Market Overview

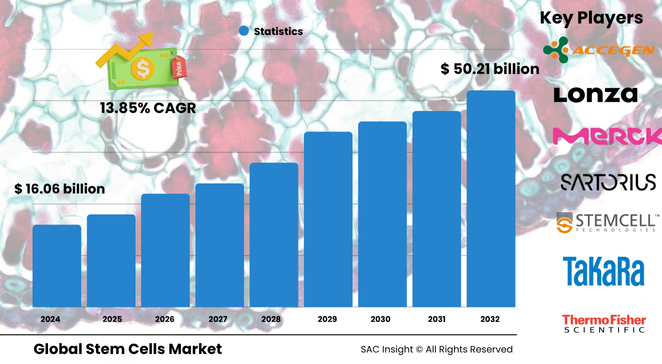

The global stem cells market size is valued at roughly US$ 16.06 billion in 2024 and is projected to approach US$ 50.21 billion by 2032, registering an average 13.855% CAGR across the 2025-2032 forecast window. SAC Insight industry insights highlight three clear growth engines: accelerating regenerative-medicine pipelines, rising clinical-trial activity in precision therapies, and fast-growing stem-cell banking services.

SAC Insight's deep market evaluation shows the United States stem cells market alone could climb toward about US$ 15.8 billion by 2032 as hospitals, biotech firms, and academic centers scale cell-based therapeutics.

Summary of Market Trends & Drivers

• Clinical trials using induced pluripotent stem cells (iPSC) and mesenchymal stem cells (MSC) are expanding quickly, reflecting wider acceptance of cell-based platforms in neurology, oncology, and cardiology.

• Robust investment in cryopreservation, gene editing, and scalable bioprocessing underpins rapid market growth and pushes product development cycles below three years.

• Government grants and public-private partnerships are directing fresh capital toward next-generation allogeneic therapies that cut treatment lead times and manufacturing costs.

Key Market Players

Large life-science suppliers dominate critical reagents and media, while specialist developers focus on targeted therapeutics. Leading names include Thermo Fisher Scientific, Merck KGaA, STEMCELL Technologies, Lonza, Sartorius, Miltenyi Biotec, PromoCell, Takara, ATCC, Bio-Techne, AcceGen, and Cellular Engineering Technologies. Their strategies revolve around capacity expansion, CRISPR-enabled product lines, and selective M&A—for example, recent acquisitions of iPSC technology platforms and cryomedia specialists—to strengthen end-to-end offerings across research and clinical scales.

Key Takeaways

• Current global stem cells market size (2024): about US$ 16.06 billion

• Projected global market size (2032): roughly US$ 50.21 billion at a 13.855% CAGR

• Adult stem cells capture the highest market share today, supported by lower ethical hurdles and established clinical protocols

• iPSC platforms represent the fastest-growing cell type as laboratories pivot toward personalized therapies

• Regenerative medicine accounts for more than four-fifths of revenue and continues to drive headline market growth

• North America leads revenue, while Asia-Pacific delivers the quickest percentage gains on the back of large patient pools and supportive funding programs

Market Dynamics

Drivers

• Expanding indications for cell therapies in chronic diseases and trauma care

• Advances in gene editing, 3D culture, and automated bioreactors that boost yield and consistency

• Rising demand for off-the-shelf allogeneic products that shorten treatment timelines

Restraints

• Ethical and regulatory complexity surrounding embryonic lines and cross-border shipment of human material

• High manufacturing costs for autologous therapies and limited skilled workforce in some regions

Opportunities

• Integration of artificial intelligence for cell-line optimization and potency testing

• Growth in cell-banking subscriptions among healthy adults seeking future therapeutic options

Challenges

• Supply-chain constraints for high-purity growth factors and single-use bioprocess hardware

• Ensuring long-term safety and immunogenicity control as therapies progress to late-stage trials

Regional Analysis

North America commands the largest revenue share thanks to strong biotech funding, streamlined regulatory pathways, and early reimbursement discussions. Europe follows with a supportive research framework, while Asia-Pacific registers the fastest CAGR on the back of government-backed stem-cell initiatives and a rising chronic-disease burden.

