Market Overview

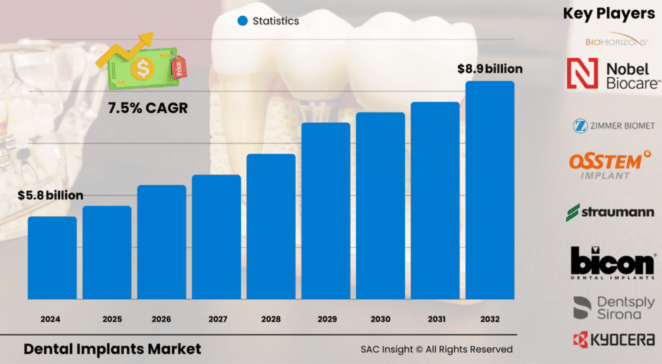

The dental implants market size was valued at US$ 5.745 billion in 2024 and is on track to hit US$ 10.195 billion by 2032, expanding at a 7.5% CAGR during the forecast period. First-hand industry insights point to three structural tailwinds: an increasing elderly population facing tooth loss, a growing appetite for aesthetic dentistry, and steady advances in digital workflows that shorten chair time. Deep market evaluation also shows a full recovery from pandemic-era clinic closures, with procedure volumes now surpassing 2019 levels. The U.S. dental implants market is forecast to top roughly US$ 3.2 billion by 2032, reflecting robust demand for premium and same-day procedures.

Summary of Market Trends and Drivers

• Surge in single-day implant procedures and 3D-printed surgical guides is pushing adoption among solo and group practices alike.

• Antibacterial surface coatings and next-gen zirconia systems are gaining traction as clinicians look to curb peri-implant infections and improve esthetics.

• Higher disposable incomes in Asia and Latin America are opening the door for value-priced implant lines, widening the addressable patient pool.

Key Market Players

The report profiles global and regional leaders such as Institut Straumann, Dentsply Sirona, Nobel Biocare, Zimmer Biomet, Osstem Implant, BioHorizons, and a rising cohort of mid-sized innovators focused on digital and cost-efficient systems. Together, these firms set the competitive tempo through rapid product refreshes and strategic MandA.

Key Takeaways

• Market value (2024): USD 5.745 billion

• Projected value (2032): USD 10.195 billion at a 7.5% CAGR

• Europe leads with roughly 35% market share, closely followed by North America.

• Titanium implants remain dominant (~90% share) thanks to proven biocompatibility, but zirconia is the fastest-growing material segment.

• Tapered, endosteal designs command the highest clinical uptake due to superior primary stability.

• Growing use of AI-driven treatment planning and chairside 3D printing is cutting surgical time and boosting patient acceptance.

Recent Market Developments

• October 2024: A top U.S. manufacturer reported a 99% survival rate for its newly launched tapered implant after a nationwide real-world registry review.

• May 2023: A leading Swiss group acquired a specialist in electrochemical decontamination systems, broadening its peri-implantitis care portfolio.

• July 2023: A Scandinavian player partnered with a resonance-frequency specialist to bundle stability diagnostics with implant kits.

• December 2022: A multi-clinic network introduced a low-cost full-arch solution across four U.S. states, signaling price pressure in the premium segment.

• February 2022: A desktop 3D-printing firm launched a high-accuracy resin printer, enabling same-day provisional crowns on implants.

Market Dynamics

• Drivers

- Growing older population losing teeth: More adults over 60 are choosing permanent solutions like implants instead of removable dentures.

- Rise of digital dentistry: Technologies like 3D printing and AI-based planning are making implants faster and easier to place, encouraging more people to opt for them.

• Restraints

- High cost of treatment: Dental implants are still expensive compared to bridges. This makes them less accessible for some patients.

- Risk of infection or implant failure: Problems like infections around the implant can affect success rates. This reduces confidence.

• Opportunities

- New antibacterial coatings: Coatings that fight bacteria could make implants safer and longer-lasting, boosting demand.

