Market Overview

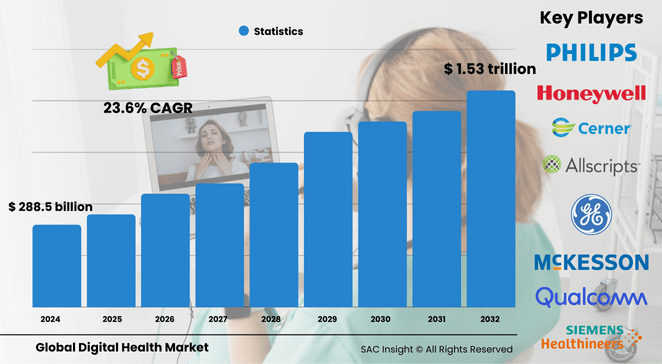

The global digital health market size was valued at US$ 288.55 billion in 2024 and is projected to climb to US$ 1.53 trillion by 2032, reflecting a strong 23.6% CAGR during the 2025-2032 forecast window. First-hand industry insights point to three structural tailwinds: soaring smartphone penetration, greater willingness to use telehealth and remote monitoring, and rising venture investment that continues to fuel product innovations.

SAC Insight's deep market evaluation also shows that chronic-disease management apps, connected wearables, and AI-powered analytics are moving from pilot projects to standard care pathways. The U.S. digital health market alone is expected to top about US$ 612.69 billion by 2032, solidifying its position as the largest single national market.

Summary of Market Trends & Drivers

• Persistent growth in telehealth visits—even post-pandemic—has cemented virtual care as a mainstream option for primary and specialty consultations.

• Rapid uptake of continuous glucose monitors, connected blood-pressure cuffs, and ECG-enabled wearables is expanding real-time patient data flows and driving personalized care plans.

• Venture capital remains active despite valuation resets; start-ups that marry strong clinical evidence with clear reimbursement pathways continue to attract late-stage funding.

Key Market Players

Industry leaders such as Apple Inc., Google (Fitbit), Koninklijke Philips N.V., Medtronic, GE HealthCare, Abbott, and Siemens Healthineers are setting the competitive tempo with regular software updates and integrated device-plus-service bundles. Their global footprints, deep R&D budgets, and broad partner ecosystems give them an edge in scaling new offerings quickly.

Alongside these multinationals, specialist innovators like Teladoc Health, Dexcom, Omada Health, AT&T’s Health division, and Qardio focus on high-growth niches—ranging from virtual chronic-care programs to advanced biosensors—providing differentiated solutions that push the market forward.

Key Takeaways

• The global digital health market value (2024): US$ 288.55 billion

• Projected value (2032): US$ 1.53 trillion at a 23.6% CAGR

• North America holds the largest market share at 37.7% of 2024 revenue; Asia Pacific is the fastest-growing region.

• Services capture the highest component share at 37.9%, driven by deployment, training, and maintenance contracts.

• Tele-healthcare leads technology adoption, strongly approaching a 45% share, supported by expanding broadband and physician acceptance.

• Diabetes management is the largest application segment, representing 24.7% of 2024 revenue.

Market Dynamics

Drivers

• Ubiquitous mobile connectivity and low-cost smart devices broaden access to digital tools.

• Government incentives and updated reimbursement codes encourage hospitals and payers to integrate telehealth and remote monitoring.

• Rising prevalence of chronic diseases pushes providers to adopt data-driven, continuous-care models.

Restraints

• High upfront costs for smaller clinics—hardware, integration, and cybersecurity—slow adoption in resource-constrained settings.

• Data privacy and security concerns remain a sticking point for both patients and regulators.

Opportunities

• AI-enabled decision support for diagnostics and treatment planning promises to cut clinician workload and improve accuracy.

• Personalized digital therapeutics targeting obesity, mental health, and oncology open new reimbursement and partnership avenues.

Challenges

• Interoperability gaps between legacy hospital IT systems and new app-centric platforms hinder seamless data exchange.

• Evolving global regulations require continuous compliance investments and rigorous post-market surveillance.

Regional Analysis

North America dominates thanks to robust IT infrastructure, favorable reimbursement policies, and an innovation-friendly investment climate. Europe follows closely, aided by nationwide EHR initiatives and a sizeable elderly population. Asia Pacific is recording the fastest market growth, propelled by large-scale mobile adoption and government digital-health agendas.

