Market Overview

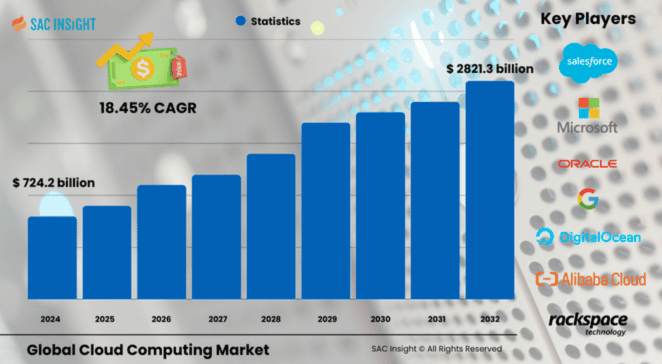

The global cloud computing market size is valued at US$ 724.23 billion in 2024 and is set to climb to roughly US$ 2,821.03 billion by 2032, registering an 18.45% CAGR over the 2025-2032 forecast window. First-hand industry insights point to four structural drivers: relentless digital transformation, the rise of data-hungry AI workloads, flexible pay-as-you-go economics, and widening adoption in developing economies. A decisive shift is observed toward hybrid and multi-cloud architectures as enterprises balance control and scalability.

The U.S. cloud computing market is projected to approach US$ 930 billion by 2032, reflecting sustained demand for hyperscale capacity, edge services, and sector-specific solutions.

Summary of Market Trends & Drivers

• Generative AI and advanced analytics are lifting compute intensity, nudging enterprises toward high-performance IaaS and GPU clouds.

• Hybrid cloud flexibility is replacing one-size-fits-all public deployments, with orchestration tools smoothing workload portability.

• Governments in Asia Pacific and the Middle East are funding national cloud initiatives, accelerating market growth across SMEs and public services.

Key Market Players

Global cloud computing market share is steered by Amazon Web Services, Microsoft Azure, Google Cloud Platform, and Alibaba Cloud, each scaling new regions, industry clouds, and AI accelerators. IBM, Oracle, Salesforce, and VMware strengthen the competitive tempo with hybrid offerings, zero-trust security, and vertical-specific stacks. Challenger brands such as DigitalOcean, GroundCloud, and Coastal Cloud focus on developer-friendly pricing and specialist media workloads, adding fresh pressure on incumbents.

Key Takeaways

• Market value (2024): USD$ 724.23 billion

• Forecast value (2032): USD$ 2,821.03 billion at an 18.45% CAGR

• North America holds about 41.6% market share in 2024; Asia Pacific posts the fastest regional advance.

• SaaS captures 54% of 2024 revenue, but IaaS is the quickest-growing service line over the forecast period.

• Resource Management accounts for more than one-third of workload spending as enterprises fine-tune capacity and cost.

• Hybrid deployments are forecast to outpace pure-public cloud at over 20% CAGR.

• The U.S. specific forecast for 2032 is estimated to approach US$ 930 billion.

Market Dynamics

Drivers

• Proliferation of AI, machine learning, and big data requiring elastic, high-performance infrastructure.

• SME appetite for cost-efficient digital tools that avoid heavy capital outlay.

• Government policies mandating data residency yet endorsing secure cloud migration.

Restraints

• Persistent data-privacy and cybersecurity concerns deterring sensitive workloads.

• Skills gaps in cloud architecture, governance, and FinOps disciplines.

Opportunities

• Edge and 5G convergence enabling low-latency applications in automotive, telemedicine, and smart cities.

• Green data-center investments and renewable-powered clouds attracting ESG-focused buyers.

Challenges

• Rising cloud spend visibility issues prompting board-level scrutiny and vendor-lock-in fears.

• Regulatory fragmentation across jurisdictions complicating cross-border workload placement.

Regional Analysis

North America remains the revenue leader thanks to early technology adoption and dense hyperscale footprints. Europe follows, shaped by stringent privacy frameworks and sovereign-cloud initiatives, while Asia Pacific records the steepest climb on the back of rapid digitalisation and start-up activity.

• North America – Mature market with strong enterprise budgets and edge roll-outs.

• Europe – Growing demand for compliant, carbon-neutral data centers.

• Asia Pacific – Fastest CAGR at 22.9%, driven by India and China’s cloud-first policies.

• Latin America – Momentum in fintech and e-commerce lifting regional uptake.

• Middle East & Africa – Government smart-city projects and local cloud zones accelerating late-stage adoption.

