Market Overview

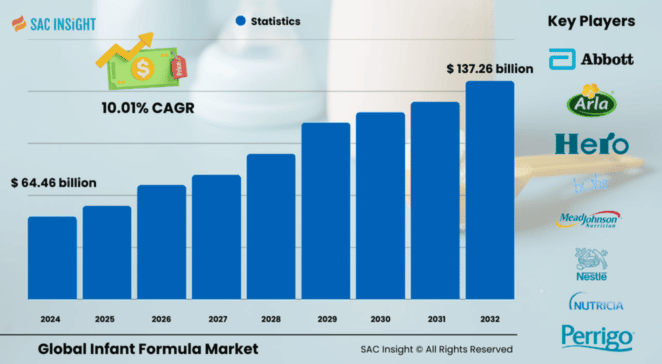

The infant formula market size stood at US$ 64.46 billion in 2024 and is projected to hit US$ 137.26 billion by 2032, charting a solid 10.1% CAGR during the forecast period. First-hand industry insights point to three structural engines of market growth: rising female workforce participation, heightened awareness of early-life nutrition, and a sharp pivot toward clean-label, plant-based formulations. Evaluation shows Asia Pacific commanding about 68.73% market share in 2024, while the U.S. infant formula market is forecast to approach US$ 12.67 billion by 2032 as demand for premium and specialty blends accelerates.

Summary of Market Trends & Drivers

• Parents are increasingly gravitating toward organic, non-GMO, and plant-forward recipes fortified with human milk oligosaccharides and vitamin D, reshaping market trends across the value chain.

• As manufacturers race to meet stricter quality expectations and regulatory scrutiny, precision nutrient delivery, AI-enabled formulation, and transparent supply-chain tracking are gaining traction.

• Rapid e-commerce expansion and on-the-go packaging formats are broadening access while boosting market growth in both mature and emerging economies.

Key Market Players

Global leaders such as Nestlé, Danone, Abbott, Arla Foods, and Yili anchor the competitive landscape with expansive product portfolios and heavy R&D outlays. These companies are doubling down on premiumization with hypoallergenic blends, plant–dairy hybrids, and DHA-rich formulas while scaling digital consumer engagement. A vibrant cohort of challengers, including Bellamy’s Organic, Bubs Australia, Perrigo, and FrieslandCampina, is carving out share through specialty positioning, grass-fed sourcing, and traceability platforms that resonate strongly with millennial parents seeking uncompromised safety.

Key Takeaways

• Global market value 2024: USD$ 64.46 billion

• Projected value 2032: USD$ 137.26 billion at a 10.1% CAGR

• Asia Pacific leads with nearly 69% of global revenue; China remains the single largest national market.

• Supermarkets account for about 36% of 2024 retail sales, but online channels are the fastest-growing.

• Toddler and specialty formulations are outpacing standard infant milk as parents address allergies and digestive sensitivities.

• Ongoing recalls underscore the premium placed on rigorous quality control and end-to-end traceability.

Market Dynamics

Drivers

• Urbanisation and dual-income households spur demand for convenient, ready-to-feed nutrition solutions.

• Rising pre-term birth rates and metabolic disorders support wider medical endorsement of fortified formulas.

• Innovation in ingredient science—probiotics, HMOs, and structured lipids—continues to elevate product efficacy and differentiation.

Restraints

• Stringent registration protocols and batch-testing requirements inflate time-to-market and compliance costs.

• Safety recalls linked to bacterial contamination erode consumer trust and trigger short-term supply gaps.

• Intensifying breastfeeding advocacy campaigns can dampen formula uptake in certain regions.

Opportunities

• Plant-dominant and lactose-free formats positioned for flexitarian parents offer fertile white space.

• Blockchain-backed provenance tools can convert safety anxieties into loyalty-building transparency.

• Expansion into emerging cities across South-East Asia, Latin America, and Africa promises new volume corridors.

