Market Overview

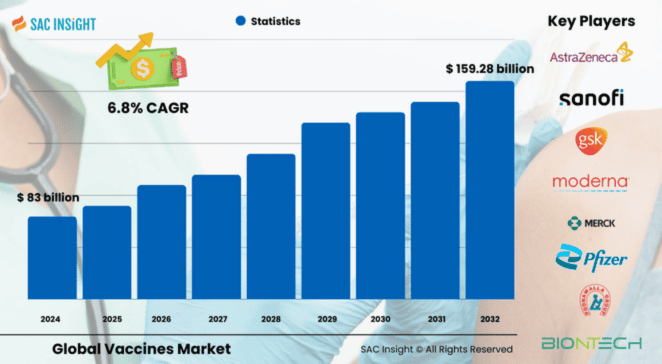

The global vaccines market size was valued at US$ 83 billion in 2024 and, according to SAC Insight evaluation, is on track to reach US$ 159.28 billion by 2032, expanding at a 6.8% CAGR over the forecaste period. First-hand industry insights point to three structural tailwinds: sustained public-private funding after COVID-19, rapid scale-up of mRNA and subunit platforms, and an accelerating shift from multi-dose vials to ready-to-use prefilled syringes that trim wastage and dosing errors. The U.S. vaccines market alone is projected to exceed US$ 62.37 billion by 2032, reflecting steady adult uptake and premium pricing in the commercial phase.

Summary of Market Trends & Drivers

• Demand is tilting toward mRNA, viral-vector, and conjugate vaccines that can be rapidly re-coded for emerging pathogens.

• Manufacturers are repurposing COVID-19 capacity for high-burden diseases such as malaria, RSV, and dengue, underpinning long-term market growth.

• Wider pharmacy administration rights and digital immunization tracking are lifting adult coverage rates, particularly for influenza, shingles, and pneumococcal shots.

Key Market Players

The global vaccines market report profiles global leaders such as Pfizer, Moderna, GSK, Sanofi, Merck, CSL Seqirus, Serum Institute of India, BioNTech, Sinovac, and AstraZeneca, alongside a rising cohort of mid-sized innovators targeting combination and thermostable formulations. These firms set the competitive tempo through aggressive pipeline investment, co-marketing pacts, and selective M&A aimed at broadening regional market share and filling technology gaps.

Key Takeaways

• Market value (2024): ~US$ 83 billion

• Projected value (2032): ~US$ 159.28 billion at a 6.8% CAGR

• mRNA vaccines captured exactly 32.32% of 2023 revenue and remain the fastest-growing type segment.

• Prefilled syringe formats are displacing vials, improving dose accuracy and reducing cold-chain losses.

• Asia Pacific commands the largest regional market share at roughly 31%, while North America posts the highest per-capita spend.

• Adult immunization volumes now outstrip pediatric doses, driven by influenza, COVID-19 boosters, and shingles vaccines.

Market Dynamics

Drivers

• Ongoing government procurement programs and rising private-market prices.

• Technological advances enabling multivalent and combination shots (e.g., COVID-flu).

• Strong pipeline investment: more than 100 late-stage candidates targeting respiratory and antimicrobial-resistant pathogens.

Restraints

• Patchy adult vaccination awareness in several high-income countries.

• Cold-chain constraints and limited last-mile logistics in low-resource settings.

Opportunities

• Oral and intranasal formulations that stimulate mucosal immunity and bypass needles.

• AI-driven antigen design to shorten development cycles and cut R&D costs.

Challenges

• Heightened regulatory scrutiny on post-marketing safety surveillance.

• Concentrated supplier base: ten companies still command close to 90% of global value, raising supply-security concerns.

Regional Analysis

The vaccines market in Asia Pacific holds the largest share thanks to a vast addressable population, improving healthcare infrastructure, and local manufacturing scale. North America, however, shows the fastest revenue growth on the back of premium pricing, adult booster programs, and strong payer coverage.

