Market Overview

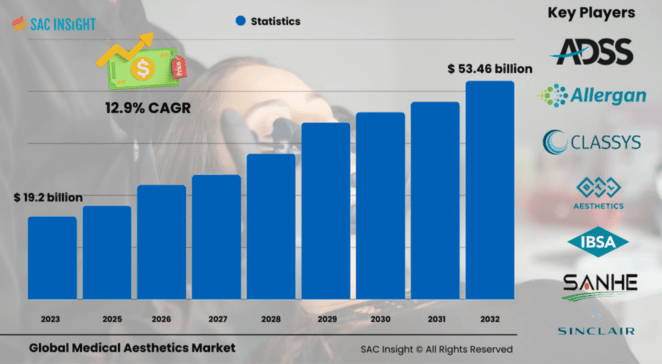

The Global medical aesthetics market size was roughly US$ 19.2 billion in 2024 and, by our SAC Insight analysis, is on track to reach US$ 53.46 billion by 2032, expanding at an average CAGR of 12.9% during 2026-2032. First-hand industry insights highlight three structural forces behind this market growth: a rising preference for minimally and non-invasive treatments, rapid device innovation that lowers downtime, and a broadening consumer base that now includes men and younger age groups. The U.S. medical aesthetics market segment alone is projected to top US$ 22.19 billion by 2032, reflecting strong procedure volumes and premium pricing power.

Summary of Market Trends & Drivers

Demand for botulinum toxin, dermal fillers, and skin-tightening platforms continues to outpace surgical interventions as patients look for quick, low-pain options.

Device makers are rolling out hybrid energy systems (laser + RF + ultrasound) that combine multiple treatments in one session, boosting clinic productivity.

Higher disposable incomes in Asia-Pacific and Latin America are widening access, while home-use LED and RF gadgets are seeding new at-home treatment habits.

Key Market Players

The medical aesthetics market report profiles established leaders and fast-moving challengers shaping market share. Global heavyweights include AbbVie (Allergan Aesthetics), Alma Lasers, Cynosure, Merz Pharma, and Johnson & Johnson (Mentor)—all known for broad portfolios and aggressive product refresh cycles. A vibrant tier of innovators such as Cutera, InMode, Apyx Medical, and Venus Concept is driving competition with niche body-contouring and energy-based systems that promise faster results and less discomfort.

Key Takeaways

• Current market value: US$ 19.2 billion (2024)

• Projected value: US$ 53.46 billion by 2032 at a 12.9 % CAGR

• North America commands over half of global revenue; Asia-Pacific delivers the fastest gains.

• Non-energy-based injectables (botulinum toxin & dermal fillers) remain the largest product slice, yet energy-based platforms post the highest CAGR.

• Home-use devices and combination technologies are the hottest product development themes.

• Male patients now represent nearly 15% of total non-surgical procedures, up from ~10% five years ago.

Market Dynamics

• Drivers

- Surge in minimally invasive procedures that promise short recovery and natural-looking outcomes.

- Technological leaps—hybrid laser/RF/ultrasound, AI-guided settings—improve safety and consistency.

- Rising disposable income and social media influence broaden consumer awareness.

• Restraints

- High capital cost of next-gen devices and limited reimbursement dampen uptake in cost-sensitive clinics.

- Stringent regulatory pathways can delay product launches and add compliance expense.

• Opportunities

- Untapped demand in emerging economies where medical tourism is booming.

- Development of long-lasting injectables and pain-free energy platforms could unlock new patient segments.

• Challenges

- Proliferation of low-cost at-home beauty gadgets may divert entry-level consumers.

- Shortage of trained aesthetic professionals in many regions could cap procedure capacity.

Regional Analysis

North America retains leadership thanks to high procedure density, robust clinic networks, and a culture of early technology adoption. Asia-Pacific is closing the gap with double-digit growth fueled by rising middle-class spending, medical tourism hubs, and influencer-driven beauty standards. Europe follows with steady demand and strong regulatory oversight that encourages premium device sales. North America had 53.77% market share in 2023, and this ratio is expected to remain robust through 2032.

