Market Overview

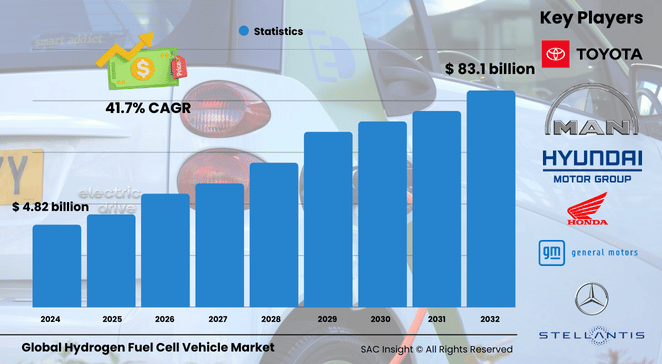

The hydrogen fuel cell vehicle market size is valued at US$ 4.82 billion in 2024 and is expected to accelerate to US$ 83.14 billion by 2032, expanding at a compound annual growth rate of about 41.7% from 2026-2032. First-hand industry insights highlight three powerful forces behind this market growth: tightening zero-emission targets, rapid advances in fuel-cell efficiency, and large-scale investments in refueling corridors. SAC Insight evaluation confirms Asia Pacific’s early lead—commanding close to 73.72% of global market share in 2024—while North America is ramping up quickly on the back of California’s incentive programs. The U.S. hydrogen fuel cell vehicle market is forecast to top US$ 5 billion by 2032, supported by state-level mandates and truck fleet trials.

Summary of Market Trends & Drivers

• Automakers are rolling out next-generation passenger and heavy-duty models with higher power density and sub-five-minute refueling, addressing range anxiety and downtime concerns.

• A wave of public-private partnerships is extending the hydrogen highway network, particularly along long-haul freight routes.

• Green-hydrogen cost curves are falling as electrolyzer projects scale, reinforcing the economics of fuel-cell mobility and shaping near-term market trends.

Key Market Players

Global hydrogen FCV market competition is led by innovation-driven OEMs that already field commercial fuel-cell cars, buses, and trucks. Toyota, Hyundai, and Honda anchor the passenger segment, while Daimler, General Motors, Nikola, and BMW are pushing heavy-duty platforms and hydrogen powertrains. Specialist stack providers such as Ballard Power Systems and Symbio supply critical components and license technology, allowing newcomers to shorten development cycles. Collaborative ventures between vehicle makers, energy majors, and infrastructure operators are central to scaling production volumes and securing a long-term supply of green hydrogen.

Key Takeaways

• Market value 2024: USD$ 4.82 billion

• Projected value 2032: USD$ 83.14 billion at a 41.7% CAGR

• Asia Pacific holds roughly 73.72% market share today; Europe is the fastest-growing infrastructure hub.

• Proton Exchange Membrane Fuel Cells dominate technology adoption thanks to high power density and vehicle packaging flexibility.

• Passenger cars account for the largest deployment base, but buses and long-haul trucks are the breakout growth story.

• Refueling times below five minutes and real-world ranges above 500 miles are shifting fleet economics in favor of hydrogen.

Market Dynamics

Drivers

• Net-zero legislation and carbon-credit incentives are steering OEM roadmaps toward fuel-cell drivetrains.

• Rising green-hydrogen availability lowers the lifetime cost of ownership versus diesel for high-utilization fleets.

• Corporate sustainability targets are accelerating bulk orders for zero-emission logistics and municipal buses.

Restraints

• High upfront capital outlay for hydrogen stations—often US$ 1-2 million per site—limits network density outside pioneering regions.

• Battery-electric vehicles enjoy broader consumer familiarity and falling battery prices, intensifying competitive benchmarking.

Opportunities

• Fuel-cell vans and light commercial vehicles offer a sweet spot for last-mile operators seeking fast refuels and payload parity with diesel.

• Mobile and modular refueling solutions enable temporary station deployment at ports, events, and construction sites, opening underserved routes.

Challenges

• Hydrogen storage still relies on high-pressure tanks or cryogenic systems, adding cost and engineering complexity.

• Skilled-labor gaps in fuel-cell maintenance and safety protocols could slow fleet rollout unless training programs scale in parallel.

Regional Analysis

Asia Pacific dominates current sales thanks to bold national hydrogen roadmaps in Japan, South Korea, and China, where leading automakers commercialize new models and governments co-fund stations. North America is building momentum, led by California’s truck corridors and Canada’s green-hydrogen projects. Europe is on track for the fastest infrastructure expansion as EU climate policy funnels capital into “Hydrogen Valley” clusters.

