Market Overview

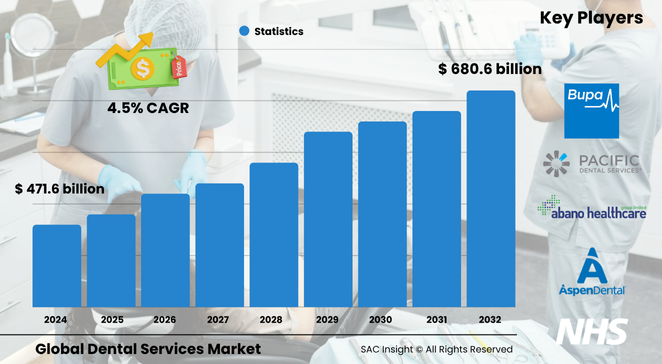

SAC Insight's deep market evaluation indicates the dental services market size stands near US$ 471.6 billion in 2024 and is on track to reach about US$ 680.6 billion by 2032, registering steady market growth at a 4.5 % CAGR. Momentum stems from higher discretionary incomes, rising awareness of preventive oral care, and rapid adoption of digital and laser technologies that shorten chair time while improving outcomes. First-hand industry insights also show cosmetic procedures and implant restorations outpacing routine check-ups as consumers view dental aesthetics as a wellness investment. The U.S. dental services segment alone mirrors the global trajectory, projected to climb from roughly US$ 471.6 billion today to around US$ 680.6 billion by 2032 as insurance coverage expands and teledentistry makes specialist advice easier to access.

Summary of Market Trends & Drivers

• Consumer demand is shifting from basic fillings toward implants, invisible aligners, and same-day crowns, underscoring a premiumization trend.

• Cloud-based practice management, AI-guided imaging, and chairside milling systems are cutting turn-around times and raising clinic throughput.

• Robust marketing—free camps, influencer campaigns, and patient-education apps—broadens the total addressable market in both mature and emerging economies.

Key Market Players

The competitive landscape blends large multi-clinic operators with national health services and private equity-backed roll-ups. Groups such as Aspen Dental Management, Pacific Dental Service, InterDent, and Apollo White Dental lead in market share by pairing scalable practice models with integrated digital workflows. Meanwhile, public health systems and regional chains in Europe and Asia are consolidating fragmented local practices, emphasizing preventive programs to curb long-term treatment costs.

Strategically, providers focus on geographic expansion, teledentistry platforms, and in-house laboratories to enhance patient retention. Franchising models—illustrated by recent U.K. network rollouts—offer dentists brand equity and centralized procurement while preserving clinical autonomy, heightening competitive intensity.

Key Takeaways

• Current global dental services market size (2024): about USD$ 471.6 billion

• Forecast global market size (2032): roughly USD$ 680.6 billion at a 4.5 % CAGR

• Dental implants hold the largest revenue share; cosmetic dentistry posts the fastest segment growth

• Dental clinics capture more than two-thirds of total revenue owing to specialist availability and cost efficiency

• North America leads market share; Asia Pacific records the quickest percentage gains, propelled by dental tourism

• AI-based diagnostics and aligner treatment planning stand out as pivotal technology market trends

Market Dynamics

Drivers

• Rising prevalence of dental caries and periodontal disease in aging and sugar-rich populations

• Growing acceptance of cosmetic treatments such as whitening, veneers, and clear aligners

• Government funding for preventive programs and expanded Medicaid/Medicare oral benefits

Restraints

• High out-of-pocket costs in low-insurance markets limit adoption of advanced procedures

• Shortage of skilled specialists in rural areas curbs service penetration

• Post-pandemic infection-control protocols add operational expenses for smaller clinics

Opportunities

• Teledentistry and home-monitoring kits enable virtual triage and follow-up, unlocking new revenue streams

• 3D-printed implants and prosthetics cut lab turnaround from weeks to hours, reducing inventory risk

• Dental tourism packages in Mexico, India, and Thailand attract price-sensitive patients seeking full-mouth rehabilitation

Challenges

• Fragmented regulatory frameworks on cross-border teledentistry and data privacy complicate scaling

• Supply-chain bottlenecks for zirconia blanks, implant fixtures, and cone-beam CT units can delay treatment plans

• Rising consumer expectations for painless, same-day outcomes pressure clinics to invest continually in technology

Regional Analysis

North America dental services market commands the largest revenue base thanks to a preventive oral-care culture, advanced insurance penetration, and continuous R&D investment. Europe follows with robust public-health spending, while Asia Pacific posts the fastest CAGR as urban middle-class consumers prioritize aesthetics and governments promote dental-care awareness. Latin America and the Middle East & Africa see incremental gains driven by clinic franchising and inbound medical travelers.

