Market Overview

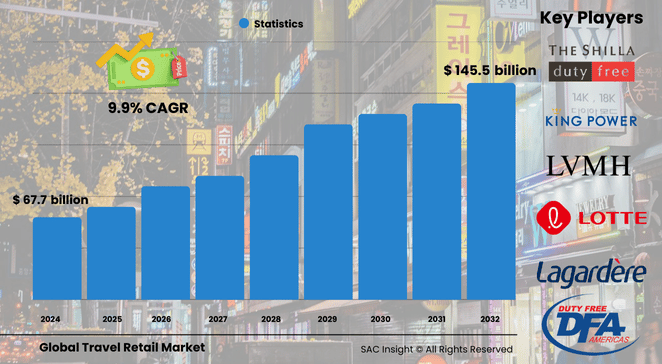

The travel retail market size was valued at roughly US$ 67.7 billion in 2024 and is projected to reach about US$ 145.5 billion by 2032, registering a 9.93% CAGR over 2025-2032. First-hand industry insights point to three powerful catalysts: rebounding international passenger traffic, rapid airport and seaport upgrades, and a consumer tilt toward premium duty-free experiences.

SAC Insight's deep market evaluation also shows the sector has not only regained but surpassed pre-pandemic footfall, with airports reporting double-digit retail revenue gains. The U.S. travel retail segment alone is expected to approach US$ 15 billion by 2032, fueled by rising long-haul departures and a strong appetite for luxury convenience shopping.

Summary of Market Trends & Drivers

A surge in post-pandemic leisure trips, expanding low-cost carrier networks, and growing preference for exclusive, travel-only product lines are reshaping market trends. Operators are investing in digital storefronts, self-checkout, and sustainability-focused store formats to improve engagement and capture incremental basket value.

Key Market Players

Global travel retail market operators such as Avolta AG, Lotte Corporation, China Duty Free Group, and DFS Group dominate market share through extensive concession portfolios and strong brand partnerships. Regional specialists like Gebr. Heinemann, Lagardère Travel Retail, The Shilla Duty Free, King Power International, Aer Rianta International, and Duty Free Americas reinforce competitive intensity by tailoring assortments to local passenger profiles and investing heavily in omnichannel capabilities. Collectively, these companies set the competitive tempo with frequent store upgrades, data-driven merchandising, and joint marketing campaigns with high-end brands.

Key Takeaways

• Market value 2024: USD$ 67.7 billion

• Projected value 2032: USD$ 145.5 billion at a 9.93% CAGR

• Asia Pacific commands roughly 52% market share, anchored by China and South Korea

• Perfumes & cosmetics lead product sales at about 41.5% share

• Airports generate more than half of global revenue, while railway outlets show the fastest segment growth • Electronics & gifts are the highest-growth category with an estimated 11.3% CAGR to 2032

Market Dynamics

Drivers

• Pent-up leisure demand and near-full recovery of international arrivals are boosting ticket volumes and duty-free footfall

• Expansion of modern terminals and retail-as-a-service concessions is increasing shelf space and shopper dwell time

• Premiumization and travel-exclusive SKUs are lifting average basket value and spurring market growth

Restraints

• High price positioning of luxury products limits penetration among cost-conscious travelers

• Currency volatility and shifting duty regulations can erode retailer margins and dampen spending power

Opportunities

• Digital pre-order and click-and-collect models offer new revenue streams while smoothing the passenger journey

• Sustainability-themed stores and eco-friendly product lines align with evolving consumer values and can capture incremental market share

Challenges

• Intensifying competition for prime concessions drives up bid fees and squeezes profitability

• Staffing constraints and supply-chain snags at hub locations risk stock-outs and lost sales opportunities

Regional Analysis

The Asia Pacific travel retail market remains the undisputed leader thanks to strong outbound tourism, rising disposable income, and aggressive airport retail expansion. Europe benefits from dense intra-regional travel and a mature luxury shopping culture, while North America is seeing accelerated upgrades and a resurgence in business travel.