• North America – Rapid station build-out in California and a growing pipeline of medium-duty truck pilots.

• Europe – Ambitious Green Deal targets and cross-border fuel-cell bus orders underpin double-digit market growth.

• Asia Pacific – Established OEM supply chains and subsidies give the region an unmatched early-mover advantage.

• Rest of World – Middle-East megaprojects and early Latin-American bus trials point to future demand pockets.

Segmentation Analysis

By Vehicle Type

• Passenger Cars – Flagship models lead early adoption

Passenger cars remain the public face of fuel-cell mobility, combining zero emissions with familiar driving dynamics, which encourage first-time buyers in technology-forward markets.

• Commercial Vehicles – High-growth, fleet-driven category

Buses, heavy trucks, and light vans leverage hydrogen’s long range and rapid refuel to minimize operational downtime, making them attractive for depot-based and intercity operations.

By Technology

• Proton Exchange Membrane Fuel Cell (PEMFC) – Market mainstay

PEMFC systems deliver quick start-up, compact form factors, and solid efficiency, cementing their role as the default stack architecture for on-road vehicles.

• Solid Oxide Fuel Cell (SOFC) – Emerging heavy-duty option

Higher operating temperatures and multi-fuel flexibility make SOFC attractive for long-haul and auxiliary power, although commercialization is nascent.

• Alkaline and Phosphoric Acid Fuel Cells – Niche applications

These legacy chemistries find limited use in specialty or stationary vehicles where cost sensitivity or specific operating conditions align.

By Range

• 0-250 Miles – Core urban segment

Short-range models satisfy daily commuting and city-bus loops, benefiting from smaller tanks and lower vehicle cost.

• 251-500 Miles – Balanced distance sweet spot

Mid-range vehicles target intercity shuttles and regional logistics, offering payload neutrality with fast refueling advantages.

• Above 500 Miles – Long-haul workhorse

Extended-range trucks and coaches appeal to freight and tour operators seeking diesel-like duty cycles without tailpipe emissions.

By Fuel Capacity (Power Output)

• Up to 75 kW – Compact passenger platforms

Small stacks reduce system weight and cost for city cars and light vans that prioritize efficiency over brute power.

• 76-150 kW – Versatile mid-segment

This band suits SUVs, sedans, and medium buses, balancing performance needs with economy.

• Above 150 kW – Heavy-duty and specialist vehicles

Large stacks power Class 8 trucks, regional-haul tractors, and high-capacity buses where torque, gradeability, and range are critical.

Industry Developments & Instances

• May 2024 – A pioneering Class 8 regional-haul truck fitted with a 75 kW stack completed multi-season durability testing ahead of fleet deployment.

• April 2024 – A European fleet operator inked an agreement to integrate hydrogen fuel-cell heavy goods vehicles into its logistics network.

• March 2024 – A major automaker launched a pilot fleet of medium-duty hydrogen trucks under a U.S. Department of Energy program.

• January 2024 – A global commercial-vehicle group confirmed customer trials of its first fuel-cell heavy truck platform slated for 2025 deliveries.

• December 2023 – A 1 MW electrolyzer came online at a U.S. fulfillment center, powering more than 200 on-site hydrogen forklifts and setting a template for similar installations.

Facts & Figures

• Real-world fuel economy exceeds 60 miles per gallon gasoline equivalent, outperforming typical internal-combustion models by over 2×.

• Global station build-out surpassed 1,000 sites in 2024, a 35% jump year on year.

• Passenger car fuel-cell ranges now reach up to 366 miles on a single fill.

• Heavy-duty hydrogen trucks cut well-to-wheel CO₂ emissions by roughly 75% when supplied with green hydrogen.

• Hydrogen station capital expenditure averages US$ 1.5 million, roughly seven times a comparable fast-charging EV site.

Analyst Review & Recommendations

Hydrogen fuel cell mobility is moving from demonstration to early scale. Our market analysis suggests that players who pair stack innovations with vertically integrated refueling solutions will capture outsized value as fleet conversions accelerate. OEMs should prioritize high-mileage segments—buses, regional haul, and delivery vans—where lifetime economics already tilt in hydrogen’s favor. Governments can hasten adoption by clustering stations along freight corridors and aligning safety codes across jurisdictions. With costs falling and infrastructure maturing, the hydrogen fuel cell vehicle market is set to transition from niche to mainstream over the next decade.