and industrial parks.

Front loaders offer high payload and quick lift cycles, making them the workhorse for large waste generators and transfer stations where turnaround time is critical.

• Rear Loaders – Core of residential collection.

Their ability to navigate tight streets and handle mixed bin sizes keeps rear loaders indispensable for curbside routes and alleyways in dense urban centers.

• Side Loaders – Fastest-growing share in automated systems.

Robotic arms and single-operator cabins make side loaders ideal for municipalities seeking labor savings and safer operations, especially in regions with standardized cart programs.

By Application

• Residential – Largest volume driver.

Curbside programs account for the majority of daily trips; demand spikes as cities adopt pay-as-you-throw schemes that require frequent, data-rich pickups.

• Commercial – Rising need for schedule flexibility.

Supermarkets, offices, and restaurants generate steady waste streams, and compactor vehicles with larger hoppers and route analytics help minimize service disruptions.

• Industrial – Specialized handling of bulky or hazardous loads.

Heavy-duty bodies with reinforced floors and sealed containers cater to factories, ports, and construction sites, balancing payload capacity with safety compliance.

By Capacity

• Small (up to 5 tons) – Ideal for narrow lanes and gated communities.

Compact wheelbases and tight turning radii allow efficient collection where standard trucks cannot operate.

• Medium (5 – 15 tons) – Versatile municipal backbone.

These units blend capacity with maneuverability, fitting the majority of mixed-waste routes without over-specifying chassis size.

• Large (15 tons and above) – Best for transfer runs and industrial hubs.

High-density compaction ratios reduce trips to landfill, cutting fuel bills and landfill gate fees for large waste producers.

By Fuel Type

• Diesel – Still mainstream but under pressure.

Modern clean-diesel engines remain reliable for long daily routes, yet fleets face mounting emissions surcharges and low-emission-zone restrictions.

• Electric – Rapidly scaling from pilot to production.

Zero tailpipe emissions, quiet operation, and lower energy costs make battery-electric trucks attractive; high-capacity batteries now support full shift cycles in most urban territories.

• Hybrid – Transitional sweet spot.

Combining diesel reliability with regenerative braking, hybrids lower fuel use by up to 25 % and ease the path toward full electrification where charging is limited.

Industry Developments & Instances

• April 2025 – A leading European OEM unveiled a 27-cubic-yard battery-electric rear loader with 250-kilometer real-world range.

• February 2025 – Major North American waste hauler placed a fleet order for 200 hybrid side loaders, citing 20 % fuel savings in trials.

• November 2024 – Asia-Pacific city awarded a smart-fleet contract integrating IoT sensors and AI-based route planning across 1,000 refuse trucks.

• July 2024 – Joint venture announced to retrofit diesel chassis with electric power-take-off systems, targeting mid-life fleet upgrades.

• March 2024 – Hydraulic supplier launched a lightweight composite body material reported to cut unladen weight by 12 % without sacrificing durability.

Facts & Figures

• Rear loaders capture roughly 40 % of global vehicle deliveries, front loaders 35 %, and side loaders 25 %.

• Residential routes represent about 45 % of total market revenue, followed by commercial at 35 % and industrial at 20 %.

• Electric and hybrid models accounted for nearly 8 % of new sales in 2024, up from 3 % in 2022.

• Smart compaction and GPS tracking can reduce fuel consumption by up to 15 % through optimized routing.

• Asia-Pacific’s market growth is projected at about 6.3 % CAGR, outpacing the global average.

Analyst Review & Recommendations

Market analysis underscores a decisive pivot toward connected, low-emission fleets. Suppliers that pair electric or hybrid drivetrains with telematics-rich bodies stand to outpace baseline market growth. To secure long-term contracts and protect margins, prioritize modular designs that ease battery upgrades, invest in training for high-voltage maintenance, and bundle analytics services that transform raw route data into measurable waste-reduction gains.