Market Overview

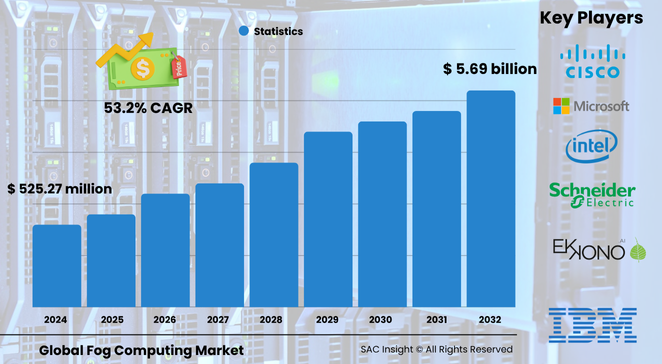

The global fog computing market size is estimated at about US$ 525.27 million in 2024 and is set to soar to roughly US$ 5.69 billion by 2032, reflecting a rapid 53.2% CAGR. SAC Insight's first-hand industry insights confirm that edge-intensive Internet-of-Things (IoT) roll-outs, tougher data-sovereignty rules, and mounting latency-sensitive workloads are rewriting enterprise network strategies.

SAC Insight's deep market evaluation shows that the United States fog computing market already captures more than 86% of North American revenue, although its exact dollar value remains unreported. Early adopters in manufacturing, transport, and healthcare are shifting analytics from distant clouds to local fog nodes, driving market growth while easing bandwidth stress and reducing attack surfaces.

Summary of Market Trends & Drivers

• Explosive IoT device proliferation demands real-time processing closer to the source, turning fog layers into the preferred architecture for sub-millisecond response.

• Rising cyber-risk and privacy mandates push organisations to keep sensitive data local, elevating fog nodes as compliance anchors.

• Hardware miniaturisation and container-based orchestration slash deployment costs, broadening access for mid-size enterprises.

Key Market Players

Market share leadership rests with a blend of global innovators and specialised start-ups. Large vendors such as Cisco, IBM, Intel, Microsoft, and Schneider Electric bundle fog-ready gateways with secure orchestration software, allowing customers to stitch together cloud and edge resources under one dashboard. Mid-tier firms including Crosser Technologies, IOTech Systems, and TERAKI focus on lightweight analytics stacks that run on sensors, gateways, or micro data centres, carving out share in industrial automation and smart-city pilots.

Competitive dynamics revolve around open-source alliances, vertical integration, and strategic acquisitions. Incumbents are embedding software development kits in network equipment, while newcomers partner with systems integrators to target brownfield plants that cannot tolerate cloud latency. This two-pronged push is accelerating overall market growth and enriching the fog computing value chain.

Key Takeaways

• Current global fog computing market size (2024): about US$ 525 million

• Projected global market size (2032): nearly US$ 5.69 billion at a 53.2 % CAGR

• Software accounts for roughly two-thirds of 2024 revenue thanks to low-cost container management and analytics stacks

• Smart manufacturing is the largest application, while smart-city projects exhibit the fastest market growth

• North America dominates market share, yet Europe and Asia-Pacific show the quickest percentage gains on greenfield projects

• Real-time safety, predictive maintenance, and telemedicine are the headline market trends shaping adoption

Market Dynamics

Drivers

• Need for low-latency decision-making in autonomous vehicles, robotics, and remote surgery

• Escalating data-security concerns that favour on-premise or near-device processing

• Bandwidth savings from local analytics, lowering operational expenditure

Restraints

• Fragmented standards hindering seamless interoperability between cloud, fog, and edge layers

• Limited talent pool in distributed-systems engineering slows implementation

Opportunities

• Integrating artificial intelligence accelerators inside fog nodes opens new revenue streams for analytics vendors

• Telecom-edge roll-outs create fertile ground for fog services bundled with 5G private networks

Challenges

• Expanded attack surface at the network edge requires continuous patching and zero-trust frameworks

• Complex life-cycle management of geographically dispersed nodes raises operating costs

Regional Analysis

North America leads the market thanks to dense IoT deployments, strong venture funding, and a mature edge-cloud ecosystem. Europe follows, propelled by strict GDPR requirements and smart-infrastructure investments, while Asia-Pacific posts the fastest CAGR as industrial automation accelerates in China, Japan, and India.

