Market Overview

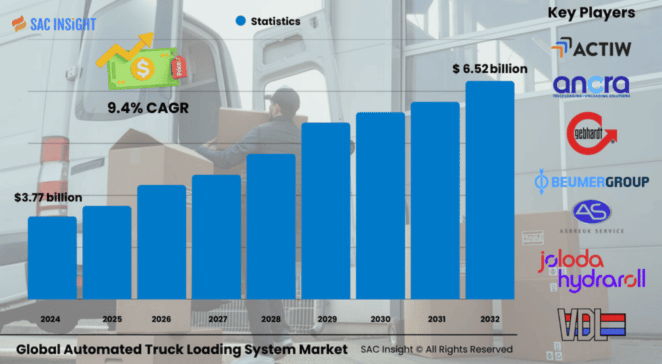

The Global automated truck loading system (ATLS) market size was valued at US$ 3.77 billion in 2024 and is on track to reach about US$ 6.52 billion by 2032, expanding at an average 9.4% CAGR during the forecast period. First‑hand industry insights show that rising e-commerce volumes, persistent warehouse labor shortages, and safety‑driven automation mandates are reshaping material‑handling strategies. SAC Insight market evaluation confirms a solid post‑pandemic rebound, with installation activity running well ahead of pre‑2020 levels.

Summary of Market Trends & Drivers

• AI‑enabled load‑planning software and IoT‑connected conveyors are cutting truck dwell times by up to 30%, sharpening the business case for full‑scale automation.

• A shift toward flush and climate‑controlled docks—driven by stricter cold‑chain and food‑safety rules—is accelerating belt‑ and roller‑based ATLS adoption.

• Rising labor costs in North America and Europe, combined with high injury rates at manual docks, continue to push market growth into double digits.

Key Market Players

The competitive landscape features a blend of established conveyor specialists and fast‑moving robotics firms. Global automated truck loading system market leaders such as BEUMER Group, ACTIW, and Joloda Hydraroll command notable market share through broad product portfolios and deep systems‑integration expertise. Meanwhile, niche innovators—think Ancra Systems, Cargo Floor, and KEITH Manufacturing—are carving out space with modular, retrofit‑friendly solutions that appeal to operators looking to automate existing fleets without costly truck modifications.

Key Takeaways

• Automated truck loading system industry value (2024): US$ 3.77 billion

• Projected value (2032): ≈ US$ 6.52 billion at a 9.4% CAGR

• Europe retains the largest market share (~40%) thanks to early technology adoption and stringent workplace‑safety regulations.

• Belt conveyor systems lead the system‑type segment, while flush docks dominate loading‑dock installations.

• Non‑modified trucks account for the majority of deployments, underscoring demand for quick, capex‑light rollouts.

• AI‑driven load optimization and end‑to‑end supply‑chain integration are the most influential market trends shaping product roadmaps.

Market Dynamics

Drivers:

• Rapid e‑commerce expansion demanding higher dock throughput and lower truck turnaround times.

• Rising workplace‑safety expectations and regulations encouraging hands‑free loading.

• Proven ROI as automation slashes labor costs and minimizes cargo damage.

Restraints:

• High upfront investment, especially for green‑field facilities in emerging markets.

• Ready access to inexpensive labor in parts of Asia and Latin America reduces immediate automation urgency.

• Integration complexity with legacy warehouse management systems (WMS) can slow decision cycles.

Opportunities:

• Retro‑fit kits for non‑modified trucks open a vast installed base of conventional fleets.

• Advanced robotics and AGVs promise fully autonomous dock‑to‑dock workflows.

• Growing need for temperature‑controlled logistics creates demand for climate‑controlled dock solutions.

Challenges:

• Fragmented standards across regions complicate global roll‑outs and after‑sales support.

• Cyber‑security risks rise as IoT‑connected ATLS platforms proliferate.

• Prolonged supply‑chain lead times for critical components (e.g., sensors, drives) can delay installations.

Regional Analysis

Europe leads the ATLS market on the back of mature logistics networks, high labor costs, and strict safety codes that favor early automation. Asia‑Pacific is the fastest‑growing region, powered by rapid industrialization and a booming online‑retail sector, while North America benefits from strong 3PL investment and warehouse modernization programs.

