Market Overview

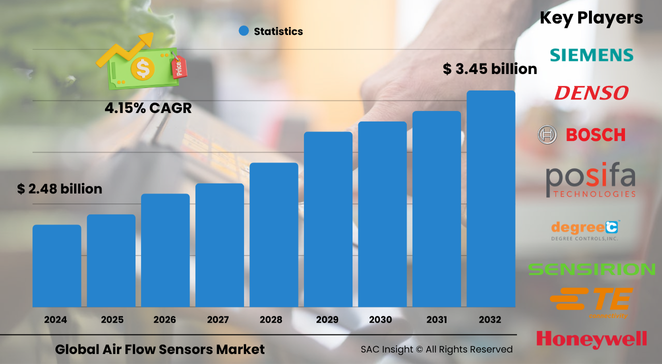

The global air flow sensors market size is valued at roughly US$ 2.48 billion in 2024 and is projected to reach about US$ 3.45 billion by 2032, expanding at an average 4.15% CAGR. First-hand industry insights point to three structural growth levers: tightening emission rules, accelerating electrification of vehicles and factories, and rapid miniaturization of MEMS-based sensing elements that lower cost per measurement.

SAC Insight's deep market evaluation shows the United States air flow sensors market alone could progress from around US$ 0.74 billion in 2024 to just over US$ 1.04 billion by 2032 as smart HVAC retrofits and electric-vehicle production ramp up.

Summary of Market Trends & Drivers

• Automakers are upgrading engine-control units and battery-cooling loops with high-precision mass sensors to meet Euro 7 and EPA Tier 3 requirements, while volume sensors underpin next-generation smart-building ventilation systems aiming for 30 % energy savings.

• IoT-ready, cloud-connected sensor nodes enable real-time air quality dashboards and predictive maintenance, reshaping market growth across manufacturing and healthcare clean-rooms.

Key Market Players

Industry leadership rests with a mix of diversified multinationals and specialist sensor innovators. Companies such as Honeywell, Sensirion, TE Connectivity, Denso, Bosch, and First Sensor deliver broad product portfolios covering automotive, HVAC, and medical applications, often bundling digital calibration and on-chip diagnostics. Alongside them, agile firms like Posifa Microsystems and Degree Controls capture niche opportunities in high-humidity medical ventilation and semiconductor clean-rooms, pushing miniaturization and power efficiency.

Competitive dynamics increasingly revolve around MEMS process know-how, integrated signal conditioning, and smart-factory partnerships. Market analysis indicates that players linking hardware with software dashboards and AI-driven analytics secure longer service contracts and higher margins.

Key Takeaways

• Current global market size (2024): US$ 2.48 billion

• Projected global market size (2032): US$ 3.45 billion at a 4.15 % CAGR

• Mass air flow sensors command the largest market share owing to precision demands in engines, EV battery packs, and spirometers

• Connected HVAC installations are the fastest-growing application, driven by smart-building mandates and pandemic-era indoor-air standards

• Asia-Pacific manufactures more than 55 % of global sensor volumes, yet North America remains the lead adopter of IoT-enabled units

• Market trends highlight edge-AI calibration, recyclable sensor housings, and high-temperature variants for hydrogen and aerospace use

Market Dynamics

Drivers

• Stricter global emission and energy-efficiency regulations accelerate demand for accurate air intake and ventilation measurement.

• Electrification of transport and factories requires thermal-management sensors in battery packs, fuel-cell stacks, and data-center cooling.

• Low-power MEMS designs and falling ASPs open mass-market opportunities in smart home appliances and consumer wearables.

Restraints

• High calibration complexity and periodic re-certification increase lifecycle costs for end users.

• Sensor accuracy can drift under extreme humidity, temperature swings, and particulate contamination, limiting deployment in heavy industry.

• Budget constraints in developing economies slow replacement of legacy mechanical gauges.

Opportunities

• IoT and cloud platforms create recurring revenue through data analytics, remote firmware updates, and predictive maintenance services.

• Renewable-energy growth spurs demand for sensors in wind-turbine nacelles, solar farm HVAC, and hydrogen production safety systems.

• Miniaturized, battery-powered units enable untapped markets in medical wearables and portable environmental monitors.

Challenges

• Supply-chain bottlenecks for specialty semiconductors and platinum thin-film elements can delay new-product roll-outs.

• Increasing cybersecurity expectations require secure boot and encrypted data links, adding design complexity.

• Managing electronic waste and meeting circular-economy targets force manufacturers to redesign housings for recyclability.

