Market Overview

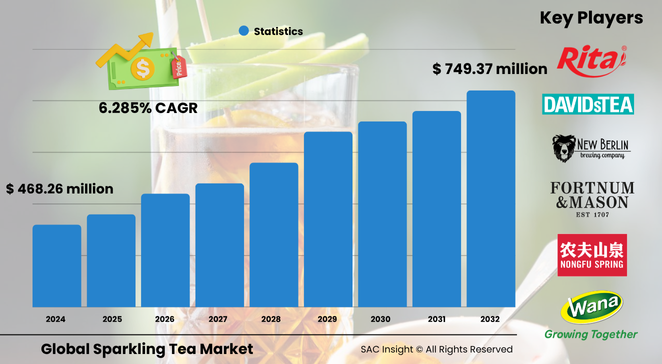

The global sparkling tea market size sits near US$ 468.26 million in 2024 and is on track to reach roughly US$ 749.37 million by 2032, reflecting a steady at a 6.285% CAGR across the 2025-2032 forecast window. SAC Insight's first-hand industry insights point to three reliable growth engines: consumers swapping sugary sodas for functional fizz, retailers expanding premium ready-to-drink (RTD) shelves, and brands pairing traditional loose-leaf quality with clean-label carbonation. SAC Insight's deep market evaluation shows the United States sparkling tea market alone could progress from about US$ 164 million in 2024 toward the low-US$ 250 million range by 2032 as health-forward millennials and Gen Z drive innovation in botanical blends and alcohol-free social beverages.

Summary of Market Trends & Drivers

• Wellness positioning, low-calorie profiles, and antioxidant claims are redefining carbonated soft-drink alternatives.

• RTD convenience, social-media storytelling, and mixology use cases widen occasion-based demand.

• Sustainable sourcing and recyclable packaging strengthen brand loyalty among environmentally minded shoppers.

Key Market Players

Well-established tea houses and agile beverage start-ups share the spotlight. Companies such as New Berlin Beverage Co., Copenhagen Sparkling Tea Company, Fortnum & Mason, Nongfu Spring, and DAVIDsTEA leverage heritage leaf expertise, small-batch brewing, and flavour experiments to retain significant market share. Alongside them, innovators like Saicho Drinks, The Real Drinks Co., Minna, and WANA Beverage prioritise organic ingredients, adaptogenic add-ins, and eye-catching cans to capture lifestyle-driven segments. Competitive dynamics increasingly revolve around collaborative flavour launches, limited-edition seasonal runs, and partnerships with mixologists or wellness influencers to extend reach without heavy advertising spend.

Key Takeaways

• Current global sparkling tea market size (2024): about US$ 468 million

• Projected global market size (2032): roughly US$ 749 million at a 6.285% CAGR

• Green sparkling tea commands the largest product market share, exceeding 40 % of 2024 revenue

• No-alcohol variants account for close to 90 % of sales, boosted by sober-curious social trends

• Glass bottles remain the preferred premium format, while aluminum cans post the fastest market growth for on-the-go use

• Asia-Pacific shows the quickest regional market growth thanks to deep tea culture and rapid urban RTD adoption

Market Dynamics

Drivers

• Rising health consciousness and flight from high-sugar sodas fuel sustained market growth.

• Expanding e-commerce and specialty-grocery distribution improve product visibility and trial rates.

• Functional add-ins (probiotics, adaptogens) differentiate offerings and justify premium pricing.

Restraints

• Intense competition from flavoured sparkling water and kombucha limits shelf space in mature markets.

• Higher production costs for quality loose-leaf bases and small-batch carbonation can pressure margins.

• Limited consumer awareness outside urban centres slows penetration in certain developing regions.

Opportunities

• Hard sparkling tea and cocktail mixers open incremental revenue streams with moderate alcohol content.

• Carbon-neutral packaging and fair-trade leaf sourcing can secure brand premium among eco-focused consumers.

• Private-label partnerships with supermarket chains widen reach without heavy marketing outlay.

Challenges

• Consistent carbonation while preserving delicate tea aromas requires precise process control.

• Regulatory scrutiny of functional claims (e.g., antioxidant levels) demands transparent lab testing.

• Supply-chain disruptions for organic botanicals or specialty flavour extracts may delay launches.

Regional Analysis

North America leads current revenue thanks to entrenched health-and-wellness culture and high buying power; Europe follows closely with sophisticated palate demand for low-calorie indulgence. Asia-Pacific posts the fastest CAGR as traditional tea drinkers embrace modern sparkling formats, while Latin America and the Middle East & Africa remain nascent but promising as premium RTDs proliferate.

