Market Overview

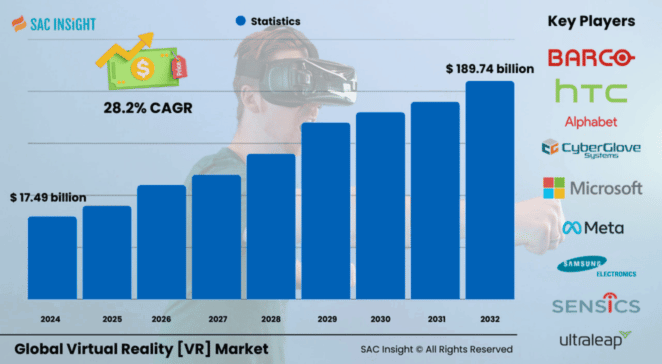

The global virtual reality market size stood at US$ 17.49 billion in 2024 and, according to SAC Insight analysis, is poised to surge US$ 189.74 billion by 2032, advancing at an average 28.2% CAGR from 2026 to 2032. First-hand industry insights highlight three structural accelerants: falling headset prices, rapid content innovation powered by generative AI, and enterprise demand for immersive training that trims field-service costs. A SAC Insight evaluation also shows post-pandemic normalization of supply chains, with premium optics and mixed-reality devices moving from back-order to mainstream retail shelves. The U.S. VR market is on track to top about US$ 80 billion by 2032, buoyed by aggressive enterprise adoption and a robust gaming ecosystem.

Summary of Market Trends & Drivers

• Hardware shifts toward lighter, standalone head-mounted displays (HMDs) and gesture-tracking accessories are redefining user comfort and session length.

• Generative AI tools now automate 3D asset creation, slashing development time and expanding use cases in design, healthcare simulation, and virtual events.

• 5G and edge computing rollouts are eliminating latency barriers, enabling cloud-rendered, photorealistic VR experiences on untethered devices.

Key Market Players

The global virtual reality [VR] market report profiles global leaders such as Meta Platforms, Alphabet, Microsoft, Sony Interactive Entertainment, HTC, Samsung Electronics, Nvidia, and Unity. These firms set the competitive tempo through rapid optics upgrades, silicon integration, and strategic content partnerships. A rising cohort of specialists—including haptics pioneer HaptX and enterprise-focused ARuVR—adds competitive diversity by targeting niche industrial and training applications.

Key Takeaways

• 2024 market value: ~US$ 17.49 billion

• Projected 2032 value: ~US$ 189.74 billion at a 28.2% CAGR

• Asia Pacific commands the largest market share (>35%), while Europe records the fastest growth pace.

• HMDs contribute over 60% of revenue; gesture-tracking devices are the fastest-growing hardware sub-segment.

• Healthcare is the highest-growth application vertical, with a forecast CAGR above 30%.

• Generative-AI-enhanced content creation is emerging as a decisive competitive differentiator.

Market Dynamics

Drivers

• Falling component costs and mass-production of micro-OLED panels are expanding consumer access.

• Enterprise push for remote collaboration, virtual prototyping, and safety-critical training fuels sustained market growth.

• Integration of AI accelerates content generation and personalizes user experiences, boosting engagement metrics.

Restraints

• Extended headset use raises concerns about eye strain and motion sickness, tempering long-session adoption.

• High-bandwidth requirements in regions with limited connectivity impede seamless immersive experiences.

Opportunities

• Hyper-realistic virtual live entertainment and sports broadcasts present new monetization avenues.

• VR-enabled mental-health therapy and telerehabilitation open untapped healthcare revenue streams.

• Cloud-rendered VR-as-a-service models reduce upfront hardware costs for small businesses.

Challenges

• Fragmented content standards complicate cross-platform development and inflate porting costs.

• Data-privacy regulations tighten around biometric and behavioral data captured during immersive sessions.

