Market Overview

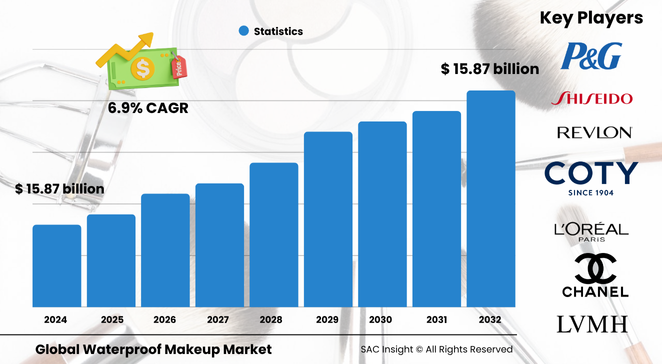

The global waterproof makeup market size is valued at about US$ 15.87 billion in 2024 and is projected to reach roughly US$ 27.82 billion by 2032, charting a steady 6.9% CAGR through the 2025-2032 forecast window. SAC Insight's first-hand industry insights point to three clear growth engines: consumers’ preference for stay-put cosmetics in humid or active settings, ongoing R&D that blends film-forming polymers with skin-care actives, and social-media amplification of long-wear performance claims.

SAC Insight's deep market analysis shows the United States waterproof makeup market alone could climb from nearly US$ 12.85 billion in 2024 to about US$ 22.53 billion by 2032 as both women and an expanding cohort of male users adopt durable complexion and eye products.

Summary of Market Trends & Drivers

• Multi-functional hybrids that pair water resistance with SPF, antioxidants, or hydrating complexes are narrowing the gap between colour cosmetics and skin care.

• Clean-label and vegan claims now influence purchase decisions almost as much as shade range, pushing formulators to swap parabens and cyclic silicones for plant-based waxes without sacrificing wear time.

• Digital “try-on” tools and creator-led tutorials accelerate awareness of transfer-proof finishes, reinforcing market growth across every price tier.

Key Market Players

The competitive field features a blend of heritage powerhouses and agile indie innovators. Global leaders such as L’Oréal, Estée Lauder, Shiseido, Chanel, Coty, and LVMH leverage vast R&D budgets, patented polymer networks, and omnichannel footprints to defend market share. Alongside them, fast-moving labels like Fenty Beauty, e.l.f. Cosmetics, Palladio, and Anastasia Beverly Hills gain traction with inclusive shade libraries, refillable packaging, and influencer partnerships that resonate with Gen Z and millennial audiences. Collectively these players shape formulation standards, sustainability targets, and merchandising tactics in the waterproof category.

Key Takeaways

• Current global market size (2024): USD$ 15.87 billion

• Projected global market size (2032): USD$ 27.82 billion at a 6.9 % CAGR

• Current US market size: USD$ 12.85 billion; forecast to reach USD$ 22.53 billion by 2032

• Mascara holds the single-largest product market share, while waterproof lipstick posts the fastest revenue climb through 2032

• Liquid formats account for more than 40 % of 2024 sales, buoyed by long-wear foundations and concealers that double as sun protection

• Online retail is the quickest-growing distribution channel, driven by virtual shade-matching and subscription replenishment programs

Market Dynamics

Drivers

• Rising gym, outdoor, and travel lifestyles raise demand for sweat-proof, fade-proof finishes

• Continuous advances in breathable film-formers improve comfort and make removal easier, broadening user acceptance

• Inclusive shade ranges and gender-neutral positioning open new customer segments

Restraints

• Higher unit prices versus standard makeup slow adoption in price-sensitive markets

• Stringent clean-beauty standards challenge chemists to maintain water resistance while removing certain silicones and PFAS derivatives

Opportunities

• Recyclable and refillable componentry can differentiate brands as retailers push for circular beauty initiatives

• AI-powered shade finders and skin-tone datasets allow brands to personalize product bundles, lifting basket size

Challenges

• Counterfeit waterproof SKUs in e-commerce undermine consumer trust and dent authentic brand revenues

• Supply-chain volatility for specialty waxes and high-grade pigments can extend lead times and inflate costs

Regional Analysis

Asia-Pacific commands the largest market share thanks to K-beauty and J-beauty’s focus on flawless, long-lasting looks, while North America delivers the highest per-capita spend and Europe progresses on sustainable packaging mandates. Emerging Latin American and Middle Eastern markets show solid upside as social-media penetration climbs.

