Market Overview

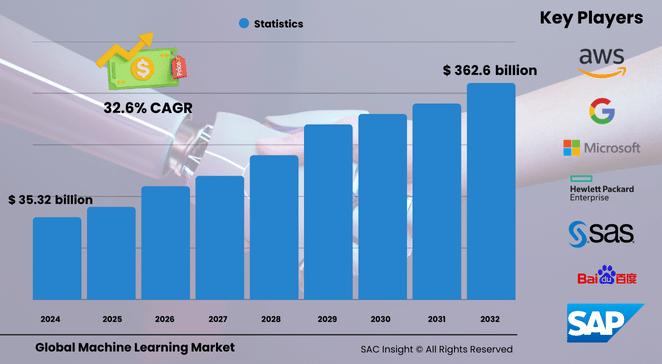

The global machine learning market size was valued at US$ 35.32 billion in 2024 and is projected to reach between US$ 362.65 billion and US$ 448.90 billion by 2032, registering a strong 32.65% CAGR over the 2025-2032 forecast horizon. This steep market growth reflects three structural forces: a rush to automate data-heavy workflows, the emerging maturity of cloud-native ML platforms, and expanding use cases in sectors as diverse as healthcare diagnostics and advertising optimization.

SAC Insight industry insights also highlight a decisive shift toward managed ML services, which already capture just over half of global revenue. In the United States machine learning market alone, machine learning revenues are on track to top US$ 109.15 billion by 2032 as enterprises scale AI-driven decision engines across front- and back-office functions.

Summary of Market Trends & Drivers

• Hyper-personalization, real-time fraud detection, and predictive maintenance are anchoring enterprise ML budgets, pushing vendors to deliver faster model iteration and tighter MLOps integration.

• Hardware accelerators optimized for ML workloads—GPUs, ASICs, and custom AI chips—are lowering training times and broadening access beyond data-science teams.

• Regulatory interest in responsible AI is encouraging transparent model monitoring and bias mitigation, adding a governance layer that favors vendors with robust compliance toolkits.

Key Market Players

Prominent providers shaping machine learning market share include Amazon Web Services, Google, Microsoft, IBM, Intel, SAP, SAS Institute, and Baidu, each investing heavily in cloud-hosted toolchains, AutoML features, and domain-specific model libraries. A fast-growing cohort of specialists such as H2O.ai, Databricks, and Imagimob is carving out niches in edge inference, open-source model ops, and low-code development environments. Strategic moves—ranging from Infineon’s edge-ML acquisition to Acquia’s customer data-platform upgrades—underscore an arms race to bundle model management, data pipelines, and real-time serving under one roof.

Key Takeaways

• Market value range in 2032: USD$ 362.65 billion to USD$ 448.90 billion at a 32.65% CAGR

• Services hold the largest component market share at 51.6% thanks to demand for managed MLOps and consulting.

• Advertising & media represents the leading end-use slice at 20%, driven by algorithmic ad-buying and audience targeting.

• North America commands 29.5% of global revenue, buoyed by cloud adoption and deep R&D funding.

• The U.S. market is set to exceed USD$ 109 billion by 2032, reflecting strong enterprise appetite for applied AI.

Market Dynamics

Drivers

• Exploding data volumes and cheaper compute are lowering entry barriers, accelerating market growth.

• Sector-specific pretrained models enhance time-to-value, enticing small and medium-sized businesses to adopt ML.

• Continuous investment in AutoML and no-code tools democratizes model development for non-experts.

Restraints

• Skill shortages and steep learning curves still slow full-scale deployment in traditional industries.

• Concerns around data privacy, algorithmic bias, and model explainability create adoption friction.

• High-performance ML hardware carries significant upfront costs for on-premise installations.

Opportunities

• Edge-based inference for IoT devices opens fresh revenue streams in manufacturing, smart cities, and autonomous mobility.

• Industry-specific compliance frameworks (finance, healthcare) create white-space for specialized vendors.

• Integration of generative AI with classical ML pipelines offers upsell potential through content creation, summarization, and simulation.

Challenges

• Fragmented tooling and vendor lock-in risk complicate seamless model lifecycle management.

• Evolving global AI regulations demand continuous updates to governance processes.

• Energy consumption of large-scale training workloads raises sustainability questions and potential cost headwinds.

Regional Analysis

North America remains the demand epicentre thanks to deep venture funding, sophisticated cloud infrastructure, and proactive corporate AI agendas. Asia-Pacific is the fastest-growing region, powered by public-sector AI initiatives in China and India and a vibrant startup ecosystem. Europe follows closely, supported by strong research institutions and tightening responsible-AI regulations that spur platform upgrades.