Regional Analysis

The virtual reality market in Asia Pacific leads the market, anchored by China’s dominant hardware manufacturing base and aggressive 5G deployment. Europe follows closely, propelled by automotive design, industrial training, and a vibrant indie-gaming scene. North America benefits from strong VC funding and a deep talent pool in both hardware and content creation.

• Asia Pacific: Hardware production hub and early 5G adoption drive scale.

• Europe: Fastest CAGR (>29%) on the back of enterprise and automotive design demand.

• North America: High headset penetration and robust content ecosystem sustain double-digit growth.

• Latin America: Growing esports culture and improving connectivity unlock incremental demand.

• Middle East & Africa: Government smart-city initiatives and tourism-focused VR experiences nurture a nascent but promising market.

Segmentation Analysis

By Device

• Head-Mounted Displays (HMDs) – Mainstream workhorse, >60% revenue share. HMDs dominate thanks to continuous improvements in optics, weight, and standalone processing, making them the default choice for gaming and enterprise training.

• Gesture-Tracking Devices (GTDs) – Fastest-growing, ~30% forecast CAGR. Advanced sensors and AI-driven hand-tracking deliver near-natural interaction, expanding use cases from design review to medical rehabilitation.

By Technology

• Semi & Fully Immersive – High-fidelity engagement, majority share. These systems recreate real-world physics and scale, ideal for mission-critical simulations and high-end gaming.

• Non-Immersive – Cost-efficient entry point. Screen-based VR offers a budget-friendly alternative for design walkthroughs and casual gaming, albeit with limited depth perception.

By Component

• Hardware – Two-thirds of revenue, under price pressure. Component miniaturization and mass-production efficiencies keep ASPs falling, widening the addressable consumer base.

• Software – ~30% revenue, highest margin. Engines, SDKs, and cloud-rendering services monetize recurring subscriptions and in-app purchases, underpinning sticky revenue streams.

By End-user

• Consumer – Largest segment, fuelled by gaming, social VR, and live entertainment. Affordable headsets and exclusive titles continue to expand the active-user base.

• Commercial/Enterprise – Fastest-growing use case. Companies deploy VR for design validation, maintenance training, and immersive marketing, delivering measurable ROI through reduced downtime and travel costs.

• Healthcare – High-impact niche. From surgical rehearsal to phobia treatment, VR proves its clinical value, attracting hospital and med-ed budgets.

Industry Developments & Instances

• Aug 2024: HTC launched VIVERSE Create, a no-code multiplayer-world builder for rapid enterprise prototyping.

• Jun 2024: Apple expanded Vision Pro availability to nine new countries, accelerating premium headset adoption.

• Feb 2024: Sony confirmed PC compatibility testing for PlayStation VR2, widening its content library.

• Jan 2023: Meta acquired fitness-centric VR app Supernatural, signaling a health-and-wellness content push.

• Mar 2022: Nvidia partnered with global cloud providers to enable high-quality VR streaming from any location.

Facts & Figures

• Roughly 98 million users engaged with VR hardware in 2023; the combined AR/VR installed base is expected to exceed 100 million by 2027.

• HMD ASPs fell by 18% between 2021 and 2024, accelerating consumer uptake.

• Healthcare simulation budgets allocated to VR grew 35% YoY in 2024.

• VR live-concert attendance jumped 140% between 2022 and 2024, reflecting rising demand for virtual events.

• Edge-rendered cloud VR can cut device power consumption by up to 30%, extending headset battery life for enterprise fieldwork.

Analyst Review & Recommendations

The virtual reality industry landscape is entering a scale-up phase where hardware affordability, AI-driven content automation, and ubiquitous 5G converge to unlock mass adoption. Vendors that integrate lightweight optics, gesture-rich interaction, and subscription-based content ecosystems will outpace hardware-only competitors. For new entrants, white-label cloud VR platforms targeting mid-market enterprises offer the fastest route to recurring revenue. Established players should double down on healthcare partnerships and standards-based content pipelines to secure long-term market share and mitigate regulatory risk.