Market Overview

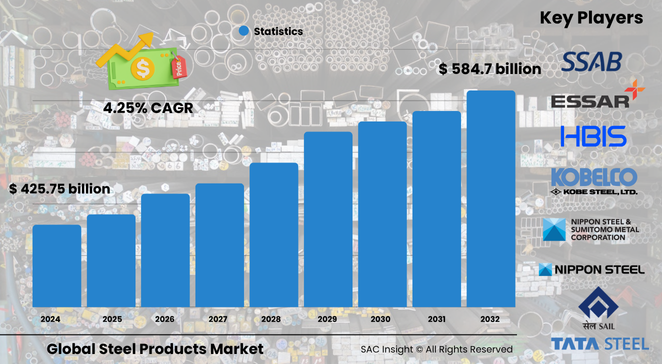

The global steel products market size stands near US$ 425.75 billion in 2024 and is on track to reach about US$ 584.7 billion by 2032, posting a steady 4.25% CAGR over 2025-2032. SAC Insight industry insights highlight three engines behind this market growth: record infrastructure budgets, rising demand for high-strength lightweight grades in mobility, and an industry-wide pivot to low-carbon “green steel.”

SAC Insight's deep market evaluation shows the United States steel products market alone could edge toward roughly US$ 90 billion by 2032 on the back of reshoring, EV production, and federal infrastructure outlays.

Summary of Market Trends & Drivers

• High-strength, corrosion-resistant flat and long products are gaining share as builders seek lighter designs without sacrificing durability.

• Integrated digital twins—from smart blast furnaces to AI-guided rolling lines—boost yield and cut energy intensity, supporting margin expansion.

• Recycling loops and hydrogen-based direct-reduction pilots are moving green steel from concept to commercial scale, reshaping competitive positioning.

Key Market Players

Large diversified producers such as ArcelorMittal, Nippon Steel, POSCO, Tata Steel, HBIS Group, and Steel Dynamics anchor global supply with extensive finishing networks and first-mover green-steel projects. Regional specialists including thyssenkrupp Steel, JFE Holdings, and Angang focus on high-value automotive, electrical, and packaging grades, leveraging proximity to OEM clusters and longstanding customer partnerships. Competitive dynamics revolve around decarbonisation roadmaps, captive renewable power, and alliances with mining majors for low-carbon iron feedstocks.

Key Takeaways

• Current global steel products market size (2024): about US$ 425.75 billion

• Projected global market size (2032): roughly US$ 584.7 billion at a 4.25% CAGR

• Flat steel commands the largest product market share due to broad construction and automotive use

• Construction remains the dominant application, while energy and automotive segments adopt advanced high-strength grades fastest

• Asia-Pacific retains the largest regional market share; Africa shows the fastest percentage growth

• Industry pivots toward hydrogen direct reduction, electric-arc furnaces on renewable power, and closed-loop scrap recycling

Market Dynamics

Drivers

• Accelerating urbanisation and megaproject pipelines in Asia and the Middle East boost demand for beams, rebar, and plate.

• Vehicle lightweighting and EV battery enclosures drive uptake of ultra-high-strength flat steel.

• Government incentives and carbon-border tariffs spur investment in low-emission steelmaking routes.

Restraints

• Volatile iron-ore and coking-coal prices squeeze mills with narrow conversion margins.

• Capital-intensive decarbonisation upgrades strain balance sheets, especially for smaller producers.

Opportunities

• Green steel premiums open a lucrative niche with early offtake agreements from automotive and appliance OEMs.

• Digital production control and predictive maintenance raise throughput and lower scrap, trimming cost per tonne.

Challenges

• Trade tensions and safeguard measures can disrupt raw-material flows and dampen export prospects.

• Skill shortages in metallurgy, automation, and hydrogen handling slow project execution.

Regional Analysis

Asia-Pacific dominates thanks to massive crude-steel output in China and India, deep downstream clusters, and state-backed infrastructure drives. North America benefits from new mini-mills tied to scrap availability and policy support for low-carbon manufacturing. Europe advances green-steel pilot lines but faces high energy costs. Africa records the fastest market growth as continental free trade, urban housing, and mining investment lift consumption.