• North America – Largest revenue contributor; early mover advantage in cloud ML services

• Europe – Strong on ethical AI standards; rapid enterprise machine learning adoption in finance and healthcare

• Asia-Pacific – Fastest growth; government-backed AI programs and expanding manufacturing applications

• Latin America – Growing digital commerce and fintech investments unlocking ML opportunities

• Middle East & Africa – Emerging adoption through smart-city and energy-sector pilots

Segmentation Analysis

By Component

• Services – Over half of market revenue Managed ML services dominate as firms outsource model monitoring, tuning, and DevOps integration to specialists, cutting time-to-value and internal headcount needs.

• Hardware – Fastest CAGR within components Specialized inference chips and high-memory GPUs slash training times, pushing demand from both hyperscalers and on-premise data-centre operators.

• Software – Cloud-native platforms enable seamless scaling Low-code model builders, feature stores, and collaborative notebooks reduce complexity, particularly for SMEs starting their AI journey.

By Deployment

• Cloud – Preferred for elasticity and pay-as-you-go pricing Enterprises favour cloud for rapid experimentation and global rollout, leveraging built-in security and compliance features without capital expense.

• On-Premise – Chosen for latency-sensitive or regulated workloads Sectors such as defense and banking deploy local clusters or private clouds to maintain data sovereignty and meet stringent audit requirements.

By Enterprise Size

• Large Enterprises – 65.9% of revenue in 2024 Deep data lakes and advanced analytics teams keep large organizations at the forefront of sophisticated ML initiatives.

• Small & Mid-Sized Enterprises – Rising adoption curve Automated feature engineering and plug-and-play APIs are removing resource barriers, letting SMEs use ML for demand forecasting and customer segmentation.

By End-Use

• Advertising & Media – Core demand engine ML optimizes ad spend, detects fraud, and personalizes content, delivering measurable ROI for marketers.

• Healthcare – Rapid diagnostic and treatment innovation Algorithms speed up image analysis, drug discovery, and patient-risk stratification, improving outcomes while easing clinical workloads.

• BFSI – Mission-critical fraud and credit scoring Banks deploy ML to flag anomalous transactions in real-time and refine loan-risk models, cutting defaults and compliance penalties.

• Law – Highest forecast CAGR Predictive analytics support case-outcome assessment and document review, reducing turnaround times for legal teams.

• Retail, Automotive & Transportation, Manufacturing, Agriculture, Others – Expanding use cases From dynamic pricing to predictive maintenance, these sectors leverage ML to boost operational efficiency and customer satisfaction.

Industry Developments & Instances

• May 2023 – A global semiconductor leader acquired an edge-ML platform to strengthen its portfolio of low-power inference solutions.

• January 2023 – A Chinese search giant announced plans to embed conversational AI across core search functions, signaling mainstream adoption of generative models.

• January 2022 – A customer-data-platform vendor launched advanced retail ML models to raise lifetime customer value for omnichannel brands.

• May 2021 – A leading cloud provider unveiled a unified ML platform that brings training, tuning, and deployment under one API and UI.

• April 2021 – A major technology firm released open datasets across genomics, transport, and labour economics to improve model accuracy and accelerate ML-as-a-service uptake.

• February 2020 – An enterprise software giant introduced a cloud data-science platform that streamlines collaborative model development and governance.

Facts & Figures

• Average global CAGR 2025-2032: 32.65%

• Global revenue expected to jump from USD$ 35.32 billion (2024) to between USD$ 362.65 billion and USD$ 448.90 billion (2032)

• U.S. market forecast: USD$ 109.15 billion by 2032

• Services command 51.6% of 2022 component market share

• Advertising & media captured 20% of 2022 end-use revenue

• North America held 29.5% of global market share in 2022

• Edge-ML silicon shipments growing above 40% annually, supporting real-time inference on billions of devices

• Over 70% of large enterprises now run at least one ML workload in the cloud, compared with 45% three years ago

Analyst Review & Recommendations

SAC Insight's deep market evaluation shows machine learning shifting from experimental pilots to core enterprise workflow. Vendors that package model lifecycle automation, transparent governance, and verticalised starter templates will capture disproportionate market growth. For incumbents, expanding hardware-software co-design and reinforcing responsible-AI toolsets are urgent priorities. Emerging players should target edge-inference and lightweight AutoML niches where agility and domain focus can beat scale. Overall, sustained double-digit expansion through 2032 looks secure as ML cements its role as the decision-engine backbone of modern business.