Market Overview

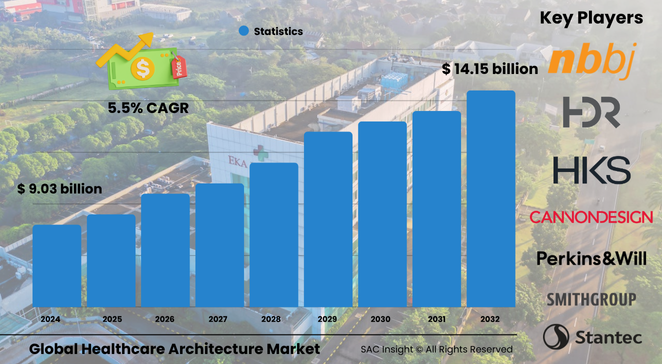

The global healthcare architecture market size is valued at roughly US$ 9.03 billion in 2024 and is expected to climb to about US$ 14.15 billion by 2032, advancing at an average 5.5% CAGR. SAC Insight industry insights link this market growth to rising hospitalization rates, strong government funding for modern medical infrastructure, and a post-pandemic focus on flexible, therapeutic design.

SAC Insight's deep market evaluation points to the United States healthcare architecture market expanding from around US$ 2.54 billion in 2024 to nearly US$ 3.98 billion by 2032 as systems upgrade ageing facilities and prepare for future public-health shocks.

Summary of Market Trends & Drivers

• Neuroaesthetic design and space-repurposing are moving from niche concepts to standard practice, shortening patient recovery times and letting providers adapt floors for new care models without full rebuilds.

• Medical-tourism hot-spots across Asia and the Middle East are fast-tracking specialty hospitals, boosting global project pipelines and contractor backlogs.

• Sustainability targets—net-zero operations, low-VOC materials, smart energy management—are now embedded in RFP scoring, steering architecture firms toward green-building toolkits.

Key Market Players

Global leadership is shared among large multidisciplinary practices and specialized healthcare studios. HDR, HKS, Perkins + Will, and Stantec hold significant market share thanks to worldwide networks and proven delivery on mega-campus projects. Jacobs Engineering Group, CannonDesign, NBBJ, SmithGroup, HOK, Perkins Eastman, and EYP complement the field with deep clinical-workflow expertise, adaptive-reuse portfolios, and digital-twin services that streamline design-to-operation cycles. Their competitive edge comes from integrating evidence-based design, BIM collaboration, and turnkey project-management services that cut lifecycle costs for hospital owners.

Key Takeaways

• Current global market size (2024): about USD$ 9.03 billion

• Projected global market size (2032): roughly USD$ 14.15 billion at a 5.5 % CAGR

• Hospitals dominate facility demand, yet ambulatory surgery centers (ASCs) show the quickest market growth as payers push outpatient care

• New-construction projects still capture the bulk of spend, but refurbishment work is accelerating where urban land is scarce

• North America leads in revenue, while Asia-Pacific posts the fastest percentage gain on the back of large-scale capacity additions

• Neuroaesthetics and adaptive reuse are emerging as high-value differentiators for design firms

Market Dynamics

Drivers

• Rising chronic-disease burden and ageing populations increase admissions, spurring investment in larger, more specialized facilities

• Government stimulus and public-private partnerships unlock capital for regional medical hubs and rural clinics

• Rapid advances in medical technology demand purpose-built spaces for robotics, imaging, and precision medicine

Restraints

• High capital intensity and lengthy approval cycles slow project starts, especially in cost-sensitive markets

• Strict regulatory codes and infection-control standards raise design complexity and compliance costs

Opportunities

• Smart-hospital blueprints that embed IoT sensors, AI analytics, and modular MEP systems deliver long-term cost savings and patient-experience gains

• Repurposing of vacant retail and office space into micro-hospitals or diagnostic centers offers faster time-to-market and lower carbon footprints

Challenges

• Supply-chain volatility for steel, glass, and HVAC components can derail construction schedules and budgets

• Talent shortages in healthcare-specialist architects and planners strain firm capacity during demand surges

Regional Analysis

North America holds the largest market share, propelled by steady capital expenditure, advanced design codes, and strong emphasis on patient-centred layouts. Europe follows with robust public health spending and pioneering green-hospital standards. Asia-Pacific records the highest market growth rate, underpinned by population expansion, medical-tourism corridors, and government drive to close care gaps. Latin America and the Middle East & Africa add selective high-value projects, often supported by sovereign investment funds.

• North America – Largest revenue base; focus on digital twins and resilience retrofits

• Europe – Strong sustainability mandates and public-private hospital upgrades

• Asia-Pacific – Fastest CAGR; mega-hospitals and medical-tourism clusters

• Latin America – Targeted investments in urban tertiary centres

• Middle East & Africa – Flagship teaching hospitals and modular rapid-build clinics

Segmentation Analysis

By Facility Type

• Hospitals – Core demand anchor, highest market share.

Large acute-care campuses continue to absorb the bulk of spending as governments expand bed capacity and integrate high-acuity units with diagnostic and research wings.

• Ambulatory Surgery Centers (ASCs) – Fastest-growing slice.

Lower operating costs and shorter patient stays drive private operators to scale stand-alone ASCs, boosting design orders for compact, high-throughput layouts.

• Long-Term Care Facilities & Nursing Homes – Rising necessity.

Ageing demographics push demand for safe, home-like environments with infection-control zoning and social-interaction spaces.

• Academic Institutes – Strategic research hubs.

Medical schools and teaching hospitals require flexible labs and simulation suites that can quickly pivot to new curricula and clinical trials.

• Others – Rehabilitation centres, specialty clinics, wellness resorts.

Niche providers seek hospitality-inspired design to differentiate patient experience and brand value.

By Service Type

• New Construction – Dominant revenue driver.

Ground-up hospitals and integrated health campuses absorb most capital as regions address capacity gaps and replace obsolete buildings.

• Refurbishment – Accelerating opportunity.

Adaptive reuse, seismic retrofits, and energy-efficiency upgrades lengthen facility lifespans and allow rapid program changes without greenfield costs.

Industry Developments & Instances

• August 2023 – HKS opened a Seattle office to serve West-Coast tech-health clients.

• June 2023 – HDR expanded in Southern California, citing biotech and life-science project wins.

• March 2023 – HDR was tapped to design a one-million-square-foot Detroit hospital expansion.

• November 2022 – CannonDesign secured the brief for a 30-storey cancer-care pavilion in New York.

• March 2022 – Stantec won planning duties for a major Ontario hospital redevelopment.

Facts & Figures

• Average new hospital build ranges from 250 to 600 USD$ per square foot, with architects accounting for about 20 % of project cost.

• Adaptive-reuse projects can be delivered up to 30 % faster than greenfield builds.

• Hospitals adopting neuroaesthetic principles report patient-stay reductions of 8–10 % on average.

• ASCs can deliver procedures at roughly 59 % lower cost than traditional hospitals.

• Electric-energy demand in smart hospitals is projected to decline up to 15 % through integrated building-management systems.

Analyst Review & Recommendations

Market analysis shows a decisive shift toward flexible, tech-enabled, and healing-focused healthcare environments. Design practices that couple evidence-based layouts, modular engineering, and end-to-end digital collaboration will capture outsize market share. Owners should prioritise refurbishments that unlock quick capacity gains, embed smart-building infrastructure early to future-proof operations, and leverage public-private funding models to balance upfront cost with long-term societal benefit.