• Europe: Early adopter, strong regulatory push, ~40% market share

• Asia‑Pacific: Double‑digit CAGR, driven by China and India’s manufacturing growth

• North America: High automation budgets among 3PLs and retailers

• Latin America & MEA: Emerging demand linked to expanding cold‑chain and port infrastructure

Segmentation Analysis

By Loading Dock:

• Flush Dock – Space‑saving, easy to retrofit. Flush docks sit flush with the building façade, making them popular among space‑constrained urban warehouses seeking streamlined ATLS installation without major structural changes.

• Enclosed & Climate‑Controlled Docks – Safety‑centric, rising in cold‑chain. Operators handling perishable or high‑value goods prefer enclosed docks to maintain temperature integrity and protect staff from weather exposure.

• Sawtooth & Other Docks – Niche layouts, efficiency boost. Irregular footprints leverage sawtooth docks to ease truck maneuvering; ATLS helps reclaim lost storage space and improve load consistency.

By Truck Type:

• Non‑Modified Trucks – Low‑capex favorite. Most fleets adopt ATLS that works with standard trailers, avoiding costly vehicle alterations and accelerating ROI.

• Modified Trucks – Purpose‑built performance. Where throughput is critical, modified trucks integrate guide rails or captive conveyors, achieving the fastest cycle times for high‑volume lanes.

By System Type:

• Belt Conveyor Systems – High throughput, broad appeal. Telescopic belt units speed parcel handling and bulk pallet moves alike, underpinning the largest revenue slice.

• Roller Track & Skate Conveyor Systems – Simple mechanics, low maintenance. Gravity‑assisted rollers or skates enable cost‑effective retrofits for lighter loads and mixed‑parcel environments.

• Chain, Slat, Loading Plate Systems & AGVs – Heavy‑duty or fully autonomous. Chain and slat conveyors tackle dense or irregular cargo, while AGVs bridge trailer and warehouse zones for seamless dock‑to‑storage automation.

By Industry:

• FMCG – Fast‑moving volumes, e‑commerce surge. Constant SKU turnover pushes FMCG operators toward ATLS for reliable, high‑speed loading.

• Automotive – Precision parts handling. Tier‑1 suppliers use modified trucks and guided conveyors to prevent damage and meet just‑in‑time schedules.

• Aviation, Cement, Paper, Post & Parcel, Textile, Pharmaceutical, Others – Diverse, specialized needs. From bagged cement to pharma pallets, sector‑specific payloads drive customized ATLS layouts that enhance safety and traceability.

Industry Developments & Instances

• Jan 2023: A major integrator partnered with a wine‑bottling logistics firm to deploy AGVs capable of lifting 1.5 t loads to 4 m, boosting site productivity.

• Mar 2023: A leading walking‑floor pioneer showcased new lightweight trailer floors at a flagship trucking expo, emphasizing reduced maintenance.

• Nov 2022: An autonomous lift‑truck with AI‑based load recognition hit the market, automating pallet pick‑and‑place before ATLS engagement.

• Aug 2022: A conveyor OEM acquired flexible‑roller technology to shorten lead times and expand retrofit options.

• May 2021: A bulk‑handling group delivered 3,000 fully automated bag loaders to a Southeast Asian cement producer, underscoring demand for high‑capacity ATLS in heavy materials.

Facts & Figures

• Average dock‑to‑dock load cycle falls from 45 minutes to • Injury claims at automated docks are 70% lower than at manual sites.

• Belt‑conveyor systems account for ≈30% of total market revenue.

• Europe houses over 1,000 large‑scale ATLS installations, the highest regional concentration worldwide.

• Integrated AI load‑planning can improve trailer fill rates by up to 12%, translating to significant freight‑cost savings.

Analyst Review & Recommendations

SAC Insight data‑driven market analysis indicates that ATLS adoption is shifting from pilot projects to core logistics infrastructure. Vendors that deliver retrofit‑friendly kits, AI‑enhanced load‑planning software, and robust after‑sales support will capture outsized market share. For end‑users, prioritizing systems with open interfaces—capable of linking WMS, TMS, and predictive‑maintenance modules—will future‑proof investments and accelerate payback periods as global freight networks continue to digitize.