Market Overview

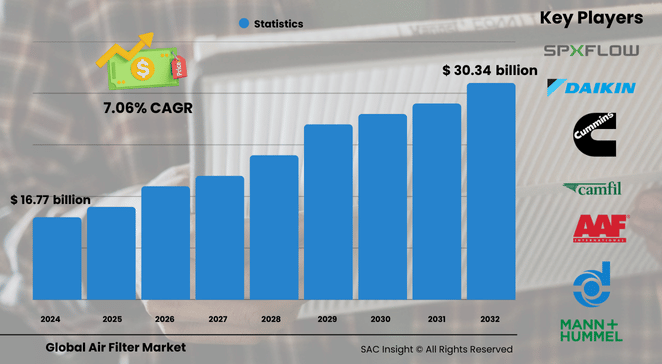

The global air filter market size was valued at US$ 16.77 billion in 2024 and is projected to reach roughly US$ 30.34 billion by 2032, advancing at a 7.065% CAGR over the 2025-2032 forecast window. Demand is rising on three fronts: tighter emission norms, surging industrial output in Asia, and heightened consumer awareness of indoor air quality since the pandemic. First-hand industry insights indicate that dust collectors remain the workhorse technology, while HEPA systems gain popularity in healthcare and premium residential segments.

SAC Insight's deep market evaluation also shows that North America captured about 37% market share in 2024, and the U.S. air filter market is on track to exceed US$ 7.31 billion by 2032.

Summary of Market Trends & Drivers

• Growing focus on sustainable manufacturing is pushing end users toward high-efficiency, reusable filters and low-pressure-drop designs.

• The automotive sector is adopting advanced cabin filtration to meet stringent air-quality standards, boosting replacement cycles.

• Smart HVAC retrofits and the construction of green buildings worldwide continue to fuel market growth.

Key Market Players

Industry leaders include globally diversified filtration specialists alongside HVAC giants and niche innovators. Firms known for broad product portfolios—ranging from large-scale dust collectors to precision HEPA units—set the competitive pace through capacity expansions, product refresh cycles, and application-specific solutions. Concurrently, a cohort of mid-sized companies is carving out space with energy-saving designs, antimicrobial media, and IoT-ready filter monitors, reshaping the competitive landscape with agile manufacturing footprints and faster design iterations.

Key Takeaways

• Market value (2024): US$ 16.77 billion

• Projected value (2032): US$ 30.34 billion at a 7.065% CAGR

• Dust collectors account for roughly 28% of 2024 revenue, the single largest product class

• Industrial end-users dominate overall demand, led by automotive, electronics, and pharmaceutical plants

• North America leads today, yet Asia Pacific is the fastest-growing region through 2032

• Reusable and washable media are a rising market trend, cutting total cost of ownership for facility managers

Market Dynamics

Drivers

• Tighter government regulations on particulate emissions and workplace air quality

• Rapid industrialization and urbanization in emerging economies

• Post-pandemic consumer preference for healthier indoor environments

Restraints

• High upfront installation and maintenance costs for multi-stage filtration systems

• Technical limits of single-point air quality monitors in large or 3-D spaces

Opportunities

• Government incentives for clean-air initiatives and green-building certifications

• Integration of IoT sensors for real-time filter performance and predictive maintenance

Challenges

• Price sensitivity among cost-constrained commercial users, encouraging low-grade imports

• Supply-chain volatility in specialty filter media and electret materials

Regional Analysis

North America maintains leadership thanks to mature HVAC penetration, strict environmental policies, and sustained aftermarket demand across automotive and industrial sectors. Asia Pacific, however, delivers the fastest trajectory as large-scale urbanization in China, India, and Southeast Asia amplifies demand for efficient air-purification solutions.

• North America – Largest revenue contributor; strong retrofit activity in commercial buildings

• Europe – Emphasizes energy-efficient filters and circular economy practices

• Asia Pacific – Highest CAGR on the back of industrial expansion and rising disposable income

• Latin America – Moderate growth tied to infrastructure upgrades in key metros

• Middle East & Africa – Growing adoption in oil-and-gas processing and new airport projects

Segmentation Analysis

By Type

• Dust collectors – Core revenue engine

Dust collectors dominate because they capture coarse and fine particulates across heavy-duty manufacturing, protecting machinery and workforce health. Their robust design and scalability make them a default choice in steel, cement, and woodworking plants.

• HEPA filters – High-efficiency niche with rapid uptake

HEPA filters remove = 99.94% of sub-micron particles, meeting the strictest indoor air-quality standards. Hospitals, cleanrooms, and upscale homes increasingly specify HEPA units for critical air purity.

• Cartridge filters – Compact option for tight spaces

Cartridge designs offer high surface area in a small footprint, making them popular in CNC workshops and paint booths where space is at a premium.

• Baghouse filters – Heavy-load performer

Baghouse systems excel in high-dust environments like mining and power generation, leveraging long-life fabric bags and pulsed air cleaning to ensure constant airflow.

• Others (mist filters) – Specialized applications

Mist filters address oil and coolant aerosols in metalworking plants, protecting personnel and extending equipment life.

By End-User

• Industrial – Dominant demand center

Manufacturing lines depend on reliable air filtration to safeguard product integrity and comply with occupational regulations. Automotive engine plants, semiconductor fabs, and pharmaceutical facilities account for the lion’s share of consumption.

• Commercial – Fast-rising segment

Office towers, shopping malls, and hospitality venues install high-MERV or HEPA systems to enhance occupant well-being and meet green-building standards.

• Residential – Opportunity in premium urban housing

Urban consumers increasingly purchase standalone purifiers and smart HVAC filters to counter rising pollution and allergens, driving steady growth in this segment.

Industry Developments & Instances

• September 2022 – A major filtration group acquired a regional service provider to strengthen aftermarket offerings in the Northeast U.S.

• August 2022 – A global manufacturer opened a 50,000 sq ft facility in Pune to boost cartridge and dust collector output for South Asia.

• July 2022 – A leading European player launched a new Arkansas plant, adding fabrication and testing lines for next-generation HEPA products.

• March 2022 – A premier HVAC brand released a long-life streamer air purifier capable of neutralizing 99.9% of viruses and allergens.

• October 2021 – A consumer technology firm introduced hot-and-cold air purifiers fitted with HEPA 13 filtration for residential buyers.

Facts & Figures

• Dust collectors held 28% of global revenue in 2024, underscoring their broad industrial adoption.

• North America captured about 37% of global market share in 2024.

• The U.S. market alone is forecast to reach US$ 7.31 billion by 2032.

• Reusable filters can cut replacement spending by up to 40% over a five-year cycle.

• Approximately 55% of the world’s population already lives in urban areas, a ratio expected to reach 68% by 2050, intensifying indoor air-quality concerns.

Analyst Review & Recommendations

Air filtration is rapidly shifting from commodity consumables to smart, efficiency-driven solutions. Companies that combine high-capture media with IoT diagnostics and reusable designs will outpace rivals. To secure long-term market growth, filter makers should focus on energy-saving geometries, develop retrofit-friendly modules for aging HVAC fleets, and expand service networks in fast-urbanizing Asian economies.