- Affordable implants for emerging markets: Lower-cost implants designed for countries like India and Brazil could open up a huge new customer base.

• Challenges

- Tougher regulations: Getting approval for new materials and products is becoming more difficult, slowing down innovation.

- Shortage of skilled dentists for advanced procedures: Many dentists are still learning how to use new digital tools properly, which can limit adoption.

The growing number of older patients and new digital technologies are pushing the dental implants market forward. At the same time, high costs and the risk of complications are holding some people back. Companies that focus on safer, affordable options and help dentists use new tools more easily are likely to succeed, according to our latest market analysis. Overall, the market is expanding steadily but faces real pressure to make implants safer, cheaper, and easier to place.

Regional Analysis

Europe currently holds the largest share of the dental implants market, helped by strong insurance coverage, an aging population, and a high demand for cosmetic dentistry. North America follows closely, with a growing number of implant procedures and fast adoption of new technologies. Asia‑Pacific is the fastest‑growing region; rising middle‑class incomes in China and India, paired with expanding clinic networks, underpin double‑digit gains.

• Europe: Leading the market with strong insurance support and growing demand for aesthetic procedures.

• North America: High procedure rates and rapid move toward digital implant technologies.

• Asia-Pacific: Fastest growth thanks to economic development, medical tourism, and large patient numbers.

• Latin America: Competitive pricing and growing interest in cosmetic dental treatments are fueling demand.

• Middle East and Africa: Growth is slower but improving as private clinics upgrade their technology.

Segmentation Analysis

• By Material:

- Titanium – Gold-standard, cost-effective, broad clinical evidence.

Titanium implants continue to lead the market because of their proven safety, high success rates, and affordability. They are widely used by dentists for most standard procedures.

- Zirconia – Metal-free aesthetics, CAGR in double digits.

Zirconia implants are becoming more popular, especially among patients looking for a metal-free and natural-looking option. Zirconia is also a good choice for people with metal sensitivities, and its cosmetic appeal is helping this segment grow quickly.

• By Design:

- Tapered – Superior bone engagement, majority share.

Tapered implants are currently the preferred design because they provide better stability when placed, especially in softer bone or in immediate loading cases where speed matters. They allow for easier and quicker placement, which makes them attractive to both dentists and patients.

- Parallel-walled – Preferred for dense cortical bone cases.

Parallel-walled implants, on the other hand, are used when bone density is high and precision is critical. Although they are less versatile than tapered designs, they are important for specific clinical situations that demand a very tight fit.

• By Type:

- Endosteal – Routine choice for single and multiple tooth replacement.

Endosteal implants, which are placed directly into the jawbone, are by far the most common type used today. They offer strong support for crowns, bridges, and dentures and work well for most patients with healthy bone.

- Subperiosteal and Transosteal – Niche options for severe bone loss.

Subperiosteal and transosteal implants are used in more complex cases where patients do not have enough natural bone. While they represent a smaller part of the market, they are crucial options for individuals who might otherwise be unable to receive implants.

Facts and Figures

• ~3 million Americans already live with dental implants, growing by 500,000 annually.

• Severe periodontal disease affects 10% of the global population, a key implant candidate pool.

• About 46‑63% of implant patients experience peri-implant mucositis; demand for antibacterial coatings is rising accordingly.

• Digital workflows can cut surgical time by 30‑40%, improving clinic throughput.

• Full‑arch restorations now represent 15% of total implant revenue, up from 10% five years ago.

Analyst Review and Recommendations

The dental implants landscape is shifting from product‑centric to solution‑centric. Players that pair titanium or zirconia fixtures with guided‑surgery software, rapid prototyping, and evidence‑backed surface treatments will outpace peers. For market entrants, mid‑priced tapered systems aimed at Asia‑Pacific’s expanding middle class offer the quickest path to scale. Established brands should deepen clinician training and post‑market surveillance to guard against regulatory headwinds and build long‑term trust.