Market Overview

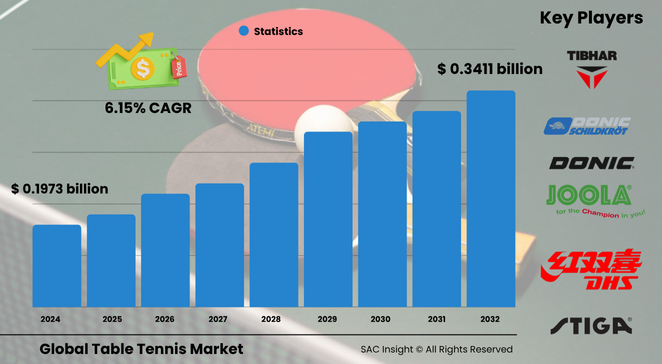

The global table tennis market size was roughly US$ 0.1973 billion in 2024 and is projected to climb to about US$ 0.3411 billion by 2032, reflecting a solid 6.15% CAGR over 2025-2032. Deep market analysis highlights three core forces behind this market growth: rising adoption of low-impact fitness activities, a visible uptick in organised amateur leagues, and steady product innovation—especially in eco-friendly balls and higher-precision 3-star offerings. First-hand industry insights indicate the U.S. table tennis market alone could approach US$ 50 million in 2024 and may edge past US$ 85 million by 2032 as schools, clubs, and community centres expand facilities.

Summary of Market Trends & Drivers

• Recreational demand is surging among Gen Z and millennials seeking compact, social sports that fit urban lifestyles.

• Product upgrades—biodegradable plastics, enhanced seam welding, and smart rubbers—are lifting performance standards and average selling prices.

• Brands are leveraging direct-to-consumer channels and influencer campaigns to tighten customer feedback loops and shorten design cycles.

Key Market Players

The competitive landscape is anchored by established Asian and European table tennis equipments brands. DHS, Butterfly, Nittaku, STIGA, and JOOLA retain significant market share through continuous R&D, sponsorship of elite events, and broad distribution. Challenger firms such as Double Fish, Xushaofa, Yinhe, Andro, TSP, DONIC, and Eastpoint Sports differentiate with price-competitive training kits, region-specific designs, and green material lines. Partnerships with national federations and junior academies have become a preferred route to long-term loyalty and recurring revenue.

Key Takeaways

• Current global market size (2024): about USD$ 0.197 billion

• Projected global market size (2032): roughly USD$ 0.341 billion at a 6.15 % CAGR

• 3 Star balls account for the largest market share, driven by training academies and televised tournaments

• Fitness & Recreation remains the dominant application segment, but Match & Training shows the fastest revenue acceleration

• Eco-friendly materials and premium multi-layer celluloid replacements are top product market trends

• Direct-to-consumer e-commerce contributes more than 30 % of current value and continues to expand

Market Dynamics

Drivers

• Rising health awareness supports steady uptake of table tennis equipment across age groups.

• Technological refinements—precision-moulded seams and micro-textured surfaces—boost ball durability and spin consistency.

• Expanding school sports budgets and public recreation grants stimulate facility purchases.

Restraints

• Intense price competition triggers margin pressure, especially in entry-level categories.

• Raw-material volatility, notably in plastics and specialty rubber, complicates cost planning.

• Counterfeit products in certain e-commerce channels erode brand equity.

Opportunities

• Untapped demand in emerging economies plus portable fold-out tables open new revenue lanes.

• Sustainable sourcing and closed-loop recycling programs can command premium pricing and strengthen brand positioning.

• Smart sensors embedded in paddles and nets offer data-driven coaching add-ons.

Challenges

• Supply-chain disruptions—political tensions or logistics bottlenecks—delay deliveries and inflate freight costs.

• Securing international quality certifications raises barriers for smaller entrants.

• Maintaining consistent bounce metrics across large production runs remains technically demanding.

Regional Analysis

The Asia-Pacific table tennis market dominates thanks to China’s deep talent pipeline, widespread club culture, and manufacturing scale. Europe follows, propelled by Germany, France, and the UK, where competitive leagues and government sports funding keep demand resilient. North America shows robust upside as community centres and after-school programs embrace the sport, while Latin America and the Middle East gain traction through corporate wellness initiatives.

• Asia-Pacific – Largest revenue base; high participation and export-oriented production

• Europe – Strong club network; premium equipment preference

• North America – Fastest near-term growth; recreational expansion and collegiate competitions

• Latin America – Emerging interest; corporate fitness adoption

• Middle East & Africa – Niche yet rising; mall-based entertainment venues spur sales

Segmentation Analysis

By Product Type

• 1 Star Ball – Entry-level choice for casual play.

Lightweight and affordable, these balls help newcomers learn basic strokes but wear out quickly, making them a volume driver for mass retailers.

• 2 Star Ball – Mid-tier option balancing cost and durability.

Often selected by schools and community clubs, they deliver acceptable bounce consistency for drills and friendly matches.

• 3 Star Ball – Tournament-grade standard and market leader.

Strict roundness tolerances and thicker shells provide reliable spin and speed, appealing to advanced training centres and sanctioned events.

• Other Balls – Oversized, training-aid, and novelty variants.

Designed for specialty coaching drills or promotional events, this sub-segment offers differentiation opportunities without direct price wars.

By Application

• Fitness & Recreation – Core demand engine.

Roughly two-thirds of sales stem from family game rooms, office common areas, and hospitality venues seeking inclusive, space-efficient entertainment.

• Match & Training – Rapidly growing professional slice.

Growth is fuelled by talent academies and televised leagues that require high-performance balls, coaching robots, and analytics-ready tables.

Industry Developments & Instances

• March 2023 – STIGA introduced a fully biodegradable 3 Star ball line, cutting plastic use by up to 50 % while maintaining ITTF bounce criteria.

• April 2019 – Double Fish rolled out a revamped product suite featuring high-elasticity rubbers and pro-grade rackets aimed at emerging markets.

Facts & Figures

• 3 Star balls capture nearly 45 % of total 2024 revenue.

• Average online unit price rose by about 7 % year-on-year in 2024 as consumers traded up to eco-friendly models.

• Smart training robots recorded a 12 % shipment increase in 2023, signalling appetite for tech-enabled coaching.

• Roughly 30 million active players participated in organised leagues worldwide in 2024, up from 26 million in 2021.

• Asia-Pacific accounts for close to 55 % of global production volume, underscoring its manufacturing advantage.

Analyst Review & Recommendations

Data-driven evaluation shows the table tennis sector moving from low-margin commodity sales toward premium, sustainable, and tech-integrated offerings. Brands that invest in green materials, advanced moulding, and direct consumer engagement should outpace average market growth. To hedge supply-chain risk, diversifying raw-material sourcing and near-shoring key assembly steps is advisable. Product managers should prioritise 3 Star innovations and complementary smart-training accessories to capture the fastest-expanding profit pools through 2032.