Regional Analysis

Asia-Pacific currently dominates revenue thanks to vast automotive output, expansive electronics manufacturing, and government-funded smart-city programs in China, Japan, and South Korea. Europe follows, buoyed by aggressive net-zero targets and prolific HVAC retrofitting, while North America commands the highest share of IoT-ready sensor deployments as enterprises digitize facilities for ESG reporting.

• North America – Strong IoT uptake, automotive emission compliance, rising data-center cooling demand

• Europe – Tight Euro 7 legislation, green-building codes, and renewable-energy projects drive precision sensing

• Asia-Pacific – Largest production base; EV growth, manufacturing automation, and urban air-quality programs propel market growth

• Middle East & Africa – Smart-infrastructure spending and extreme-climate HVAC requirements foster steady adoption

• South & Central America – Automotive assembly and mining ventilation upgrades underpin moderate expansion

Segmentation Analysis

By Type

• Mass Air Flow Sensors – Precision cornerstone, dominant share.

Mass sensors directly measure the mass of incoming air, enabling accurate fuel metering, battery thermal management, and medical ventilator control. Their digital linearity and temperature compensation keep them ahead in automotive, healthcare, and industrial combustion applications.

• Volume Air Flow Sensors – Cost-effective option for large ducts.

Volume sensors track velocity and static pressure to calculate cubic-meter flow, making them popular in HVAC, clean-rooms, and process industries where absolute mass accuracy is less critical but energy monitoring is essential.

By Output Signal

• Analog – Legacy integration, robust in harsh settings.

Analog voltage or current outputs remain common in older engine-control modules and basic industrial PLCs, prized for simplicity and real-time response without ADC latency.

• Digital – Fastest-growing, IoT-ready.

I²C, SPI, and CAN-enabled outputs deliver calibrated flow values, on-chip fault flags, and easier network integration, reducing engineering effort for smart-building and medical OEMs.

By Application

• Automotive – Core demand engine.

Sensors optimize combustion air-fuel ratios, filter clog detection, turbo boost control, and EV battery cooling, directly impacting efficiency and emissions targets.

• HVAC – Rapid expansion with smart buildings.

Flow sensors balance duct systems, verify fresh-air rates, and feed energy dashboards, helping facility managers cut operating costs and meet indoor air-quality standards.

• Healthcare – Life-critical accuracy.

In ventilators, anesthesia machines, and spirometers, low-pressure differential sensors ensure precise tidal volumes and patient safety, spurring premium pricing.

• Industrial & Manufacturing – Process efficiency.

Factories deploy sensors in compressed-air lines, clean-rooms, and combustion furnaces to trim waste and enable predictive maintenance.

• Aerospace & Power & Utility – Niche but high value.

High-temperature variants withstand up to 800 °C for turbine intake monitoring, while utilities use them for emissions-control feedback loops.

Industry Developments & Instances

• September 2023 – ENVEA launched a high-temperature volume-flow sensor rated to 800 °C, extending instrument life in cement kilns and biomass boilers.

• April 2021 – Posifa Technologies introduced humidity-tolerant mass sensors for next-generation respiratory devices, improving accuracy under condensate conditions.

• December 2024 – A leading auto OEM signed a multi-year agreement with a sensor supplier to integrate in-line diagnostics for battery-pack airflow in new EV models.

• June 2024 – A Japanese HVAC giant partnered with a sensor start-up to embed edge-AI algorithms that auto-calibrate duct sensors, reducing commissioning time by 40 %.

• March 2024 – Regulations in the EU mandated continuous air-flow monitoring in commercial kitchens, spurring retrofits across hospitality chains.

Facts & Figures

• Connected HVAC deployments can lower energy use by up to 30% when paired with digital flow sensors.

• More than 90% of new passenger vehicles sold in Europe and North America now integrate electronic mass air flow sensors.

• IoT-ready digital sensors fetch an average 18% price premium over analog units.

• High-temperature variants (>700 °C) grew at 6% year on year in 2024, outpacing the overall market growth rate.

• Asia-Pacific produced approximately 55 million automotive mass sensors in 2023, accounting for over half of global output.

Analyst Review & Recommendations

Market growth is shifting from simple component sales toward data-centric service models. Suppliers that bundle secure digital outputs, embedded AI calibration, and cloud dashboards will capture disproportionate value. We recommend prioritizing ultra-low-power MEMS designs for battery-operated devices, partnering with HVAC and EV platform leaders for joint development, and aligning product roadmaps with circular-economy directives to future-proof compliance and bolster customer trust.