• North America – Largest market, driven by robust clinical pipelines and high per-capita healthcare spend

• Europe – Strong academic collaborations and harmonized regulations spur cross-border trials

• Asia-Pacific – Double-digit market growth supported by government grants and large patient cohorts

• Latin America – Growing private hospital networks adopt stem-cell banking and orthopedic applications

• Middle East & Africa – Early-stage adoption, with focused investment in cord-blood banking hubs

Segmentation Analysis

By Cell Type

• Adult Stem Cells – Dominant share, broad clinical track record.

Adult stem cells, including MSCs and hematopoietic lines, avoid embryo-related concerns and demonstrate low graft-rejection risk, making them the mainstay of current therapies.

• Induced Pluripotent Stem Cells – Fastest CAGR.

iPSCs replicate embryonic pluripotency without ethical controversy and enable patient-specific disease models, accelerating drug-screening programs and custom graft development.

• Embryonic Stem Cells – Ethical hurdles slow uptake.

While offering full pluripotency, strict oversight and alternative sources limit their commercial momentum.

• Very Small Embryonic-Like Cells – Niche research focus.

These rare cells show promise in regenerative cardiology but remain at exploratory stages.

By Application

• Regenerative Medicine – Core demand engine.

Roughly 85 % of revenue arises from tissue repair in orthopedics, neurology, cardiology, and wound-healing, underpinned by rising orthopedic surgeries and aging demographics.

• Drug Discovery & Development – Rapid secondary market.

Pharma sponsors leverage stem-cell-derived organoids and disease models to de-risk pipelines and cut preclinical time, expanding reagent sales.

By Technology

• Cell Acquisition – Largest revenue slice. Bone-marrow harvest, cord-blood collection, and apheresis remain fundamental inputs for therapy manufacture.

Automated harvest kits and closed-system apheresis devices improve sterility and donor comfort, supporting scalable procurement.

• Cell Production – High-growth segment.

Therapeutic cloning, in-vitro fertilization, and high-density bioreactors lift output and cut cost per dose.

• Cryopreservation, Expansion & Sub-culture – Critical enablers.

Improved cryomedia and cold-chain logistics extend shelf life, while controlled expansion preserves potency for late-stage trials.

By Therapy

• Allogeneic – Revenue leader.

Off-the-shelf compatibility and lower per-patient cost drive adoption, with biomanufacturers scaling master cell banks to meet demand.

• Autologous – Higher safety, rising in personalized orthopedics and dermatology.

Point-of-care platforms and rapid turnaround labs reduce vein-to-vein times and broaden clinical utility.

By End-use

• Pharmaceutical & Biotechnology Companies – Over half of market revenue.

Big pharma partners with cell-gear suppliers to co-develop pipeline assets, while biotech players pursue niche indications.

• Hospitals & Cell Banks – Expanding service footprint.

Integrated transplant units and private cord-blood banks boost local access to advanced therapies.

• Academic & Research Institutes – Innovation hotbeds.

Government-funded centers explore novel gene-edited lines, driving early-stage discoveries that feed commercial pipelines.

Industry Developments & Instances

• April 2024 – PromoCell released Cryo-SFM Plus, a serum-free medium that enhances post-thaw viability for both research and clinical cell lines.

• January 2024 – STEMCELL Technologies acquired a proprietary EpiX platform to accelerate epithelial-cell manufacturing for regenerative medicine.

• December 2023 – A master services pact between a US university and a cell-therapy CDMO targets rapid scale-up of allogeneic products for oncology trials.

• September 2023 – A UK-India collaboration launched a genotype study on neurodegenerative disorders using patient-derived iPSCs.

• July 2022 – A major pharma acquisition of a cell-replacement start-up signaled intensifying competition for pancreas-derived therapies.

Facts & Figures

• Adult stem cells currently account for roughly 71% of global revenue.

• iPSC clinical trials grew more than 20% year-on-year between 2021 and 2024.

• Regenerative-medicine applications capture about 85% of total market spend.

• North America holds close to 44% market share, with the U.S. responsible for nearly three-quarters of regional revenue.

• More than 5 000 active stem-cell trials are registered worldwide, up from fewer than 3 500 five years ago.

Analyst Review & Recommendations

Market analysis indicates a decisive shift from single-patient autologous procedures to large-batch allogeneic platforms supported by advanced gene editing and automated bioprocessing. Companies that integrate closed-loop manufacturing, AI-guided cell-line selection, and transparent regulatory compliance will outpace average market growth. We recommend prioritizing investment in scalable cryo-logistics, partnerships with academic innovation hubs, and early engagement with payers to demonstrate real-world cost savings and clinical value."