• North America – strong spend on prestige brands and athleisure-ready formulas

• Europe – fastest shift toward clean and eco-friendly waterproof lines

• Asia-Pacific – innovation hub for hybrid makeup-skin-care products; rapid e-commerce uptick

• Latin America – humidity-driven demand spikes, especially in coastal nations

• Middle East & Africa – rising tourism and wedding segments boost premium sales

Segmentation Analysis

By Product

• Mascara – Eye-defining anchor.

Mascara captures a leading share because tubing and panoramic brushes deliver clump-free volume that survives sweat, tears, and pool dives.

• Foundation & Skin Tint – All-weather complexion staple.

Long-wear liquids with SPF and oil control gain ground among consumers who want a flawless finish from morning commute through evening events.

• Eyeliner – Precision plus endurance.

Gel and pen formats that set in 30 seconds meet the demand for graphic eye looks that resist smudging in hot climates.

• Lipstick – Transfer-proof colour surge.

Liquid mattes and flexible stains maintain rich pigment through meals, pushing the segment toward an estimated 8 % CAGR by 2032.

• Brow Gel & Others – Natural-look hold.

Water-resistant pomades tame brows for up to 24 hours, aligning with the trend toward groomed yet effortless arches.

By Form

• Liquid – Versatile and breathable.

Sheer-to-full-coverage liquids blend skincare and colour, holding roughly 42 % of 2024 revenue.

• Gel – High precision.

Gel pots and pencils excel in eyeliners and brow products, forecast to expand at about 6.7 % CAGR.

• Powder – Lightweight finishing.

Setting powders lock base makeup, but growth is moderate as consumers favour sprays for all-day hold.

By End Use

• Women – Core demand engine.

Over 60 % share stems from diverse routines that layer primer, base, and setting spray for lasting wear at work, gym, and social events.

• Men – Emerging grooming frontier.

Concealers and brow definers help men cover blemishes discreetly, creating a near-7 % CAGR niche through 2032.

By Distribution Channel

• Supermarkets/Hypermarkets – High convenience.

Expanded beauty aisles mix mass and masstige options, supporting impulse purchases.

• Specialty Beauty Stores – Experiential hubs.

In-store consultations elevate premium sales; loyalty programs drive repeat business.

• Drugstores/Pharmacies – Trusted access.

Derm-led brands attract sensitive-skin users seeking hypoallergenic waterproof solutions.

• Online – Fastest track.

Virtual try-ons, same-day shipping, and influencer bundles accelerate click-to-cart conversion.

Industry Developments & Instances

• June 2024 – A leading global brand launched a 24-hour panorama waterproof mascara in Southeast Asia, spotlighting panoramic application wands and clump-resistant polymers.

• May 2024 – A celebrity-backed label rolled out a naturally luminous, heat-proof foundation targeting hot-and-humid markets.

• April 2023 – A luxury conglomerate acquired a designer beauty house for USD$ 2.8 billion to expand its waterproof complexion and eye portfolio.

Facts & Figures

• Mascara represents roughly 28 % of waterproof revenue in 2024.

• Liquid formats account for more than 40 % of category sales.

• Online channels are projected to post around 7.3 % CAGR from 2025 to 2032.

• Asia-Pacific holds close to 39 % of current market share, led by South Korea and Japan.

• Inclusive shade launches have expanded foundation ranges to more than 50 tones at several leading brands.

Analyst Review & Recommendations

Market growth will hinge on balancing performance with clean-beauty benchmarks and sustainable packaging. Brands that integrate breathable film-formers, broad-spectrum SPF, and refillable compacts can outpace the average CAGR while satisfying retailer guidelines. Investing in AI-powered shade-matching and gender-neutral marketing will unlock incremental buyers, particularly in North America and Asia-Pacific. Finally, proactive counterfeit monitoring across marketplace platforms safeguards brand equity and supports healthy long-term market share gains.