• North America – Largest revenue base; early 5G-edge integration and strong R&D spend

• Europe – Rapid growth; privacy regulation and disaster-resilience projects fuel demand

• Asia-Pacific – Fastest CAGR; manufacturing upgrades and smart-city megaprojects dominate

• Latin America – Gradual uptake; logistics tracking and energy-grid modernisation are primary use cases

• Middle East & Africa – Emerging market; smart-transport and sustainability initiatives drive pilot deployments

Segmentation Analysis

By Component

• Software – Core revenue driver.

Flexible container platforms, real-time stream-processing engines, and policy orchestration suites let enterprises deploy, monitor, and monetise distributed analytics without rewriting cloud workloads.

• Hardware – Fastest-growing slice.

Next-gen gateways, ruggedised routers, and sensor-rich micro data centres now ship with AI chips, widening the addressable market across harsh industrial and outdoor environments.

By Application

• Smart Manufacturing – Largest share.

Plant operators leverage fog nodes for closed-loop quality control and predictive maintenance, cutting downtime and scrap rates.

Local analytics allow split-second response to vibration or thermal anomalies, improving yield and freeing cloud links for aggregate reporting.

• Smart Cities – Rapid growth.

Traffic cameras, lighting, and emergency systems process video and telemetry on-site, ensuring resilience even during network outages.

This decentralised design keeps critical services running and lowers backhaul costs for municipalities.

• Connected Vehicles – Safety-critical niche.

Road-side fog clusters exchange telemetry with autonomous cars to coordinate lane changes and hazard alerts.

Millisecond-scale processing reduces collision risk and supports future vehicle-to-everything ecosystems.

• Smart Energy – Grid stabiliser.

Substation-level analytics optimise load balancing and detect faults before they cascade.

Utilities deploy fog to integrate renewables and microgrids without large cloud-compute bills.

• Connected Healthcare – Real-time patient insights.

Edge gateways in hospitals analyse vitals locally, ensuring compliance with health-data rules and reducing diagnostic latency.

• Security & Emergencies – Situational awareness.

Surveillance feeds and environmental sensors run threat detection algorithms on local nodes, triggering rapid response even when connectivity is intermittent.

• Others (Retail, Agriculture, Environment)

Retailers employ fog for checkout-free stores, while farms use edge analytics to fine-tune irrigation and fertiliser schedules.

Industry Developments & Instances

• January 2025 – Cisco released an AI-enabled IOx upgrade that auto-scales container workloads across thousands of fog gateways.

• November 2024 – IBM and Schneider Electric launched a joint reference architecture aimed at zero-downtime industrial automation.

• July 2024 – TERAKI secured Series B funding to embed sensor-fusion analytics in aftermarket automotive gateways.

• March 2024 – A European smart-city consortium selected Crosser’s low-code edge platform for real-time air-quality monitoring across 12 urban districts.

Facts & Figures

• Local processing can cut IoT backhaul traffic by up to 90 % in sensor-dense factories.

• Average cost of a data breach hit USD$ 4.35 million in 2022, intensifying demand for on-premise analytics.

• Over 236 million ransomware attempts were recorded globally in the first half of 2022, prompting stricter edge-security budgets.

• Software captured roughly 64 % of total fog computing market share in 2023.

• Smart manufacturing contributed the highest revenue slice in 2023, while smart-city deployments show a double-digit shipment surge through 2030.

Analyst Review & Recommendations

Fog computing is moving from proof-of-concept to production as enterprises chase latency gains, privacy assurance, and bandwidth savings. Vendors that blend rugged hardware, zero-trust security, and developer-friendly orchestration will outpace average market growth. We recommend prioritising vertical bundles—such as pre-validated factory kits or smart-city starter packs—that shorten deployment cycles, while investing in AI-ready chipsets and standards-based APIs to future-proof offerings.