Market Overview

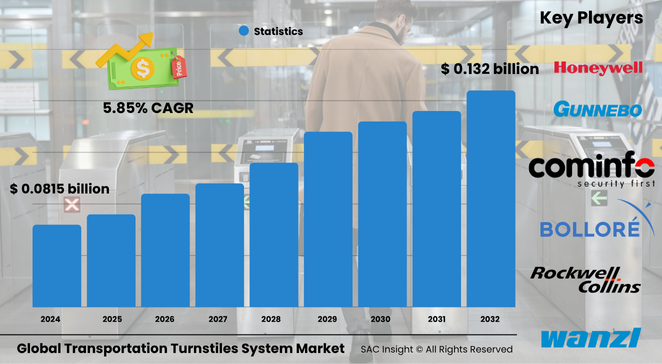

The global transportation turnstiles system market size is valued at roughly US$ 0.0815 billion in 2024 and is projected to reach about US$ 0.132 billion by 2032, expanding at an average 5.85 % CAGR. SAC Insights first-hand industry insights point to three clear growth engines: rapid urban rail expansion, heightened security mandates that curb fare evasion, and steady upgrades to contactless ticketing. SAC Insight's deep market evaluation shows the United States transportation turnstiles system market alone could advance from about US$ 0.04 billion in 2024 to nearly US$ 0.064 billion by 2032 as transit agencies modernize legacy gating and integrate biometric access.

Summary of Market Trends & Drivers

• Transit operators are swapping mechanical gates for smart, optical lanes that process QR codes, NFC wallets, and facial recognition in under a second, trimming queues and operating costs.

• Governments are bundling station refurbishments with analytics platforms that track passenger flow, turning turnstiles into data hubs for crowd management and preventive maintenance.

Key Market Players

Industry leadership rests with specialists that pair rugged hardware and agile software. Gunnebo, Boon Edam, Wanzl, Turnstar Systems, and Automatic Systems deliver full-height and optical lanes engineered for 24/7 metro duty. Meanwhile Mikroelektronika, Cominfo, Kaba Gallenschuetz, Alvarado, Axess, and Hayward Turnstiles compete on modular builds, open APIs, and fast deployment for airports and bus terminals.

Competitive dynamics increasingly revolve around partnerships with ticketing integrators and AI vendors. Hardware makers are embedding edge processors, while software firms license video analytics that detect tailgating and predict maintenance windows, sharpening each supplier’s value proposition.

Key Takeaways

• Current global market size (2024): about USD$ 0.0815 billion

• Projected global market size (2032): roughly USD$ 0.132 billion at a 5.85 % CAGR

• Asia-Pacific holds the largest market share and registers the fastest market growth due to high-speed rail and smart-city funding

• Contactless optical lanes capture over half of new installations as hygiene and throughput priorities rise

• The U.S. market is set to climb to nearly USD$ 0.064 billion by 2032 on back-to-office ridership rebounds and federal infrastructure grants

Market Dynamics

Drivers

• Accelerating metro and light-rail projects in Asia, Europe, and the Middle East demand reliable access control that scales with passenger peaks.

• Security agencies push for biometric validation to curb fare fraud and improve threat detection in high-traffic nodes.

Restraints

• High upfront installation and civil-works costs can delay adoption for cash-strapped operators.

• Legacy fare systems sometimes lack the open standards needed to interface with advanced turnstile software.

Opportunities

• Edge AI that flags congestion and malfunctions in real time opens new recurring-revenue streams for vendors.

• Energy-efficient motors and recycled stainless parts appeal to transit authorities pursuing sustainability targets.

Challenges

• Fragmented regional certification and data-privacy rules complicate cross-border product roll-outs.

• Supply-chain swings in semiconductors and specialty steel can extend delivery lead times and squeeze margins.

Regional Analysis

Asia-Pacific dominates market analysis thanks to dense urbanization, national smart-city programs, and high-speed rail corridors. China, India, and Japan collectively invest billions in station automation, driving demand for integrated gates, ticketing, and analytics. Europe follows, propelled by multimodal ticketing mandates and renovation of 1960s-era metros. North America sees solid but steadier growth, with federal funds accelerating subway refreshes in New York, Washington, and Toronto.

• Asia-Pacific – Largest and fastest-growing; mega-metro projects and digital payment ubiquity

• Europe – Strong retrofit cycle, strict fare-evasion enforcement

• North America – Infrastructure bill funding, focus on ADA-compliant gates

• Latin America – Bus rapid-transit networks add smart tripod units

• Middle East & Africa – Airport expansions and new metro builds spur premium full-height models

Segmentation Analysis

By Type

• Equipment – Core revenue driver.