Segmentation Analysis

By Service

• Software as a Service – Largest slice at 54% revenue share

SaaS wins on simplicity: instant access, automatic updates, and subscription pricing continue to attract companies looking to trim IT overheads.

• Infrastructure as a Service – Fastest-growing at roughly 22% CAGR

IaaS offers on-demand compute and storage, letting firms scale experiments or seasonal traffic without hardware risk.

• Platform as a Service – Developer productivity catalyst

PaaS bundles runtime, middleware, and DevOps tooling, shortening release cycles for cloud-native apps.

By Workload

• Resource Management – Over 34% share

Automation of provisioning, scaling, and cost controls keeps this workload segment in the lead as environments grow more complex. Cloud-based optimization dashboards help CIOs rein in spend while improving performance baselines.

• Application Development & Testing – Rapid expansion

Elastic sandboxes and CI/CD services slash iteration time, fueling adoption among agile teams. Easy spin-up of parallel test environments reduces project bottlenecks and speeds product launches.

• Data Storage & Backup – Core resilience layer

Object storage and snapshot backups underpin business continuity strategies, especially for ransomware defense.

• Orchestration Services and Others – Glue for multi-cloud

Kubernetes, service meshes, and API gateways coordinate distributed workloads and simplify portability.

By Deployment

• Private Cloud – 46% share for mission-critical control

Dedicated resources appeal to industries with strict compliance needs and predictable performance targets.

• Hybrid Cloud – Growth engine above 20% CAGR

Blending on-prem, private, and public resources, hybrid models offer gradual migration paths and flexible disaster recovery.

• Public Cloud – Entry-level scalability

Start-ups and test environments gravitate to pay-as-you-go services for speed and global reach.

By Enterprise Size

• Large Enterprises – 50.5% share

Automation and global collaboration drive large-scale adoption, freeing IT staff for strategic work.

• Small & Medium Enterprises – CAGR near 21%

Cloud levels the playing field, giving SMEs enterprise-grade applications without large capex.

By End-use

• BFSI – 24% revenue share

Cloud-enabled risk analytics, mobile banking, and regulatory reporting underpin demand. Banks lean on certified platforms for encrypted storage and automated compliance checks.

• IT & Telecom – Heavy cloud spend

Network virtualization, BSS/OSS modernization, and content delivery rely on scalable compute.

• Manufacturing – Rising on the back of Industry 4.0

Digital twins and 3D printing workflows tap cloud GPUs and abundant storage to shorten design cycles.

• Healthcare, Retail & Consumer Goods, Energy & Utilities, Media & Entertainment, Government & Public Sector, Others – Each vertical benefits from tailored SaaS and data platforms simplifying operations and unlocking new revenue models.

Industry Developments & Instances

• April 2024 – A leading hyperscaler introduced a custom Arm-based server chip aimed at lowering total cloud cost for high-throughput AI workloads.

• January 2024 – A tower infrastructure group partnered with a global tech giant to fuse edge data centers with hybrid-cloud stacks for 5G and IoT use cases.

• January 2024 – An IT services firm signed a five-year pact with a major cloud provider to co-deliver AI and industry cloud solutions across Europe.

• February 2025 – A top U.S. server maker reported double-digit share gains on the back of AI-optimized systems for cloud providers.

• February 2025 – A cloud leader unveiled a foundation-model marketplace, letting customers access cutting-edge generative AI via managed APIs.

Facts & Figures

• North America captures about 41.6% market share in 2024, equivalent to roughly US$ 302 billion in revenue.

• The hybrid cloud segment is projected to expand at more than 20% CAGR through 2032.

• SMEs adopting cloud report up to 30% lower IT operating costs versus on-premise setups.

• Edge-to-cloud deployments can cut latency by up to 60% for real-time analytics applications.

• Over 39% of enterprises experienced a cloud security incident in 2022, underscoring the push toward zero-trust frameworks.

• Asia Pacific’s market size is set to triple between 2024 and 2032, driven by escalating mobile data traffic and e-commerce volumes.

Analyst Review & Recommendations

Cloud computing has moved from back-office convenience to strategic backbone. Market analysis suggests that players marrying high-performance infrastructure with robust security, granular cost controls, and sovereign options will capture disproportionate market share. Providers should double down on edge capabilities, carbon-neutral operations, and vertical clouds to align with emerging customer priorities. Buyers should benchmark performance, portability, and transparent pricing to avoid lock-in and optimize long-term value as the market growth trajectory remains firmly upward.