• North America: Mature market, highest per-capita spend, strong presence of certified plastic surgeons.

• Europe: Emphasis on safety and quality, growth in medical tourism (Spain, Germany, U.K.).

• Asia-Pacific: Fastest expansion; China, South Korea, and Thailand lead injectable and skin-brightening demand.

• Latin America: Brazil and Mexico benefit from competitive pricing and a large pool of surgeons.

• Middle East & Africa: Dubai and Saudi Arabia invest heavily in aesthetic clinics; growth from affluent clientele.

Segmentation Analysis

• By Type

Non-Energy-Based Devices – Largest share, broad patient appeal.

Injectables such as botulinum toxin and dermal fillers dominate because they are quick, predictable, and require minimal downtime. Clinics leverage these high-margin treatments to drive repeat visits.

Energy-Based Devices – Highest CAGR, technology-driven.

Lasers, radiofrequency, ultrasound, and light-based platforms are gaining traction for body contouring and skin resurfacing. Hybrid systems that merge multiple energies in a single handpiece are shortening treatment sessions and improving outcomes.

Others – Niche but essential.

Implants and microdermabrasion systems serve specific indications like breast augmentation and surface exfoliation, providing clinics with comprehensive service lines.

• By Application

Skin Resurfacing & Tightening – Top revenue contributor.

Procedures addressing wrinkles, acne scars, and lax skin command premium pricing and repeat business. Advances in fractional laser and RF microneedling deliver visible results with minimal downtime, attracting a broad age range.

Body Contouring & Cellulite Reduction – Rapid climber.

Non-surgical fat reduction and muscle-toning devices (e.g., magnetic stimulation) are popular among fitness-minded consumers seeking subtle sculpting without surgery.

Hair & Tattoo Removal – Steady performer.

Next-gen diode and Alexandrite lasers with skin-tone sensing boost safety across Fitzpatrick types, driving consistent clinic traffic.

Breast Augmentation & Others – Procedure-specific growth.

Silicone gel implants and emerging fat-grafting techniques cater to patients seeking longer-lasting anatomical enhancements.

• By End-User

Specialty Clinics – Market leader.

Focused expertise, flexible scheduling, and boutique service models attract patients looking for personalized care.

Hospitals – High surgical volume.

Complex breast and reconstructive procedures remain hospital-based, supported by multidisciplinary teams.

Others (Medical Spas & Home Use) – Expanding frontier.

Medical spas blend wellness and aesthetics, while FDA-cleared home-use devices introduce first-time users to entry-level treatments.

Industry Developments & Recent Market Developments

• Nov 2024: FDA clears a next-generation ice-cooling diode laser for pain-reduced hair removal.

• Oct 2024: Regulatory approval for BOTOX® Cosmetic targeting neck platysma bands broadens neuromodulator indications.

• Jan 2024: Launch of a bone-mimicking hyaluronic acid injectable for chin augmentation extends facial-contouring options.

• May 2023: Micro-droplet HA skin-booster receives U.S. clearance, underscoring demand for subtle texture improvements.

• Jul 2022: RF-powered skin-tightening device gains clearance for neck laxity, signaling continued energy-device innovation.

Facts & Figures

• Non-surgical procedures made up ~6 million treatments in the U.S. alone last year.

• Male botulinum toxin sessions exceeded 1.3 million worldwide in 2022, a 15% YoY rise.

• Average list price of a new multi-energy platform: US$ 200,000–250,000.

• Home-use LED masks now represent 8% of global facial-device revenue, up from 3% in 2020.

• More than 7,400 board-certified plastic surgeons practice in the U.S., the largest national pool worldwide.

Analyst Review & Recommendations

SAC Insight evaluation confirms that consumers favor quick, low-risk enhancements, and clinics respond by bundling injectables with energy-based add-ons for comprehensive makeovers. Vendors that integrate AI-driven treatment presets, painless delivery modes, and robust clinician training will capture outsized market share. For new entrants, mid-priced, portable devices aimed at emerging markets offer a fast scale pathway, while established brands should double down on long-duration fillers and combination platforms to defend premium positions through 2032.