Market Overview

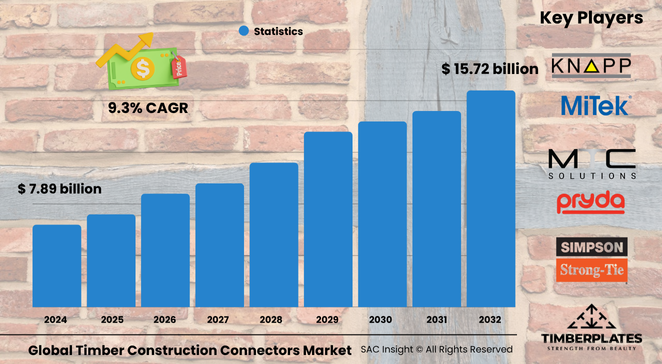

The global timber construction connectors market size is valued at about US$ 7.89 billion in 2024 and, according to deep market analysis, is set to reach roughly US$ 15.72 billion by 2032, reflecting a solid 9.3% CAGR. SAC Insight's first-hand industry insights show that growing demand for low-carbon buildings, supportive building-code revisions, and rapid advances in precision-engineered fastening systems are the prime engines of market growth.

In the United States timber construction connectors market share alone, is expected to climb from nearly US$ 1.22 billion in 2024 toward the US$ 2.5 billion mark by 2032 as developers accelerate mass-timber adoption for mid- and high-rise projects.

Summary of Market Trends & Drivers

• Mass engineered timber (MET) and cross-laminated timber (CLT) projects are moving from pilot status to mainstream bids, driving steady connector demand.

• Automated CNC milling and cold-formed steel inserts shorten fabrication cycles, lowering total installed costs and widening market adoption.

• New energy-efficiency rules reward biophilic, carbon-storing materials, positioning wood connectors as a strategic substitute for high-emission steel joins.

Key Market Players

Competition is led by specialists that blend structural know-how with global distribution. Simpson Strong-Tie, Hilti, MiTek, and Pryda supply comprehensive connector portfolios and on-site engineering support, enabling quick code compliance. Mid-tier innovators such as Eurotec, Knapp, MTC Solutions, Timberplates, Connext Post and Beam, and BPC Fixings focus on niche solutions—from concealed shear plates to hybrid steel-timber nodes—that boost design flexibility.

Market players sharpen their edge through in-house testing labs, software plug-ins for BIM workflows, and regional production upgrades. Recent capacity expansions in Germany, the U.S., and India illustrate how proximity to growing CLT panel lines is becoming a competitive necessity.

Key Takeaways

• Current global market size (2024): about US$ 7.89 billion

• Forecast global market size (2032): near US$ 15.72 billion at a 9.3% CAGR

• U.S. market poised to double to roughly US$ 2.5 billion by 2032

• Timber-to-timber connectors hold the largest product market share at more than 80% today

• Residential construction accounts for close to 55% of revenue, yet commercial high-rise projects are the fastest-growing application

• High-corrosion-resistant coatings are gaining traction in coastal and humid zones, pushing premium connector sales

Market Dynamics

Drivers

• Rising preference for sustainable, carbon-negative structures in housing and offices

• Updated building codes allowing timber structures up to 18 stories in key markets

• Advancements in ring, plate, and rod connectors that carry heavier loads with fewer fasteners

Restraints

• Volatile lumber prices and supply-chain disruptions can delay projects

• Limited skilled labor for precision timber fabrication in emerging regions

• Fire-safety perception gaps slow approvals for very tall wood buildings

Opportunities

• Modular off-site manufacturing needs plug-and-play connectors that cut assembly time

• Growing refurbishment market for historic masonry-timber hybrids demands specialized brackets

• IoT-enabled load-sensing connectors could unlock predictive-maintenance revenue streams

Challenges

• Standardizing connector performance across varying regional standards

• Balancing aesthetics with structural code requirements in exposed-beam architecture

• Ensuring long-term corrosion performance in increasingly humid urban microclimates

Regional Analysis

Europe currently leads global market share thanks to decades of wood-construction culture, aggressive net-zero targets, and supportive grants. North America follows, buoyed by Build-America wood policies and an expanding CLT manufacturing base, while Asia-Pacific shows the quickest percentage gains as high-rise timber pilot towers rise in Japan, Australia, and South Korea.

• North America – Significant volume growth driven by residential retrofits and multi-story commercial builds

• Europe – Largest revenue base; Germany, Sweden, and France spearhead mass-timber adoption

• Asia-Pacific – Fastest CAGR on the back of dense urban housing demand and government carbon mandates

• Latin America – Early-stage adoption, led by Chile’s seismic-resistant timber code updates

• Middle East & Africa – Niche projects in eco-tourism resorts and low-income housing pilots

Segmentation Analysis

By Product

• Timber to Timber – Dominant share with split rings, shear plates, and toothed plates.