Physical gates, barriers, and optical sensors account for the bulk of spending because durable hardware is indispensable for secure entry control.

Every new rail line specifies stainless or tempered-glass lanes that withstand millions of cycles, anchoring predictable replacement cycles.

• Software – Fastest-growing slice.

Cloud-based control suites, predictive maintenance dashboards, and payment gateways unlock recurring fees and remote upgrades.

Transit agencies increasingly value real-time dashboards that visualize dwell time, enabling dynamic staffing and advertising decisions.

By Mechanism

• Mechanical turnstiles – Cost-effective legacy choice.

Simple tripod arms still serve low-volume bus terminals where power or network links are scarce.

Though basic, their rugged design and minimal electronics keep maintenance low, sustaining demand in budget-sensitive deployments.

• Electronic and motorized turnstiles – Preferred for metros.

Servo-driven wings or sliding doors enable quiet, rapid throughput ideal for rush-hour surges.

Integrated sensors detect tailgating and trigger alarms, improving revenue assurance and safety.

• Smart and biometric activation – Emerging premium tier.

Units with facial, palm, or iris recognition cut card handling and enhance security in airports and corporate campuses.

Growing public acceptance of contactless ID bolsters adoption, especially where health protocols remain strict.

By Application

• Metro stations – Largest segment.

Continuous ridership and multi-modal ticketing make metros the prime customer base, commanding tailored vandal-resistant designs.

Fleet-wide upgrades synchronize with signal and platform-screen-door modernizations, ensuring cohesive passenger journeys.

• Airports – Rapidly expanding demand.

Automated boarding gates and secure-zone entry systems optimize passenger flow amid rising air-travel volumes.

Biometric corridors align with border-control initiatives, shortening processing time and increasing gate utilization.

• Bus stations – Niche but rising.

Bus rapid-transit corridors adopt slim optical barriers that validate mobile QR codes, keeping dwell time under 30 seconds.

Integrated video counters feed planners with accurate boarding data for route optimization.

• Other venues – Steady supplemental revenue.

Stadiums, theme parks, and corporate lobbies deploy customized lanes for ticket validation, enhancing visitor experience and security.

By Material

• Stainless steel – Dominant choice.

Corrosion resistance and structural rigidity ensure long service life in humid or coastal stations, justifying slightly higher cost.

Vendors powder-coat or polish finishes to match architectural aesthetics without compromising durability.

• Aluminum and composites – Lightweight alternatives.

Selected where floor load limits are tight, such as elevated platforms.

Lower mass cuts shipping and installation labor, appealing to remote build sites.

By Features

• Access-control integration – Standard requirement.

Open-protocol readers and APIs let agencies migrate gradually from magnetic stripe to EMV or digital wallets.

This flexibility safeguards prior investment while paving the way for contactless expansion.

• Data capture and reporting – Key differentiator.

Built-in counters and edge AI produce actionable dashboards on dwell time, malfunctions, and fare compliance.

Operators leverage insights to fine-tune schedules and target maintenance crews before breakdowns occur.

Industry Developments & Instances

• October 2023 – Leading vendors rolled out AI-ready lanes that overlay predictive analytics on top of existing PLC controls.

• March 2024 – A metro operator in Southeast Asia awarded a multi-year contract for 1 200 optical gates featuring palm-vein readers and cloud diagnostics.

• May 2024 – A European airport completed phase one of a biometric fast-track corridor, halving security-checkpoint wait times.

• February 2025 – Consortium of hardware and fintech firms launched a pilot enabling direct open-loop EMV payments at bus-rapid-transit gates in Latin America.

Facts & Figures

• Optical and flap gates accounted for roughly 55 % of global installations in 2023.

• Biometric-enabled lanes can process up to 45 passengers per minute versus about 25 for traditional tripod units.

• Predictive maintenance platforms have lowered unscheduled downtime by nearly 20 % in retrofitted metro systems.

• Energy-efficient brushless motors cut gate power draw by up to 30 %, aiding net-zero station targets.

• Asia-Pacific represented about 35 % of revenue in 2023 and is poised to exceed 40 % by 2032.

Analyst Review & Recommendations

Market analysis indicates a decisive shift from standalone mechanical barriers to networked, sensor-rich lanes that double as data collectors. Suppliers that bundle durable equipment with open-API software and edge analytics will outpace average market growth. We advise vendors to prioritize modular designs for rapid field swaps, invest in privacy-compliant biometric options, and cultivate service contracts that monetize predictive maintenance and passenger-flow data over the system life cycle."