• North America – Largest revenue share; premium RTDs thrive in metropolitan clusters.

• Europe – Growing preference for botanical infusions and low-alcohol social drinks.

• Asia-Pacific – Fastest market growth driven by tea heritage and urban convenience culture.

• Latin America – Early-stage adoption alongside kombucha and functional beverages.

• Middle East & Africa – Gradual uptake via upscale cafés and hospitality venues.

Segmentation Analysis

By Product

• Green Tea – Health-first flagship.

Green variants account for the lion’s market share, riding high antioxidant awareness and metabolic-health positioning; citrus or floral accents keep flavours vibrant.

• White Tea – Premium niche.

Delicate profiles and limited harvests appeal to connoisseurs seeking subtle sweetness and perceived skin-health benefits.

• Yellow Tea – Rare specialty.

Limited supply and artisanal processing give yellow tea sparkling lines a luxury halo in gourmet retail.

• Black Tea – Robust and versatile.

Bolder notes hold up well in cocktails and food pairings, supporting steady market analysis momentum.

• Others – Herbal, oolong, rooibos.

These niche infusions fuel experimentation and seasonal limited editions, widening consumer choice.

By Category

• No Alcohol – Core demand engine.

Roughly nine in ten bottles or cans sold contain zero alcohol, satisfying sober-curious gatherings, lunchtime refreshment, and fitness-friendly indulgence.

• Alcohol-Based – Emerging premium.

Hard sparkling teas at 4-6 % ABV ride the craft-cider wave, giving breweries and RTD spirits brands a healthier-perceived mixer base.

By Packaging

• Glass Bottles – Heritage premium.

Strong barrier properties safeguard flavour integrity; reusable glass reinforces sustainability credentials in specialty channels.

• Plastic Bottles – Cost-effective convenience.

Lightweight PET serves price-sensitive markets but faces eco-concerns that spur recycled-content innovation.

• Aluminum Cans – Fastest riser.

Shatter-proof, fully recyclable, and perfect for outdoor events, cans power on-the-go consumption spikes.

• Tetra Pak – Shelf-stable niche.

Aseptic packs target travel retail and export markets where cold-chain gaps persist.

By Distribution Channel

• Supermarkets & Hypermarkets – Primary volume driver.

Dedicated functional-beverage aisles and in-store tastings lift consumer education and repeat sales.

• Convenience Stores – Impulse growth.

Chilled single-serve cans capture commuters and gym-goers seeking quick refreshment.

• Online Retail – Double-digit digital climb.

Direct-to-consumer subscriptions and influencer bundles accelerate brand discovery and personalised upselling.

• Specialty Tea Shops – Experiential upsell.

Sampling flights and pairing workshops deepen category understanding among enthusiasts.

• Cafés & Restaurants – Menu upgrade.

Sparkling tea spritzers and mocktails diversify non-alcoholic beverage programmes for hospitality operators.

Industry Developments & Instances

• July 2024 – A leading loose-leaf retailer debuted three organic RTD sparkling teas to broaden brand reach in grocery cold cases.

• June 2024 – A UK craft producer released canned versions of its fermented sparkling teas, tapping picnic and events demand.

• March 2024 – A U.S. start-up partnered with a national coffee chain to pilot hard sparkling tea on draught at flagship cafés.

• December 2023 – An Asia-Pacific beverage group invested in a carbon-neutral bottling line dedicated to tea-based RTDs.

• June 2023 – A premium British department store launched a private-label sparkling tea trio featuring botanicals sourced from regenerative farms.

Facts & Figures

• Green sparkling tea captured about 43 % of global revenue in 2024.

• Glass bottles represented roughly 48 % of packaging market share last year, yet cans recorded a 7 % CAGR.

• Online sales grew nearly 15 % year on year in 2023-2024, outpacing brick-and-mortar growth rates.

• No-alcohol variants hold close to 89 % category share, reflecting mainstream moderation trends.

• North America accounted for approximately 35 % of global revenue in 2024; Asia-Pacific is forecast to post a 6.9 % CAGR through 2032.

Analyst Review & Recommendations

The sparkling tea market analysis underscores a clear transition from novelty to everyday refreshment. Brands that blend functional ingredients with transparent sourcing and planet-friendly packaging will outpace average market growth. Operators should prioritise scalable canning capacity, flavour collaboration with bartenders, and direct-to-consumer storytelling to strengthen loyalty ahead of inevitable big-beverage entry. Expect continued premiumisation, cross-category fusions, and sustainability credentials to shape competitive advantage through 2032.