Market Overview

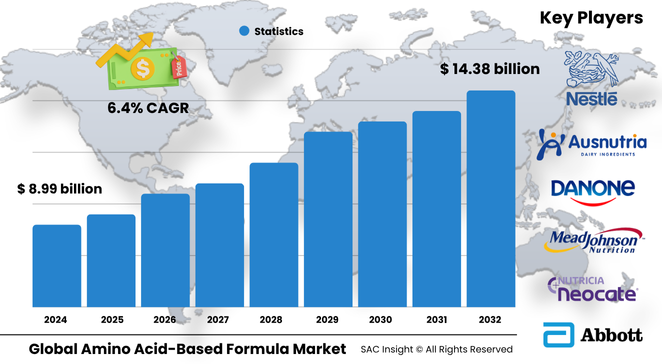

The global amino acid-based formula market size stands at about US$ 8.99 billion in 2024 and is projected to approach roughly US$ 14.38 billion by 2032, reflecting a healthy 6.4% CAGR. SAC Insight's first-hand industry insights indicate that rising milk-protein allergies, sub-optimal breastfeeding rates, and the quest for precise, hypoallergenic nutrition are the chief engines of market growth.

SAC Insight’s deep market evaluation suggests the United States amino acid-based formula market alone could advance from around US$ 1.6 billion in 2024 to nearly US$ 2.9 billion by 2032 as pediatricians shift prescriptions toward fully elemental formulas for severe cow-milk protein intolerance.

Summary of Market Trends & Drivers

• Parents in urban Asia are trading traditional dairy for ready-to-feed amino acid formulas, favouring convenience and clinical reassurance.

• Digital pharmacies and direct-to-consumer subscriptions are widening access, supporting double-digit online channel expansion.

• Manufacturers are lowering bitterness with new flavour-masking peptides, boosting repeat purchase rates and underpinning long-term market growth.

Key Market Players

Multinational nutrition houses dominate market share through extensive paediatric portfolios and global distribution footprints. Brands owned by Nestlé, Abbott, Mead Johnson, and Nutricia leverage clinical trial data and hospital detailing to cement formulary preference. Meanwhile, Ausnutria and Aptamil strengthen regional relevance via specialised formulations for East Asian taste profiles and lactose-free variants. Competitive dynamics are intensifying around e-commerce partnerships, joint ventures with local dairies, and investments in flavour science to overcome historic palatability issues.

Key Takeaways

• Current global market size (2024): about USD$ 8.99 billion

• Projected global market size (2032): roughly USD$ 14.38 billion at a 6.4 % CAGR

• Growing-up milk formula captures the largest product market share and could exceed USD$ 6 billion by 2032

• Lactose-free variants are expanding faster than lactose-containing lines as paediatric allergy screening improves

• East Asia remains the demand epicentre, yet North America’s prescription-based segment retains premium pricing power

• Online direct sales are rising more than twice as fast as brick-and-mortar channels, propelled by subscription convenience

Market Dynamics

Drivers

• Escalating incidence of milk-protein allergy and gastrointestinal disorders in infants

• Greater workforce participation among women, fuelling reliance on high-performance breast-milk substitutes

• Continuous product innovation—flavour masking, synbiotic fortification, and convenient packaging—stimulating adoption

Restraints

• Premium price versus mainstream formulas limits uptake in low- and middle-income segments

• Persistent taste challenges can hinder long-term compliance despite clinical benefits

• Regulatory hurdles on labelling and protein claims differ by region, complicating market entry

Opportunities

• Personalised nutrition platforms that tailor amino acid ratios to genetic allergy profiles

• Strategic partnerships with paediatric tele-health providers to bundle formula with virtual care plans

• Expansion into adult medical-nutrition niches for malabsorption and post-surgical recovery

Challenges

• Volatile whey, casein, and amino acid input costs pressure manufacturer margins

• Counterfeit infant nutrition online undermines brand trust and necessitates robust verification tech

• Environmental scrutiny of formula packaging drives demand for recyclable or plant-based materials

Regional Analysis

East Asia commands the largest market share owing to high urban birth rates, stringent safety perceptions after past dairy scandals, and a strong preference for imported premium formulas. North America follows, sustained by prescription coverage and paediatrician advocacy, while Europe benefits from robust export output and supportive allergy-management guidelines.

