Market Overview

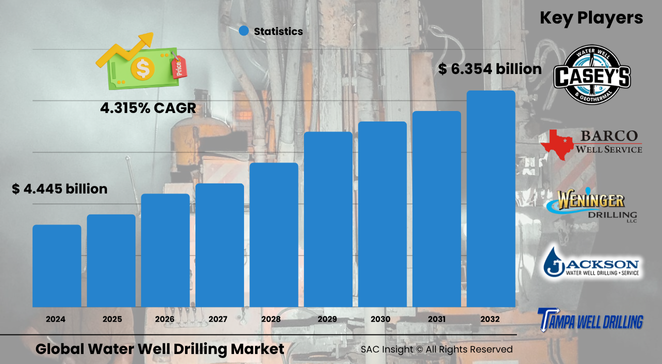

The global water well drilling market size is valued at about US$ 4.445 billion in 2024 and is projected to reach roughly US$ 6.354 billion by 2032, reflecting a steady 4.315% CAGR. First-hand industry insights highlight three direct growth engines: mounting pressure on groundwater resources in drought-prone regions, rapid industrial expansion across emerging economies, and rising investment in climate-resilient irrigation networks. SAC Insight's deep market evaluation indicates that the U.S. water well drilling market alone could advance from around US$ 1.3 billion in 2024 to nearly US$ 1.8 billion by 2032 as homeowners, farms, and small municipalities choose private wells to hedge against surface-water volatility.

Summary of Market Trends & Drivers

• Large-scale farms are commissioning high-capacity boreholes to offset erratic rainfall, underpinning market growth in irrigation-intensive belts.

• Urban edge communities are adopting small-footprint drilling rigs that minimize disturbance and shorten permitting timelines.

• Advances such as sonic drilling and dual-tube flooded reverse circulation are raising penetration rates, trimming operating costs, and widening service margins.

Key Market Players

Regional specialists and a handful of multinational service providers shape the competitive landscape. Companies such as Layne, Weninger Drilling, Tampa Well Drilling, Gordon and Sons, Barco Well Service, Johnson Water Well Drilling, Nelson Drilling Company, Jackson Water Well, and Craig Waterwell & Drilling focus on turnkey packages that bundle site surveys, drilling, casing, and after-care. Their strategies emphasize reliable equipment fleets, local aquifer knowledge, and post-installation service contracts that secure recurring revenue as wells require monitoring and maintenance.

Competitive dynamics increasingly revolve around technology adoption and regional reach. Drillers offering sonic rigs, remotely monitored pumps, and environmentally compliant mud systems capture higher-margin projects, while partnerships with pump manufacturers and irrigation integrators help secure full-cycle contracts from agricultural clients.

Key Takeaways

• Current global market size (2024): about USD$ 4.445 billion

• Projected global market size (2032): roughly USD$ 6.354 billion at a 4.315% CAGR

• Domestic wells account for the largest market share, driven by household demand for reliable, chemical-free water supplies

• 4–8 inch diameter wells dominate new installations thanks to their balance of flow rate and manageable drilling cost

• Cable tool & auger drilling retains a sizeable share in soft-formation regions, while rotary and sonic systems gain traction in harder strata

• North America and Asia-Pacific collectively command more than half of global revenue as industrial users pivot from surface to groundwater sources

Market Dynamics

Drivers

• Expanding irrigated acreage in water-stress zones boosts demand for high-capacity agricultural wells.

• Industrial facilities prefer on-site groundwater to avoid rising municipal tariffs and supply constraints.

• Improved drilling technologies cut non-productive time and lower per-foot costs, encouraging new projects.

Restraints

• Depleting aquifers in arid regions raise sustainability concerns and heighten regulatory scrutiny.

• High bargaining power of buyers in fragmented local markets keeps service prices under pressure.

• Seasonal permitting delays can stall projects, especially in environmentally sensitive zones.

Opportunities

• Smart pump monitoring and remote telemetry open subscription-based revenue streams for service providers.

• Government incentives for climate-resilient farming create funding pools for communal irrigation wells.

• Re-development of abandoned wells using down-hole cameras and liner technology offers a cost-effective alternative to greenfield drilling.

Challenges

• Variability of subsurface geology demands versatile rigs and skilled crews, complicating capacity planning.

• Stringent groundwater management rules may cap extraction volumes, affecting well spacing and sizing.

