Market Overview

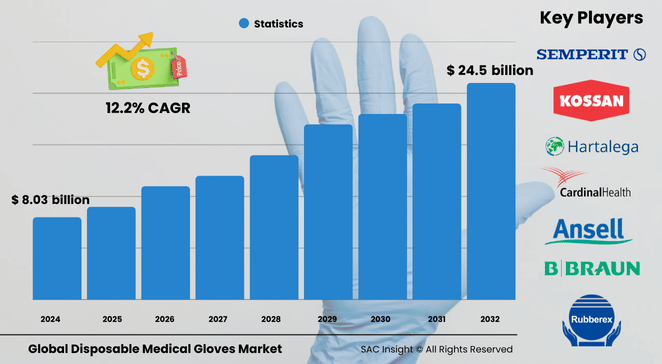

The global disposable medical gloves market size was valued at US$ 8.035 billion in 2024 and is projected to reach roughly US$ 24.57 billion by 2032, expanding at a 12.25% CAGR over the 2025-2032 forecast window. First-hand industry insights point to three powerful tailwinds: a stricter focus on infection prevention, aggressive healthcare capacity expansion in emerging economies, and a clear shift toward powder-free synthetic gloves that minimize allergic reactions.

SAC Insight's deep market evaluation also highlights the push for domestic production in North America, where the U.S. disposable medical gloves market is set to touch about USD$ 11.52 billion by 2032, reinforcing the region’s 41.37% market share in 2024.

Summary of Market Trends & Drivers

Demand is migrating rapidly from latex to nitrile and other synthetics as hospitals phase out allergenic materials and powder-coated products. Manufacturers are doubling down on biodegradable and chemo-rated lines, while automated dipping lines and just-in-time logistics smooth supply swings. Mass vaccination drives, routine diagnostics, and home-based care continue to underpin steady market growth.

Key Market Players

Global production remains concentrated among Malaysian leaders such as Top Glove, Hartalega, Supermax, and Kossan, each leveraging scale and vertical integration to defend pricing. Outside Asia, Ansell, Cardinal Health, Semperit, Dynarex, B. Braun, Rubberex, and Kimberly-Clark are investing in capacity upgrades, antimicrobial coatings, and U.S. reshoring projects to secure contracts with major health systems.

These companies keep competitive tempo high through merger activity, regional expansions, and frequent product refreshes. Their combined R&D spend targets puncture-strength gains, eco-friendly materials, and ergonomic designs that cut hand fatigue during prolonged use.

Key Takeaways

• Current global disposable medical gloves market size: USD$ 8.035 billion (2024)

• Forecast value: USD$ 24.57 billion by 2032 at a 12.25% CAGR

• North America leads with a 41.37% market share; the U.S. alone could top USD$ 11.52 billion by 2032

• Natural rubber retains a 37.2% share today, yet nitrile is the fastest-growing material class

• Examination gloves dominate volume thanks to high testing throughput and routine patient interactions

• Powder-free products are outpacing powdered varieties as more countries impose starch bans

Market Dynamics

Drivers

• Rising incidence of healthcare-associated infections (HAIs) intensifies infection-control protocols across hospitals and outpatient centers

• Expanding global surgical volumes, coupled with greater chronic-disease burden, fuel sustained demand for single-use barrier protection

• Government incentives and private capital are backing local glove manufacturing, reducing supply-chain risk and stimulating market growth

Restraints

• Latex allergies and powder-induced respiratory irritation curb adoption of traditional glove types

• Raw-material price volatility, especially for nitrile feedstocks, squeezes manufacturer margins

• Overcapacity following pandemic-era build-outs has triggered periodic price wars and inventory write-downs

Opportunities

• Biodegradable nitrile formulations and plant-based polymers open new ESG-friendly revenue streams

• AI-driven demand forecasting and automated dipping lines promise better asset utilization and quicker time-to-market

• Rapid expansion of home-health services and point-of-care diagnostics in emerging economies widens the addressable base

Challenges

• Stricter regulatory testing for chemo-rated and antimicrobial gloves raises compliance costs

• Ensuring consistent quality across sprawling contract manufacturing networks remains difficult

• Talent shortages in clean-room-grade production create operational bottlenecks for high-spec product lines

Regional Analysis

The North America disposable medical gloves market sets the pace, underpinned by sizeable per-capita healthcare spending, a robust legal focus on worker safety, and ongoing on-shoring of nitrile capacity. Asia Pacific, the production heartland, is delivering the fastest consumption gains as rising incomes, urbanization, and massive vaccination drives lift glove penetration in China, India, and Southeast Asia.