• North America – Largest share; strong insurance coverage and technology uptake

• Europe – Stable demand; public programs focus on early intervention

• Asia Pacific – Fastest growth; expanding clinic networks and dental tourism hubs

• Latin America – Steady expansion; franchised clinics fill service gaps

• Middle East & Africa – Emerging opportunities; high unmet need and government investment

Segmentation Analysis

By Type

• Dental Implants – Cornerstone revenue driver.

Implants provide lasting functional and aesthetic solutions, with surface-treated titanium fixtures and immediate-load protocols spurring adoption among partially edentulous adults.

• Orthodontics – Clear-aligner revolution.

Invisible braces appeal to teens and adults alike; AI-enabled treatment planning shortens case times and fuels double-digit shipment growth.

• Periodontics – Rising chronic-disease care.

Diabetes and smoking prevalence push demand for scaling, root-planing, and regenerative procedures, sustaining specialist workloads.

• Endodontics – Technology-led efficiency.

Rotary files and cone-beam CT imaging enhance root-canal success, making preservation preferable to extraction.

• Cosmetic Dentistry – Fastest-growing segment.

Whitening, bonding, and veneer packages gain traction as social-media culture emphasizes perfect smiles.

• Laser Dentistry – Minimally invasive niche.

Lasers enable soft-tissue contouring and caries removal with less anesthesia, attracting anxious patients.

• Dentures – Affordable tooth-replacement mainstay.

Digital impressions and 3D printing enhance fit and cut remake rates, keeping dentures relevant for cost-conscious seniors.

• Oral & Maxillofacial Surgery – Trauma and reconstructive backbone.

Corrective jaw surgery and wisdom-tooth extractions rely on specialized hospital units, anchoring referral networks.

• Others – Preventive and pediatric care.

Fluoride varnishes, sealants, and behavioral guidance programs cement long-term patient loyalty.

By End-use

• Dental Clinics – Dominant revenue channel.

Owner-operated practices and corporate chains combine specialist access, flexible hours, and advanced equipment, attracting over two-thirds of global spending.

• Hospitals – Complex-case referral centers.

Tertiary facilities manage trauma, oncology, and medically compromised patients, integrating oral care within wider treatment pathways.

Industry Developments & Instances

• June 2025 – A major U.S. chain deployed AI-driven imaging software across 900 locations, reporting 15 % faster diagnosis times.

• March 2025 – An India-based network added 500 suburban clinics, underscoring aggressive regional expansion strategies.

• August 2024 – A teledentistry start-up partnered with insurers to offer virtual hygiene check-ups, trimming claim costs by 7 %.

• July 2024 – A leading implant manufacturer opened a 3D-printing hub in Europe, slashing custom-abutment lead times to 24 hours.

Facts & Figures

• Dental implants represent roughly 21 % of global revenue, with unit demand rising about 6 % annually.

• Cosmetic procedures are growing near 8 % per year—almost twice the overall market rate.

• Private clinics account for approximately 68.5 % of expenditure, reflecting patient preference for specialist availability.

• North America holds just over 48 % market share, driven by strong insurance coverage and high procedure intensity.

• Asia Pacific’s clinic count is expanding at nearly 6 % annually, thanks to urbanization and dental-tourism investment.

Analyst Review & Recommendations

Data-driven market analysis points to a clear pivot toward technology-enabled, patient-centric care models. Providers that bundle digital diagnostics, chairside fabrication, and flexible payment plans will outpace average market growth. To sustain competitive advantage, clinics should invest in AI-assisted imaging, strengthen referral links with cosmetic and implant specialists, and explore hybrid teledentistry services that extend reach while optimizing chair utilization.