Market Overview

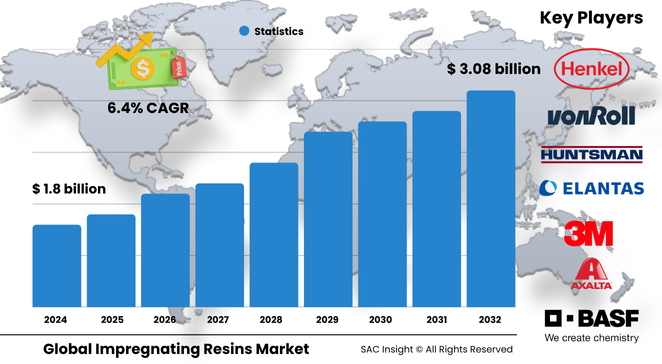

The global impregnating resins market size stands near US$ 1.87 billion in 2024 and is on track to reach about US$ 3.08 billion by 2032, reflecting a solid 6.4% CAGR through the 2025-2032 forecast window. First-hand industry insights point to three central catalysts: the electrification of vehicles and industrial drives, ongoing grid modernisation that demands high-reliability transformers, and rising productivity requirements in motors and generators.

SAC Insight’s deep market evaluation suggests the U.S. impregnating resins market could expand from roughly US$ 0.29 billion in 2024 to close to US$ 0.48 billion by 2032 as domestic EV output and grid-hardening projects scale up.

Summary of Market Trends & Drivers

Automakers are shifting from combustion engines to efficient electric powertrains, accelerating demand for high-performance rotor and stator insulation. Grid operators, meanwhile, are upgrading ageing infrastructure to handle renewable intermittency, which drives steady orders for transformer-grade resins. On the production side, solventless formulations dominate because they cut VOCs, cure faster, and improve winding fill, pushing market growth toward greener, higher-throughput process lines.

Key Market Players

Industry leadership rests with a mix of global chemical majors and specialised electrical-insulation suppliers. Firms such as BASF, Henkel, Axalta, Von Roll, ELANTAS, and Huntsman provide broad resin portfolios and strong technical support, while 3M, Wacker Chemie, Momentive, and Kyocera focus on niche high-temperature or low-emission grades that meet demanding OEM specifications. Competitive dynamics increasingly revolve around rapid new-product launches—low-styrene, high-thermal-class epoxies, for example—and regional capacity expansions that shorten lead times for motor, generator, and transformer plants in Asia and North America.

Key Takeaways

• Current global market size (2024): about USD$ 1.87 billion

• Projected global market size (2032): roughly USD$ 3.08 billion at a 6.4 % CAGR

• Solventless resins command the largest market share, exceeding half of all revenue thanks to low viscosity and VOC-free processing

• Epoxy chemistry leads in market trends for high chemical and thermal resistance, capturing more than 60 % of type-based demand

• Powertrain systems remain the core application, representing over 40 % of 2024 revenue as EV production ramps worldwide

• Asia-Pacific generates the lion’s share of market revenue today, but North America shows the fastest incremental demand from grid-hardening and e-mobility investments

Market Dynamics

Drivers

• Growing EV penetration drives large-scale adoption of rotor and stator insulation materials in traction motors

• Grid upgrades and renewable integration expand transformer fleets, lifting resin consumption for coil impregnation

• Process efficiency gains—from vacuum-pressure impregnation to inline curing—lower total cost of ownership and encourage resin upgrades

Restraints

• Volatile raw-material prices for key intermediates such as bisphenol-A and reactive diluents pressure margins

• Stringent environmental rules restrict styrene content and tighten oversight on solvent emissions, raising compliance costs

• Limited awareness of advanced resins among small motor rewind shops slows penetration in some emerging economies

Opportunities

• Waterborne and bio-based resin technologies can capture sustainability-driven demand and help OEMs meet ESG targets

• Hybrid drones, electric two-wheelers, and distributed energy resources create new, smaller-volume niches for high-temperature grades

• Digital twins that optimise impregnating-process parameters enable value-added service bundles for material suppliers

Challenges

• Ensuring impregnation uniformity in high-slot-fill motors for premium EV platforms requires tight viscosity control

• Supply-chain disruptions for specialty catalysts or fillers can extend equipment downtime at motor and transformer plants

• Rising space constraints in urban substations push thermal limits, demanding continual formulation innovation

Regional Analysis

Asia-Pacific dominates the impregnating resins landscape, buoyed by dense manufacturing clusters, surging e-vehicle output in China and India, and aggressive electrification targets. Europe follows with a mature appliance and industrial-machinery base and strong environmental regulations that favour low-emission chemistries. North America exhibits rapid catch-up momentum as federal infrastructure funds roll out and EV adoption accelerates.