• North America – Policy-backed nitrile expansions and high infection-control standards keep demand resilient

• Europe – Powder bans and aging demographics sustain steady uptake of powder-free synthetics

• Asia Pacific – Dominant manufacturing hub with double-digit domestic consumption growth, especially in China and India

• Latin America – Private-hospital investment and aging populations drive moderate but consistent adoption

• Middle East & Africa – Rising public-health spending and infection-control campaigns spur gradual penetration

Segmentation Analysis

By Material

• Natural Rubber – 37.2% share, tactile benchmark

Natural rubber (latex) offers unmatched tactile feedback and stretch, making it a staple in surgical suites. However, allergy concerns and powder bans are steadily trimming its dominance.

• Nitrile – Fastest-growing, high puncture resistance

Nitrile balances strong barrier performance with hypoallergenic safety, positioning it as the go-to choice for blood-borne pathogen protection and chemo drug handling.

• Vinyl – Budget-friendly option for low-risk tasks

Vinyl serves cost-sensitive settings requiring quick glove changes, though lower tear strength limits use in high-stress procedures.

• Neoprene – Chemical-resistant niche

Neoprene’s heat and chemical resilience appeals to chemotherapy wards and sterile drug manufacturing, albeit at a premium price.

• Polyethylene – Lightweight, food-service crossover

Thin, loose-fitting polyethylene gloves handle light exams and ancillary duties where tactile precision is secondary.

• Others – Hybrid and bio-based blends

Emerging polymers and plant-based hybrids aim to blend biodegradability with medical-grade barrier properties, creating a new frontier for sustainable supply.

By Product

• Powdered – Legacy lubricant, declining share

Cornstarch-dusted gloves once accelerated donning speed but now face widespread bans due to airway and wound contamination risks.

• Powder-Free – Hospital standard, double-digit rise

Chlorinated or polymer-coated interiors make powder-free gloves easy to slip on while eliminating starch-related complications, driving hospital procurement guidelines worldwide.

By Application

• Examination – Core demand engine

Routine exams, phlebotomy, and vaccination drives create constant high-volume turnover, cementing examination gloves as the largest revenue slice.

• Surgical – Rebound with elective procedures

The resumption of elective operations and growth in minimally invasive techniques are steadily boosting surgical glove volumes after pandemic disruptions.

By End-Use

• Hospitals – Largest consumer group

Multi-disciplinary care settings and strict infection-control protocols keep hospitals at the top of the consumption chart.

• Home Healthcare – Rapidly expanding niche

Aging populations and chronic-care programs are increasing glove usage in home-based nursing and tele-health support

• Outpatient/Primary Care – Steady uptick

Walk-in clinics and primary practices rely on examination gloves for every patient interaction, maintaining stable baseline demand.

• Others – Dental, laboratory, and veterinary settings

Specialized clinics value barrier protection for aerosol-generating procedures and specimen handling, adding incremental volume.

Industry Developments & Instances

• February 2022 – Kimberly-Clark introduced chemo-rated Opal nitrile gloves featuring low-allergen formulation

• April 2022 – Unigloves rolled out BioTouch biodegradable nitrile to address end-of-life waste concerns

• April 2022 – SHOWA secured FDA clearance for the first biodegradable medical-grade nitrile gloves in the U.S.

• November 2022 – SafeSource Direct landed a major U.S. group-purchasing deal for chemo-rated nitrile exam gloves

• December 2022 – Semperit divested its medical-glove unit to sharpen focus on industrial hand protection

• September 2021 – American Nitrile launched a new Ohio plant, signaling a push toward domestic supply resilience

Facts & Figures

• Global market value 2024: USD$ 8.035 billion

• Forecast market value 2032: USD$ 24.57 billion

• Average global CAGR 2025-2032: 12.25%

• U.S. market size 2024: USD$ 4.19 billion; projected USD$ 11.52 billion by 2032

• North America’s 2024 market share: 41.37%

• Latex allergies affect roughly 4.3% of the global population, accelerating the nitrile shift

• Malaysia supplied about 49% of global rubber-glove exports in 2021

• Natural rubber held a 37.2% material share in 2024, still the single-largest slice despite nitrile gains

Analyst Review & Recommendations

Market analysis confirms a decisive pivot toward powder-free nitrile and next-generation eco-friendly gloves. Suppliers that combine high-throughput automated lines with transparent ESG credentials will capture the strongest contracts. Healthcare providers should diversify sourcing across regions and materials to hedge raw-material swings, while investors can look to niche chem-resistant and biodegradable segments for above-average margin potential over the next decade.