Challenges

• Volatile raw-milk prices and supply-chain disruptions pressure margin stability.

• Heightened ESG expectations demand measurable progress on carbon reduction and sustainable packaging.

• Talent shortages in quality assurance and regulatory affairs complicate multinational rollout strategies.

Regional Analysis

Asia Pacific remains the undisputed epicentre of market analysis, buoyed by sheer population scale, rising disposable incomes, and pro-nutrition policies. China’s easing of birth restrictions and India’s expanding middle class together underpin double-digit regional growth, while Japan and Australia add incremental premium volume through clean-label demand.

• Asia Pacific – Highest revenue and fastest CAGR, driven by population size and product innovation.

• North America – Premium and specialty formulas surge as allergy awareness climbs.

• Europe – Strong regulatory standards and organic preferences sustain steady uptake.

• Latin America – Urbanisation in Brazil and Mexico expands supermarket shelf space for infant milk.

• Middle East & Africa – Infrastructure upgrades and rising birth rates open new distribution opportunities.

Segmentation Analysis

By Type

• Infant Milk – Core volume leader

Infant milk dominates early feeding stages thanks to wide retail availability and ongoing product line refreshes focused on digestibility.

• Follow-on Formula – Accelerated uptake post-six months

Parents transitioning to complementary feeding increasingly choose follow-on blends enhanced with iron and prebiotics for immunity support.

• Toddler Formula – High-growth, US$ 19.8 billion in 2024

These nutrient-dense drinks cater to active toddlers requiring calcium, DHA, and protein boosts beyond standard cow’s milk.

• Specialty Formula – Tailored solutions for allergies and metabolic needs

Hypoallergenic, lactose-free, and condition-specific variants command premium pricing as pediatric recommendations rise.

By Distribution Channel

• Hypermarkets / Supermarkets – About 36% share in 2024

One-stop convenience and frequent promotions make large-format stores the default choice for bulk buyers.

• Pharmacy / Medical Stores – Trusted advice hub

Parents seeking clinical reassurance rely on pharmacists for specialty and therapeutic formulations.

• Specialty Stores – Niche, service-oriented retail

Organic-only outlets and boutique baby shops appeal to health-conscious consumers willing to pay a premium.

• Online & Others – Rapidly scaling click-to-cart segment

Subscription models, doorstep delivery, and real-time stock updates fuel double-digit e-commerce expansion worldwide.

Industry Developments & Instances

• July 2023 – A leading multinational introduced a formula with milk-fat droplets structurally similar to breast milk in China.

• May 2023 – A dairy cooperative launched Lacprodan Alpha-50, an alpha-lactalbumin-rich ingredient aimed at low-protein formulations.

• March 2023 – A hypoallergenic brand entered the U.S. market to ease supply shortages, focusing on cow-milk-allergy relief.

• October 2022 – A global nutrition firm invested US$ 500 million in a new U.S. plant to boost domestic supply resilience.

• March 2022 – A start-up debuted a formula blending grass-fed whole milk with key breast-milk proteins after five years of research.

Facts & Figures

• Asia Pacific generated US$ 56.17 billion in 2024 revenue.

• Supermarkets captured 36.16% of global retail sales in 2024.

• Average global birth rate stood at 18.7 per 1,000 people in 2023.

• Approximately 380,000 babies are born prematurely each year in the U.S.

• The toddler segment posted US$ 19.8 billion in 2024 revenue.

• The U.S. market is forecast to approach US$ 12.67 billion by 2032.

• Average global CAGR 2026-2032: 10.1%.

Analyst Review & Recommendations

The infant formula arena is shifting from mass-produced powder to precision-nutrition ecosystems. Manufacturers that integrate advanced ingredient science with transparent sourcing and agile digital channels will secure outsized share as regulatory oversight tightens. Investment in plant-based R&D, blockchain traceability, and localised production capacity offers the clearest pathway to sustained market growth and consumer trust through 2032.