These connectors distribute loads evenly and preserve the visual warmth architects want in exposed-beam interiors.

• Timber to Masonry – Growing need for angle brackets, joist hangers, and restraint straps.

They secure wooden floors to brick or concrete walls, a common hybrid in urban renovations.

• Timber to Steel – Fastest-growing slice as CLT meets steel cores in hybrid high-rises.

Heavy-duty plates and dowels absorb differential movement between the two materials.

By Application

• Residential – Core demand engine.

Detached homes and mid-rise apartments rely on connectors for panelized walls and floor diaphragms.

• Commercial – Rapid uptake in offices, malls, and hospitality.

Developers pursue biophilic designs that lift leasing rates, fueling connector upgrades for higher loads.

• Infrastructure – Emerging segment with pedestrian bridges, lookout towers, and bus shelters.

Structural authorities trial hardwood-glulam beams paired with high-capacity connectors.

By Material

• Steel – Workhorse material thanks to high strength-to-cost ratio.

Galvanized finishes extend service life, making steel the go-to for exterior joins.

• Stainless Steel – Preferred in coastal and chemical-exposed sites.

Superior corrosion resistance offsets its premium price in harsh environments.

• Aluminum – Niche use in lightweight modular kits.

Its low mass simplifies manual handling, ideal for remote builds.

• Timber & Composites – Concealed connectors for clean aesthetics.

Engineered-wood inserts and fiber-reinforced plastics permit all-wood visuals without visible metal hardware.

By Structural Application

• Beams & Columns – Largest volume; split-ring and dowel systems maintain load paths.

High-rise timber frames depend on precise dowel placement to manage axial loads.

• Walls & Floors – CLT panels tied with self-tapping screws and bearing plates.

Large-format panels require oversized plates to resist uplift and shear.

• Roofs, Joists, Trusses – Require lightweight yet strong hanger systems.

Adjustable truss shoes simplify on-site pitch variations.

By Load Capacity

• Light – For internal partitions and low-load decorative elements.

Quick-fix screws dominate, enabling rapid interior fit-out.

• Medium – Covers most residential floors and walls.

Angle brackets with reinforcing ribs balance affordability and strength.

• Heavy – Targets commercial decks and industrial mezzanines.

Bolted knife-plate assemblies deliver high moment capacity.

• Extra Heavy – Used in long-span bridges and sports halls.

Custom-fabricated steel nodes manage complex multiaxial forces.

By Corrosion Resistance

• Standard – Zinc-plated connectors suit dry interiors.

Cost-effective for the bulk of residential builds.

• Moderate – Thick galvanizing extends life in mixed-humidity zones.

Popular in temperate climates with seasonal moisture swings.

• High – Epoxy-coated or duplex stainless connectors safeguard coastal resorts.

Rising marine developments propel this tier.

• Extreme – Specialized alloys for offshore boardwalks and chemical plants.

Though niche, margin per unit is highest.

Industry Developments & Instances

• April 2025 – A leading supplier launched BIM-integrated sizing software that auto-selects connectors based on CLT panel geometry.

• January 2025 – An EU-backed research consortium unveiled carbon-neutral stainless connectors using green hydrogen in smelting.

• September 2024 – Production capacity at a German plant doubled, cutting lead times for heavy shear plates in Europe by 30 %.

• June 2024 – New Indian facility began manufacturing code-compliant joist hangers locally, trimming import costs for South-Asian builders.

• February 2024 – North American code body approved a 10 % higher design-load rating for proprietary ring connectors after extensive fire tests.

Facts & Figures

• Timber-to-timber systems account for more than 80 % of current product revenue.

• Residential applications captured roughly 55 % of global turnover in 2024.

• Average load-rated capacity of modern split-ring connectors tops 80 kN, up 15 % since 2020.

• Automated production lines have cut connector unit costs by up to 12 % in the last three years.

• High-corrosion-resistant variants already represent nearly 20 % of sales in coastal Europe and Australia.

Analyst Review & Recommendations

Data-driven analysis confirms the timber construction connectors market is transitioning from early-adopter phase to scalable industrial supply. Suppliers that integrate digital design tools, develop hybrid steel-timber nodes, and expand regional stocking facilities will outpace average market growth. Strategically, investing in extreme-corrosion-resistant alloys and smart load-monitoring add-ons offers a clear path to premium margins while supporting the sector’s sustainability narrative.