• North America – Early technology adoption, strong venture funding, and supportive reimbursement frameworks

• Europe – Focus on chronic-care digitalization and stringent data-governance standards

• Asia Pacific – Rapid smartphone uptake, expanding telemedicine regulations, and growing middle-class healthcare spending

• Latin America – Gradual telehealth roll-outs supported by public-private partnerships

• Middle East & Africa – Rising investment in smart hospitals and remote-care models to bridge geographic gaps

Segmentation Analysis

By Component

• Services – Largest share, anchoring deployment and ongoing support

Services dominate because providers need installation, integration, and staff training to achieve meaningful clinical impact and ROI.

• Software – Fastest-growing sub-segment

Cloud-based EHRs, analytics dashboards, and patient-engagement apps are scaling quickly as health systems modernize legacy platforms.

• Hardware – Steady demand from sensors and connected devices

Wearables, remote monitoring kits, and point-of-care terminals form the physical backbone of digital health ecosystems.

By Technology

• Tele-healthcare – Core engine of market growth

Video visits, virtual triage, and remote clinical workflows are now embedded in routine care, supported by better broadband and consumer familiarity.

• mHealth – Expanding lifestyle and wellness footprint

Smartphone apps for medication adherence, mental-health check-ins, and preventive health coaching continue to proliferate.

• Digital Therapeutics & Health Management Solutions – Evidence-backed software interventions

Prescription-grade apps for diabetes, hypertension, and behavioral health offer scalable adjuncts or alternatives to traditional therapies.

By Application

• Diabetes – Leading share at 24.7%

Continuous glucose monitoring and cloud-based insulin-dosing algorithms empower patients and clinicians with actionable data.

• Obesity – Rising demand for personalized weight-management platforms

Smart scales, metabolic trackers, and AI-guided nutrition plans appeal to both consumers and payers looking for cost-effective interventions.

• Cardiovascular, Cancer, Respiratory, and Others – Expanding use of remote vitals and symptom tracking

Early-warning alerts and virtual follow-ups reduce hospital readmissions and improve quality-of-life outcomes.

By End Use

• Patients – Largest and fastest-growing segment

Self-management tools and user-friendly interfaces fuel patient adoption and sustained engagement.

• Providers – Integrating digital solutions to extend reach and optimize workflows

Hospitals and clinics increasingly embed telehealth and analytics into routine operations to enhance care coordination and efficiency.

Industry Developments & Instances

• October 2023 – NextGen Healthcare launched an ambient listening tool that auto-summarizes patient-provider conversations.

• September 2023 – Enovacom acquired NEHS Digital and Xperis to bolster its e-health portfolio.

• May 2023 – Medtronic announced the acquisition of EOFlow to expand its wearable insulin-delivery offering.

• March 2023 – GE HealthCare partnered with Advantus Health Partners on a multi-year technology-management contract.

• March 2022 – Telefonica Tech acquired Incremental for USD$ 232 million, deepening its UK digital-transformation reach.

• Apple continues to add ambient-light sensors and advanced motion tracking to AirPods, positioning the device as a health-monitoring accessory.

Facts & Figures

• Services capture 37.9% of component revenue amid strong demand for implementation and maintenance.

• Tele-healthcare commands a strong share, reflecting sticky consumer adoption of video visits.

• Global funding for US digital health start-ups hit USD$ 10.1 billion across 497 deals in 2024.

• North America holds 37.7% of global revenue, while Asia Pacific is logging the fastest double-digit regional CAGR.

• Diabetes apps and devices account for roughly one-quarter of total application revenue, underscoring the chronic-disease burden.

• Smartphone penetration is projected to reach 77% worldwide by 2025, expanding the addressable user base for mHealth solutions.

Analyst Review & Recommendations

Digital health is moving from a "nice-to-have" adjunct to a core pillar of modern care delivery. Providers that invest early in interoperable platforms, robust security, and clear patient-experience metrics will see sustainable gains in outcomes and cost control. Manufacturers and software vendors should prioritize evidence generation and regulatory clarity to ease payer adoption. With market growth propelled by chronic-disease prevalence and consumer expectations for convenience, the competitive edge will go to firms that combine intuitive design, airtight data stewardship, and demonstrable clinical value.