Market Overview

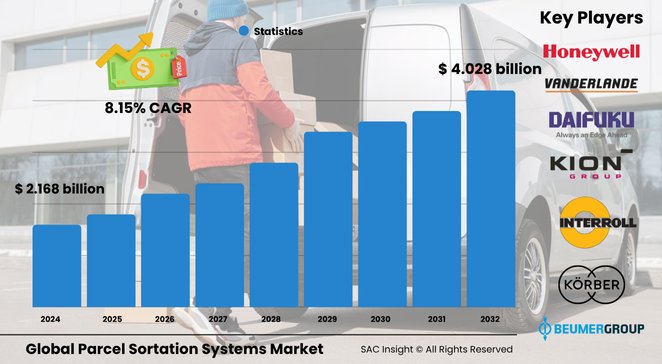

The global parcel sortation systems market size is valued at roughly US$ 2.168 billion in 2024 and is projected to climb to about US$ 4.028 billion by 2032, advancing at an average 8.15% CAGR. SAC Insight's deep market evaluation shows three clear engines behind this market growth: the relentless expansion of e-commerce, rising labour constraints that make automation a necessity, and first-hand industry insights pointing to rapid integration of AI-driven vision and robotics for higher throughput. Within this landscape the United States alone represents nearly US$ 2.15 billion today and could approach US$ 3.98 billion by 2032 as retailers tighten next-day delivery promises.

Summary of Market Trends & Drivers

• Same-day fulfilment commitments and the surge in returns are reshaping warehouse footprints, prompting operators to favour modular, high-speed sorters that slot into brownfield sites.

• Hardware innovations—lighter conveyor materials, quieter shoe sorters, self-healing belts—are pairing with smart analytics platforms that predict jams and balance chute loads in real time.

• Government sustainability targets are nudging fleets toward energy-efficient drives and compact loop designs that cut power draw per parcel.

Key Market Players

The global parcel sortation systems market share leadership rests with a mix of established intralogistics majors and agile specialists. Firms such as Beumer Group, Interroll Group, Vanderlande Industries, Daifuku, Kion-owned Dematic, Honeywell, and Bastian Solutions supply full-line systems that span conveyors, cross-belt sorters, and warehouse control software. Their competitive edge comes from vertically integrated portfolios and global service footprints that keep downtime low during peak seasons.

Challengers including Körber, SSI Schaefer, TGW Logistics, Fives, and Equinox are differentiating through AI-based parcel recognition, micro-fulfilment modules, and pay-per-parcel service models that lower capital outlay for mid-tier operators. Partnerships with robotics start-ups and cloud IoT platforms are common strategies to accelerate feature roll-outs without long development cycles.

Key Takeaways

• Current global parcel sortation systems market size (2024): roughly US$ 2.168 billion

• Projected global market size (2032): about US$ 4.028 billion at an 8.15 % CAGR

• Hardware captures more than half of revenue today; services are the fastest-growing slice through 2032

• Loop (circular) systems post the highest throughput and are pacing market trends in mega-hubs

• Logistics remains the largest vertical, while e-commerce is the standout growth engine

• Asia-Pacific commands the biggest regional share and continues to widen its lead

Market Dynamics

Drivers

• Explosive parcel volumes from omnichannel retail push operators toward high-speed automated sorters.

• Labour shortages and rising wages make automated handling more economical than manual sorting.

• Advances in machine vision and predictive maintenance reduce error rates and unexpected downtime.

Restraints

• High initial capital expenditure, often north of US$ 2 million per site, deters smaller facilities.

• Complex integration with legacy warehouse management systems can extend deployment timelines.

• Tight floor-space constraints in urban fulfilment centres limit adoption of large loop layouts.

Opportunities

• Industry 4.0 retrofits—sensors, IoT gateways, digital twins—unlock data-driven optimisation services.

• Modular micro-sorters tailored for last-mile depots open new revenue streams in dense city zones.

• Emerging markets in Southeast Asia and Latin America present greenfield demand for turnkey hubs.

Challenges

• Irregular or damaged parcels still trick camera-barcode pairs, leading to manual recirculation.

• Dependence on specialised components exposes operators to supply-chain disruptions.

• Energy-efficiency mandates force redesign of motors and drives, adding engineering complexity.