• North America – Prescription dominance and high per-capita spend support premium pricing.

• Europe – Leading production hub with strong export flow to Asia; investments in flavour-science facilities rising.

• East Asia – Fastest absolute growth; Chinese demand alone exceeds 25 % of global volume.

• South Asia & Oceania – Growing awareness in India and Australia drives steady double-digit uptake.

• Middle East & Africa – Nascent but expanding through pharmacy chains and GCC fertility-rate growth.

• Latin America – Moderate growth as urban middle-class consumers adopt imported hypoallergenic brands.

Segmentation Analysis

By Product Type

• Growing-Up Milk Formula – Core revenue engine.

Parents of toddlers turn to amino acid-based growing-up formulas for allergy management beyond infancy, giving this segment over 45 % market share and the highest forecast CAGR.

• Follow-On Milk Formula – Rapidly rising.

Infants switching from starter formulas need seamless allergy protection; improved taste profiles accelerate demand among 6- to 12-month-olds.

• Specialty & Others – Niche but vital.

Formulas targeting metabolic disorders and severe reflux command premium margins despite smaller volumes.

By Type

• Lactose-Free – Outpacing global average.

Heightened intolerance screening and paediatric recommendations push lactose-free lines toward a double-digit growth trajectory.

• Lactose – Established base.

Preferred where mild sensitivities allow, offering cost advantages and familiar taste yet growing more slowly than lactose-free options.

By Point of Sale

• Prescription-Based – Trust-driven high value.

Hospital protocols and insurance coverage underpin stable demand, especially in North America and Europe.

• Over-the-Counter – Expanding reach.

Retail pharmacy chains and baby-care stores in emerging markets foster broader consumer trial.

By Age Group

• 0-3 Months – Critical clinical niche.

Elemental formulations serve neonates with severe intolerance, supported by neonatal-clinic endorsements.

• 4-7 Months and 8-12 Months – Steady acceleration.

As weaning begins, parents rely on amino acid formulas to manage transition without allergen exposure.

• 12 Months & Above – Largest absolute volume.

Toddlers requiring sustained allergy management drive consistent repeat purchases and bulk-pack demand.

By Sales Channel

• Offline – Hypermarkets, specialty outlets, pharmacies.

Trusted physical presence remains important for first-time buyers seeking pharmacist guidance.

• Online – Direct brand sites and third-party e-commerce.

Subscription bundles, rapid delivery, and educational content fuel the highest channel growth rate.

Industry Developments & Instances

• May 2025 – A leading global nutrition firm launched a synbiotic-enhanced amino acid formula targeting gut-microbiome support.

• February 2025 – Two major brands formed a joint venture in Southeast Asia to localise production and cut import tariffs.

• November 2024 – An e-pharmacy platform introduced blockchain serialization for infant-formula authenticity across the Middle East.

• July 2024 – A European dairy group invested USD$ 120 million in a flavour-masking research centre to improve elemental formula palatability.

Facts & Figures

• Tier-1 manufacturers hold roughly 75 % of global market share.

• Ready-to-feed variants trimmed preparation time by up to 70 %, driving a 12 % jump in repeat sales during 2024.

• Online direct-to-consumer subscriptions represent more than 18 % of total volume, up from 9 % in 2021.

• Average retail price per kilogram is about 4 × higher than standard cow-milk formula, highlighting premium positioning.

• Lactose-free SKUs account for nearly 60 % of new product launches in 2024.

Analyst Review & Recommendations

Market analysis shows a decisive shift toward clinically validated, convenience-driven solutions. Brands that couple evidence-backed hypoallergenic claims with improved taste and sustainable packaging will capture disproportionate market share. Prioritising partnerships with paediatric tele-health networks and investing in flavour-science R&D will help manufacturers widen adoption while defending premium pricing through 2032.