Market Overview

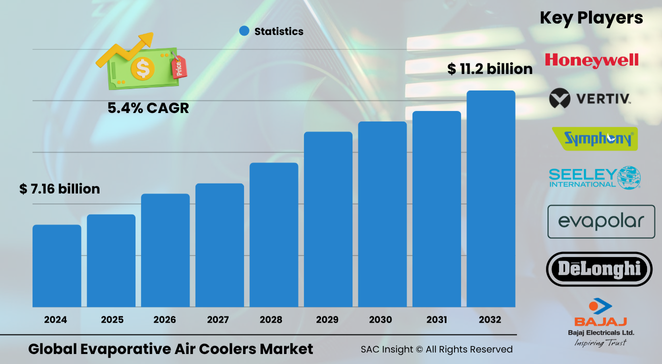

The evaporative air coolers market size is valued at about US$ 7.16 billion in 2024 and is projected to reach roughly US$ 11.22 billion by 2032, advancing at a 5.45 % CAGR. First-hand industry insights highlight three demand engines: steep rises in summertime heat, the shift toward energy-efficient appliances as electricity tariffs climb, and rental-app models that lower the cost of access for budget-focused users. SAC Insight’s deep market evaluation shows the U.S. evaporative air coolers market could climb from approximately US$ 1.4 billion in 2024 to nearly US$ 2.3 billion by 2032 as small businesses and homeowners replace aging window ACs with low-carbon cooling alternatives.

Summary of Market Trends & Drivers

Cost-effective cooling, sustainability mandates, and smart-control upgrades form the core market trends driving adoption. Manufacturers are fitting variable-speed motors, Wi-Fi remotes, and air-filtration pads to raise efficiency while rental platforms expand market reach, particularly in emerging economies where up-front appliance purchases remain a hurdle.

Key Market Players

Delta Cooling Towers, SPX Cooling Technologies, Phoenix Manufacturing, Evapco Group, Baltimore Aircoil, and Munters anchor the global supply base with diversified portfolios that cover industrial towers and residential portables. Their scale allows continuous investment in noise-reduction housings, corrosion-resistant plastics, and hybrid indirect–direct coolers.

Regional and mid-tier challengers such as Celsius Design, Bonaire, Breezair, CFW Evapcool, Condair, and Colt Group are sharpening competitive intensity through localized production, rapid model refresh cycles, and alliances with e-commerce marketplaces to compress delivery times.

Key Takeaways

• Current global market size (2024): USD$ 7.16 billion

• Projected global market size (2032): USD$ 11.22 billion at a 5.45 % CAGR

• Portable coolers are on track to top USD$ 6.5 billion by 2032 thanks to remote-work and outdoor-event use cases

• Residential end use captures more than 80 % market share and will likely surpass USD$ 9 billion by 2032

• East Asia holds the largest regional market share at around 25 %, propelled by rising urban temperatures and dense housing

• Smart sensors, rental subscriptions, and recyclable polymers represent the fastest-emerging technology trends shaping future market growth

Market Dynamics

Drivers

• Rising electricity prices push consumers toward low-wattage cooling solutions

• Government energy-efficiency standards and green-building codes favor refrigerant-free technologies

• Mobile lifestyles and pop-up commerce spur demand for plug-and-play portables

Restraints

• Bulkier form factors and aesthetics can clash with modern interior design preferences

• Competitive pressure from compact inverter ACs and ductless mini-splits may slow replacement cycles

• Limited effectiveness in high-humidity coastal zones reduces addressable market size

Opportunities

• Integration with solar PV and DC-powered battery packs opens off-grid applications

• Emerging rental marketplaces in India, Southeast Asia, and Africa unlock new user segments

• Expansion into data-center pre-cooling and greenhouse climate control diversifies revenue streams

Challenges

• Water-scarcity regulations in arid regions require closed-loop or low-bleed designs, raising costs

• Supply-chain disruptions for high-performance motor bearings and antimicrobial pads can delay launches

• Educating first-time buyers on maintenance and water-quality needs remains critical for long-term customer satisfaction

Regional Analysis

East Asia leads overall revenue as extreme heatwaves accelerate new installations, while South Asia & Pacific shows the quickest percentage gains on the back of affordable portable coolers and app-based rentals. North America maintains robust replacement demand driven by energy retrofits, and Europe’s focus on decarbonizing commercial buildings fuels indirect-evaporative deployments.

• North America – Roughly one-fifth of global revenue; retrofit incentives and wild-fire smoke filtration drive upgrades

• Europe – Indirect systems for data centers and retail chains lift growth despite milder summers

• East Asia – Largest market share; high urban density and frequent heat advisories support volume sales

• South Asia & Pacific – Fastest CAGR, with India alone topping USD$ 997 million by 2032 on price-sensitive residential demand

• Middle East & Africa – Industrial warehousing and hospitality projects stimulate uptake, tempered by water-use rules

• Latin America – Rising construction of distribution hubs and open-air venues underpins steady adoption

Segmentation Analysis

By Product Type

• Portable Coolers – Flexible, rapidly growing.