• North America: High per-capita spend, expanding adult recommendations, robust private market.

• Europe: Consistent public funding, stringent safety standards, growing elderly demographic.

• Asia Pacific: Large birth cohorts, rapid urbanization, aggressive capacity expansions in India and China.

• Latin America: Government tenders drive volume; partnerships with multinational firms are deepening.

• Middle East & Africa: Gradual uptake aided by GAVI/UNICEF procurement and rising influenza awareness.

Segmentation Analysis

By Type

• mRNA – Rapidly programmable, 32.32% 2023 share.

Platforms allow swift updates against new variants, propelling double-digit annual growth.

• Recombinant/Conjugate/Subunit – Proven safety, broad pediatric use.

These vaccines remain the volume backbone for hepatitis, HPV, and pneumococcal programs.

• Live Attenuated & Inactivated – Established efficacy, slower growth.

Widely used for polio and measles but face competition from newer technologies.

• Viral Vector & Toxoid – Niche yet vital.

Vector vaccines gained prominence during COVID-19; toxoid shots anchor diphtheria-tetanus markets.

By Route of Administration

• Parenteral – 97% market share, gold standard for systemic immunity.

Intramuscular and subcutaneous delivery ensures reliable uptake, explaining its dominance.

• Oral – Rising interest for polio, rotavirus, and next-gen candidates.

Needle-free delivery appeals for mass campaigns and pediatric compliance.

By Disease Indication

• Viral Diseases – ~64% revenue led by COVID-19, influenza, HPV.

Frequent mutation and high burden sustain continuous demand.

• Bacterial Diseases – Fastest CAGR, propelled by pneumococcal and meningococcal programs.

AMR concerns are pushing new conjugate and protein-based designs.

By Age Group

• Adults – 57% share, driven by boosters and aging populations.

Expanded guidelines for RSV and shingles are enlarging the addressable base.

• Pediatric – Rebounding post-pandemic as routine immunization campaigns normalize.

By Distribution Channel

• Government Suppliers – Nearly 60% of doses via national tenders and pooled procurement.

Bulk purchasing secures lower prices and predictable demand.

• Hospital & Retail Pharmacies – Fastest-growing channel in developed markets.

Convenient access and pharmacist prescribing rights are boosting uptake.

Industry Developments & Recent Market Moves

• May 2024: Global co-marketing deal signed to co-develop a combined COVID-19–influenza shot.

• Feb 2024: Major pharma began nationwide roll-out of RSV vaccine following positive Phase 3 data.

• Mar 2023: A leading Indian manufacturer repurposed COVID-19 lines for malaria and dengue, lifting capacity to 4 billion doses.

• Jun 2022–Apr 2023: Multiple approvals for next-gen pneumococcal and chikungunya vaccines expand adult portfolios.

Facts & Figures

• Prefilled syringe adoption has cut dose wastage by up to 25% in pilot programs.

• More than 120 mRNA and viral-vector candidates are in late-stage trials worldwide.

• Adult vaccine volumes grew 9-fold versus pre-pandemic levels, while pediatric volumes are recovering at 15% annually.

• 31% of global revenue originated in Asia Pacific in 2023.

• Top five manufacturers control ≈65% of global market share, underscoring consolidation.

Analyst Review & Recommendations

The vaccines landscape is shifting from single-pathogen products to platform-based portfolios that can be swiftly re-engineered. Players that pair agile mRNA or conjugate technologies with ready-to-use presentations and strong pharmacovigilance will outpace the field. For new entrants, thermostable oral or intranasal formats targeting dengue and RSV in tropical regions offer the quickest path to meaningful market share. Established leaders should deepen adult-immunization awareness and invest in AI-guided antigen design to stay ahead of emerging variants and regulatory expectations. Overall, sustained public funding, private-market pricing power, and relentless innovation underpin a solid outlook for market growth through 2032.