• Asia Pacific – Over 52% share; buoyed by low-cost carriers, luxury appetite, and airport mega-projects

• Europe – High passenger density and affluent traveler mix support steady duty-free demand

• North America – Modernization of major hubs and strong premium brand affinity drive consistent market growth

• Middle East & Africa – Strategic transit hubs and tourism initiatives fuel double-digit gains in select airports • Central & South America – Recovery in cruise and regional air traffic fosters gradual revenue uplift

Segmentation Analysis

By Product Type

• Cosmetics & Fragrances – commanding 41.5% share, tax-free luxury magnet Travelers prize beauty brands that are either discounted or airport-exclusive, making this the top revenue generator for retailers.

• Wines & Spirits – premium gifting mainstay with resilient demand High perceived savings on aged whisky, cognac, and limited-edition releases keep this aisle busy, particularly in long-haul terminals.

• Confectionery & Fine Foods – impulse-buy favorite for souvenirs and gifting Colorful packaging and travel-exclusive assortments drive high turnover and encourage multi-unit purchases.

• Tobacco Products – steady contributor but facing regulatory headwinds Regulation and smoking restrictions temper long-term upside, yet duty-free pricing preserves niche demand, especially in transcontinental routes.

• Fashion & Accessories – growing lifestyle segment boosted by celebrity culture Collaborations and pop-up boutiques attract trend-oriented passengers seeking quick luxury hits without downtown detours.

• Others (Electronics, Gifts) – fastest-growing at roughly 11.3% CAGR Tech-savvy travelers favor last-minute gadget upgrades and travel-friendly accessories at competitive, tax-adjusted pricing.

By Sector

• Duty-Free – core revenue engine thanks to tax savings and exclusive ranges Price advantages and prestige positioning make duty-free the first stop for global passengers.

• Duty-Paid – gaining ground through curated local assortments and seamless checkout Retailers are adding sense-of-place products and contactless payment to convert non-eligible shoppers and locals.

By Sales Channel

• Airport & Airline Shops – over 55% of revenue, unrivaled passenger capture Wide assortments, experiential store concepts, and inflight pre-order platforms keep this channel dominant.

• Seaport & Cruise Line Shops – resilient recovery on the back of cruise tourism rebound Expansive product displays and leisure-oriented merchandising spur discretionary spend onboard.

• Border Downtown Hotel Shops – niche but lucrative, driven by affluent cross-border tourists Convenient city-center locations and extended shopping hours cater to tour groups and business travelers.

• Railway Stations – projected 9% CAGR, powered by high-speed rail expansion Improved passenger amenities and strategic retail zoning are lifting average sales per traveler.

• Others – includes ferries and highway outlets targeting regional excursionists Flexible pop-ups and mobile kiosks capture incremental sales during peak holiday migrations.

Industry Developments & Instances

• March 2024 – A leading operator inked an innovation alliance to accelerate the rollout of AI-driven store formats and frictionless checkout

• November 2023 – Three new Tech2go electronics shops opened in Frankfurt Terminal 1, adding 200 m² of premium gadget space

• July 2023 – A global duty-free group partnered with a mobility brand to merge smart-travel products into airport retail assortments

• June 2023 – A lifestyle label debuted its first airport boutique in Dubai, leveraging travel-exclusive lines for brand visibility

• January 2023 – Automated, computer-vision duty-free kiosks launched in Brussels, slashing average transaction time for short-haul passengers

Facts & Figures

• 97% of pre-pandemic international arrival volumes were restored in Q1 2024, translating to about 285 million overnight visitors

• Airport duty-free pricing can save shoppers up to 25% on premium fragrances versus downtown stores

• Electronics and gifts segment is on course for an 11.3% CAGR, outpacing the overall market growth rate

• Global cruise passenger numbers rebounded from 5.8 million in 2020 to an estimated 29 million in 2024

• Average basket value in Asia-Pacific airports rose 14% year-on-year as luxury penetration deepened

Analyst Review & Recommendations

Travel retail has regained its stride and now faces a profitability race rather than a recovery race. Operators should double down on omnichannel engagement—allow passengers to browse, reserve, and pay on mobile, then collect with zero friction. Expanding curated eco-friendly lines and data-led merchandising will help maintain loyalty among sustainably minded travelers. Finally, bidding strategically for high-traffic concession zones while balancing margin discipline will separate long-term winners from volume-chasing rivals.