Their wheeled footprints and household-plug compatibility make them the go-to choice for renters, outdoor events, and small shops. Advances in brushless DC motors and honeycomb pads continue to push airflow while lowering noise.

• Window-Mounted Coolers – Budget stalwarts.

Favoured in hot-dry regions where masonry homes have predefined wall slots, these units offer quick installation at minimal cost, though design upgrades focus on slimmer silhouettes to preserve curb appeal.

• Personal Coolers – Niche comfort devices.

Desktop and bedside units cater to single-user spaces, emphasizing USB power and scented-pad options for aromatherapy-plus-cooling appeal.

• Tower Coolers – Premium living-room upgrade.

Tall, slim designs with oscillating louvers blend into modern interiors, and IoT dashboards allow scheduling around peak-tariff hours.

By Water Tank Capacity

• 5-25 Liters – Light-duty convenience.

Ideal for personal and desktop models, these require frequent refills but meet portability needs for college dorms and small offices.

• 26-70 Liters – Mainstream balance.

The sweet spot for most household and SME users, offering 6–10-hour autonomy without excessive footprint.

• 71 Liters & Above – Extended operation.

Targeted at warehouses and banquet halls where continuous overnight running is essential, often coupled with auto-fill kits to cut labour time.

By Material

• Plastic – Dominant share.

UV-stabilized ABS and polypropylene casings deliver corrosion resistance and lighter shipping weights, helping e-commerce sales.

• Fiber & Metal – Durability play.

Fiber-reinforced polymers and galvanised sheets serve industrial models facing rough handling and high-dust settings, boosting product life cycles.

By Effective Cooling Area

• 100-399 sq ft – Apartment focus.

Compact models cool bedrooms and small retail kiosks, a big draw in dense Asian cities.

• 400-999 sq ft – Versatile workhorse.

Satisfies midsize living rooms, cafés, and classrooms, balancing airflow with manageable acoustics.

• 1 000 sq ft & Above – Large-space solution.

High-CFM desert coolers address factory floors and event venues, increasingly paired with variable-speed drives to trim energy peaks.

By Sales Channel

• Specialty Stores – Advice-driven choice.

Floor demonstrations and bundled maintenance contracts sway buyers who prioritise hands-on inspection.

• Online Stores – Fastest-rising route.

Flash sales, doorstep service, and easy price comparison attract tech-savvy millennials, pushing manufacturers toward flat-pack shipping designs.

• Direct Sales & Modern Trade – Institutional access.

Bulk orders from schools, warehouses, and rental fleets rely on direct negotiations and after-sales guarantees.

By End Use

• Residential – Core demand engine.

Open-plan flats and rising remote-working hours boost full-day usage, and consumers appreciate the lower electricity bills versus inverter ACs.

• Commercial – Niche, but high-value.

Small factories, logistics hubs, and restaurant patios use high-capacity towers for spot cooling, especially where ducted AC is impractical.

Industry Developments & Instances

• March 2024 – Thomson launched four smart coolers with honeycomb pads and app-based scheduling to cut energy use by up to 30 %.

• June 2023 – Celsius Design introduced EcoCool industrial units claiming 15 °C temperature drops while consuming 80 % less power than conventional chillers.

• March 2023 – Delta Cooling Towers rolled out closed-circuit evaporative systems targeting pharmaceutical process cooling with low water bleed-off.

• September 2022 – Novamax debuted heavy-duty desert coolers for mid-size factories, pairing large tanks with three-speed EC motors.

Facts & Figures

• Portable coolers are expected to command nearly 58 % market share by 2032.

• A typical 150-Watt evaporative cooler uses about one-tenth the electricity of a comparable 1.5-ton window AC.

• East Asia accounts for roughly 24.8 % of global revenue in 2024.

• Residential purchases contribute over USD$ 5.7 billion, or 79 % of 2024 sales.

• Water-efficient pads can reduce make-up water consumption by up to 20 %, supporting adoption in drought-prone regions.

Analyst Review & Recommendations

Market analysis indicates that evaporative air coolers sit at the intersection of affordability, sustainability, and smart-home convenience. Suppliers that pair recyclable casings with sensor-driven water management and seamless app integration will outpace market growth. To capture emerging opportunities, manufacturers should cultivate rental-platform partnerships, invest in aesthetic redesigns for urban condos, and develop closed-loop models for water-stressed geographies. Continued R&D in antimicrobial pads and variable-speed electronics will be crucial for maintaining price-performance leadership through 2032.