• Shortage of trained drill operators in fast-growing regions could extend lead times and inflate wages.

Regional Analysis

North America currently leads market share, driven by mature residential demand, solid rural financing schemes, and first-mover adoption of sonic drilling. Asia-Pacific follows closely, with rapid industrialization and smallholder farm modernization fueling double-digit project counts. Europe’s stricter water-rights framework tempers well counts but pushes demand for advanced, low-impact rigs. Latin America and the Middle East & Africa show rising investment in deep-aquifer projects as climate variability intensifies.

• North America – Largest revenue base; strong residential and agricultural uptake

• Asia-Pacific – Fastest percentage growth; industrial expansion and government irrigation programs

• Europe – Technology-rich; favors eco-compliant, low-noise rigs in regulated markets

• Middle East & Africa – Deep-aquifer exploration to secure potable supplies for arid zones

• Latin America – Growth tied to cash-crop irrigation and rural water-supply schemes

Segmentation Analysis

By Diameter

• 4–8 inch – Workhorse category, majority share.

This size delivers reliable flow for homes and mid-sized farms without the high casing and pump costs of larger bores, keeping it the preferred choice across most regions.

• – Niche for shallow domestic wells.

Suited to single-family homes in high-water-table areas, they remain popular where small-rig access and minimal upfront spend outweigh long-term yield constraints.

• 8–10 inch – Emerging for pivot irrigation.

Medium-scale farms adopt this class when crops require higher discharge rates and longer pumping cycles.

• 10–12 inch and >12 inch – High-capacity industrial and municipal segment.

These large diameters supply food processors, mining camps, and small towns that need continuous, high-volume withdrawal from deep aquifers.

By Application

• Domestic – Core demand engine, especially in rural and peri-urban zones.

Homeowners prize well water for independence from municipal networks, perceived purity, and predictable utility bills.

• Industrial – Rising share as factories convert to groundwater.

Industries such as food, paper, and chemicals need consistent process water; deep wells mitigate the risk of supply cuts.

• Irrigation – Strong growth track.

Crop-intensive regions rely on boreholes to stabilize yields amid erratic rainfall, driving multi-well orders and service contracts.

• Others – Institutions, resorts, and disaster-relief projects round out demand, often requiring rapid-deployment rigs.

By Drilling Method

• Cable Tool & Auger – Cost-effective in soft formations.

Lower equipment outlay and single-operator viability keep this hybrid method attractive for shallow to moderate depths.

• Rotary – High-penetration, versatile option.

Top-drive rotary rigs tackle diverse lithologies and are favoured for projects above 500 feet.

• Sonic & Dual-Tube Flooded Reverse – Premium, fastest-growing slice.

High-frequency vibration and continuous core return boost speed, cut deviation, and minimize waste, appealing to environmentally sensitive projects.

Industry Developments & Instances

• April 2025 – A leading driller rolled out tele-metered pump controllers that flag draw-down issues before failure.

• January 2025 – Joint venture in Southeast Asia commissioned a fleet of compact sonic rigs targeting export-oriented fruit farms.

• September 2024 – Municipal utility in the U.S. Midwest awarded a framework contract for rehabilitating 50 legacy wells with down-hole liners.

• June 2024 – African mining consortium adopted dual-tube flooded reverse circulation to supply 24 hour process water at a remote gold site.

Facts & Figures

• Around 70 percent of the world’s extracted groundwater is used for agriculture.

• The National Ground Water Association reports roughly 500,000 new residential wells drilled each year in the U.S.

• Sonic drilling can achieve up to 2–3 times faster penetration rates in unconsolidated soils compared with conventional rotary rigs.

• 4–8 inch wells account for an estimated 55 percent of total installations worldwide.

• Remote pump monitoring can reduce unscheduled maintenance visits by up to 30 percent, improving service profitability.

• Average depth of new industrial wells has increased from 450 feet in 2019 to nearly 600 feet in 2024 as shallow aquifers deplete.

Analyst Review & Recommendations

Market analysis underscores a clear shift from ad-hoc, standalone drilling toward full-lifecycle water-asset management. Service providers that combine versatile rig fleets with data-enabled pump monitoring and credible sustainability reporting are poised to outpace average market growth. To secure long-term margins, drillers should prioritize technician training, invest in low-impact sonic or dual-tube systems for regulated regions, and explore subscription-based after-care packages that turn episodic projects into recurring revenue streams."