• Asia-Pacific – Largest revenue contributor; OEM-heavy economies drive volume and localised resin production

• Europe – Technology-focused; stringent VOC limits spur solventless and waterborne innovation

• North America – Fast market growth tied to grid-hardening grants and EV supply-chain investments

• Middle East & Africa – Gradual adoption as utilities upgrade transmission networks and expand renewables

• Latin America – Emerging market share built on appliance manufacturing hubs and regional EV incentives

Segmentation Analysis

By Form

• Solventless – VOC-free, high-performance leader.

These low-viscosity systems penetrate windings quickly, cure without solvent evaporation, and deliver superior dielectric strength, making them the preferred choice for high-speed production lines and stringent emission standards.

• Solvent-based – Legacy option for niche needs.

Although offering a broader working window, higher dissipation factors and solvent emissions limit long-term prospects outside certain small-batch repair and rewind operations.

By Type

• Epoxy – Thermal and chemical benchmark.

Epoxy resins withstand temperatures above 200 °C, provide robust insulation, and account for the majority of market revenue, especially in demanding automotive and industrial applications.

• Polyurethane – Vibration-damping specialist.

Polyurethane systems improve bonding, reduce noise, and enhance thermal conductivity, carving a growing share in high-speed motor and generator markets.

• Polyester – Cost-effective workhorse.

Polyester grades offer balanced performance for standard appliance and low-to-medium-duty motors where cost sensitivities predominate.

• Polyesterimide – High-heat performer.

Blending polyester ease with imide durability, these resins cater to traction motors and aerospace generators that face intermittent overloads.

• Others – Specialty chemistries.

Silicone, acrylic, and hybrid systems address extreme environments such as offshore wind turbines or mining equipment where unique dielectric or moisture-resistance traits are required.

By Application

• Powertrain Systems – Core demand engine.

Traction motors, hybrids, and integrated starter-generators rely on impregnation to boost slot fill, cut losses, and extend service intervals, ensuring this segment maintains the top revenue share.

• Motors & Generators – Industrial reliability pillar.

Heavy-duty pumps, compressors, and turbines consume large volumes of resin to safeguard windings against thermal cycling and moisture ingress in continuous-operation settings.

• Transformers – Grid stability backbone.

Distribution and instrument transformers use impregnating resins in coils to manage heat and partial discharges, with demand rising as utilities reinforce power networks.

• Home Appliances – Steady, volume-driven slice.

Fans, washing machines, and HVAC blowers continue to require resin-insulated stators, though price competition caps margins.

• Automotive Components & Others – Emerging niches.

Electric power steering, auxiliary pumps, and cordless power tools create incremental growth opportunities for fast-curing, drop-in formulations.

Industry Developments & Instances

• December 2024 – A leading supplier commissioned a 15-kiloton solventless epoxy reactor in Gujarat to meet South-Asian EV demand

• August 2024 – A European motor OEM adopted VOC-free polyurethane resin for its new 800-volt e-axle platform, citing 10 % lower winding temperatures

• April 2024 – A global chemicals group launched a bio-based impregnating resin line featuring 30 % renewable carbon content and drop-in process compatibility

• November 2023 – A five-year technical partnership between a resin producer and an EV start-up targets customised high-slot-fill formulations for axial-flux motors

Facts & Figures

• Solventless grades captured roughly 51 % of global revenue in 2024

• Epoxy chemistry commands more than 60 % of the market share by type

• Asia-Pacific accounts for approximately 62 % of current sales volume

• Average impregnation cycle times in modern vacuum-pressure lines have fallen below 30 minutes, a 20 % improvement since 2020

• Transitioning from solvent-based to solventless systems can cut plant VOC emissions by up to 85 %

• SAC Insight forecasts more than 45 million EV traction motors will require resin impregnation between 2025 and 2032

Analyst Review & Recommendations

Market analysis points to a decisive shift toward eco-efficient, high-heat materials that maximise winding density while complying with tightening environmental rules. Suppliers that couple next-generation solventless or bio-based chemistries with process optimisation support will outpace average market growth. Investing in regional production hubs, expanding R&D on low-styrene alternatives, and partnering closely with EV, transformer, and industrial-drive OEMs should secure competitive advantage as the market advances toward the USD$ 3 billion mark by 2032.