Regional Analysis

Asia-Pacific sets the pace, driven by cross-border e-commerce giants and governments funding logistics corridors. North America follows, anchored by well-capitalised retailers upgrading legacy DCs, while Europe advances automation to comply with stricter delivery-time and sustainability regulations.

• Asia-Pacific – Largest revenue share; soaring online sales in China, India, and South Korea drive continuous capacity adds.

• North America – High adoption of AI-enabled loop sorters to manage peak-season spikes and sprawling geography.

• Europe – Regulations on delivery speed and carbon footprint accelerate investment in energy-efficient solutions.

• Latin America – Growing middle-class e-commerce demand spurs new fulfilment centre builds.

• Middle East & Africa – Logistics free zones and airport-linked hubs foster steady uptake, albeit from a smaller base.

Segmentation Analysis

By Offering

• Hardware – Core investment anchor.

Hardware—including conveyors, diverters, scanners, and sorters—accounts for more than 54 % of market revenue. Upgrades focus on noise reduction, smart belts, and quick-swap modules to keep uptime high.

• Software – Intelligence layer.

Warehouse control and execution software orchestrates parcel flow, dynamically reroutes bottlenecks, and feeds analytics dashboards. Cloud-based licences and AI vision add-ons are pushing double-digit annual growth.

• Services – Fast-rising support backbone.

Design, integration, training, and life-cycle maintenance services grow fastest as operators lean on external expertise to keep systems tuned and staff up-skilled.

By Type

• Loop (circular) Systems – High-throughput headline act.

Cross-belt and tilt-tray designs handle diverse parcel mixes at 10 000+ pieces per hour, ideal for national and regional hubs scaling for peak demand.

• Linear Systems – Modular and space-efficient.

Activated roller belt, pop-up, and shoe sorters excel in medium-volume or narrow-footprint warehouses. Their plug-and-play modules allow incremental capacity additions for first-time automators.

By Industry Vertical

• Logistics – Traditional bedrock.

Third-party logistics providers rely on sorters to meet service-level agreements; upgrades focus on integrating returns handling and value-added kitting lines.

• E-commerce – Fastest-expanding vertical.

Pure-play and omnichannel retailers deploy loop systems with embedded AI to slash cut-off-to-dispatch times and cope with flash-sale surges.

• Airports – Security-driven niche.

Inbound mail and duty-free parcels demand high accuracy and low noise; compact, enclosed sorters fit constrained terminal basements.

• Others – Pharmaceuticals, food & beverage, postal.

Temperature-controlled or compliance-heavy sectors adopt vision-guided sorters for traceability and gentle handling.

Industry Developments & Instances

• January 2024 – Viettel Post installed a robot-based system processing 6 000 parcels per hour, boosting throughput and cutting error rates.

• December 2023 – BeeVision secured a multi-hub deal with Aramex for its AI BeeSort platform.

• October 2023 – Pitney Bowes expanded deployment of Ambi Robotics’ B-Series sorters across coastal hubs for middle-mile efficiency.

• March 2022 – Vanderlande unveiled an automated piece-picking robot enhancing parcel induction speed.

• December 2021 – Beumer Group launched a sorter dedicated to small and medium e-commerce packets for urban micro-hubs.

• May 2021 – Fives introduced a unified smart-automation web portal streamlining lifecycle support.

Facts & Figures

• Hardware retains roughly 54 % of 2024 market revenue, with loop systems delivering the highest throughput.

• Asia-Pacific captured about 40 % of global market share in 2023 and is widening its lead.

• Average installation cost for a mid-capacity sorter line sits between US$ 2 million and US$ 5 million, depending on site complexity.

• AI-enabled vision has cut mis-sort rates below 0.2 % in leading e-commerce hubs.

• Energy-efficient drives can reduce power consumption per parcel by up to 30 % versus legacy motors.

Analyst Review & Recommendations

Market analysis signals a decisive shift from single-lane conveyors to architected, data-rich ecosystems that blend high-speed hardware with cloud analytics. Suppliers that pair modular loop platforms with predictive maintenance and rapid-deployment service teams are set to outpace average market trends. For operators, prioritising flexible, space-saving designs and investing early in AI-driven vision will secure resilience against volume spikes and evolving parcel profiles while maximising return on capital outlay.