• North America – Reshoring, infrastructure spending, high-grade plate for wind towers

• Europe – Early green-steel adopters, stringent carbon regulations, automotive coil demand

• Asia-Pacific – Over 50 % of global output, smart-city and EV expansion, export-oriented mills

• Middle East & Africa – Rapid urban growth, pipeline steel for energy projects, emerging hydrogen hubs

• Latin America – Construction recovery, flat-steel demand for appliances, new EAF capacity

Segmentation Analysis

By Type

• Rolled and Drawn Steel – Workhorse of modern infrastructure.

Rolled and drawn products supply beams, bars, and cold-drawn wire for bridges, high-rises, and precision components, sustaining the largest revenue share through 2032.

• Iron and Steel Pipe and Tube – Backbone of energy logistics.

Oil, gas, and water transmission lines rely on seamless and welded tube; hydrogen-ready pipe standards expand future demand.

By Product Type

• Flat Steel – Core growth engine.

Sheets, coils, and plate underpin automotive panels, shipbuilding, and wind-tower fabrication, keeping flat products at the top of the product hierarchy.

• Long Steel – Essential for structural integrity.

Rebar, merchant bars, and sections reinforce concrete and deliver load-bearing strength in buildings and transport corridors.

• Tubular Steel – Niche but strategic.

Precision tubes for boilers, heat exchangers, and bicycle frames fill high-margin specialty orders.

• Steel Pipes – Bulk mover.

Large-diameter line pipe serves energy midstream and municipal water projects, with demand tied to pipeline capex cycles.

• Steel Tubes – Lightweight versatility.

Auto chassis, furniture, and mechanical engineering applications prize hollow structural sections for rigidity at lower weight.

By Application

• Construction – Primary consumption base.

Skyscrapers, metro systems, and modular housing keep construction on top, accounting for around one-third of global volume.

• Automotive – High-strength transformation.

Shift to electric and lightweight platforms pushes adoption of advanced ultra-high-strength steels and press-hardened parts.

• Energy – Low-carbon infrastructure.

Wind-turbine towers, solar-farm supports, and hydrogen pipelines drive demand for heavy plate and specialty tube.

• Packaging – Steady niche.

Tinplate and coated sheet supply food cans and aerosol containers, benefiting from recycling loops.

• Railways & Highways – Growth in heavy sections.

Expansion of freight corridors and high-speed rail requires rails, sleepers, and guardrails.

• Others – Machinery, shipbuilding, and domestic appliances round out consumption.

Industry Developments & Instances

• October 2024 – Rio Tinto and NISCO signed an MoU to trial biomass-based ironmaking with Pilbara fines, targeting significant Scope 1 emission cuts.

• September 2024 – thyssenkrupp welcomed EP Corporate Group as a 20 % equity partner to accelerate hydrogen-ready furnace conversion.

• December 2024 – SKF and Swiss Steel achieved a 40 % CO2 reduction in bearing-grade bar through renewable power sourcing.

• March 2024 – Schnitzer launched GRN Steel, a net-zero scrap-based product line for North American construction customers.

• April 2023 – Nippon Steel detailed investment plans to upgrade U.S. Steel blast furnaces with efficiency and environmental controls.

Facts & Figures

• China produced over 1 billion t of crude steel in 2023, equal to roughly half of global output.

• India’s crude-steel output rose 6 % y-o-y to 125 million t in 2023.

• Africa’s apparent steel consumption is projected to reach nearly 38.9 million t by 2025.

• High-strength lightweight grades now account for about 25 % of automotive flat-steel shipments, up from 15 % in 2018.

• Hydrogen-based direct-reduction projects under construction exceed 5 million t of annual capacity, signalling rapid scale-up.

Analyst Review & Recommendations

Market analysis indicates a decisive shift toward cleaner, smarter, and lighter steel. Producers that pair electric-arc furnaces on renewable power with digital quality control and certified low-carbon slabs will capture premium market share. For downstream users, early offtake agreements secure supply security and ESG credentials. Strategic focus on circular scrap flows, hydrogen partnerships, and high-strength product development remains the clearest path to sustained competitive advantage through 2032."