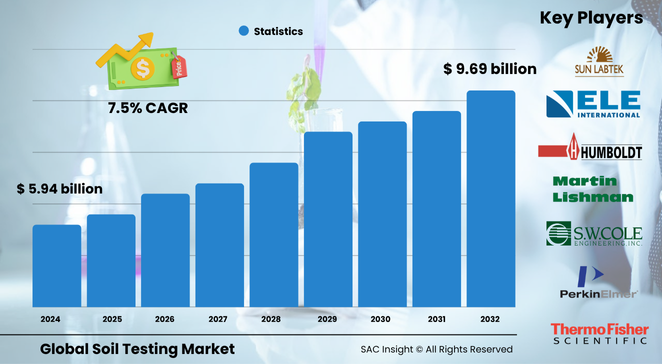

The global soil testing market size is valued at about US$ 5.94 billion in 2024 and is expected to climb to US$ 9.69 billion by 2032, reflecting a healthy 7.5 % CAGR. First-hand industry insights show that precision agriculture, tighter construction codes, and escalating sustainability targets are the core engines behind this market growth. SAC Insight's deep market evaluation indicates the United States soil testing market alone could edge toward roughly US$ 3 billion by 2032 as producers adopt digital soil analytics to push yields higher and comply with regenerative-farming commitments.

Summary of Market Trends & Drivers

• Portable spectrometry and cloud dashboards are turning lab-grade assays into real-time field decisions, shrinking turnaround from weeks to minutes.

• Public incentives that bundle soil-health testing with carbon-credit verification are accelerating adoption among row-crop growers and specialty farmers alike.

• Construction and infrastructure projects now demand comprehensive geotechnical soil analysis upfront, adding a steady non-agricultural revenue stream.

Key Market Players

Industry leadership features a mix of diversified instrument giants and specialist firms. Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer provide high-precision analyzers that set the benchmark for chemical and residual testing. Humboldt, Martin Lishman, and LaMotte focus on rugged field kits and semi-automatic rigs that cater to mid-sized farms and on-site engineers. Competitive dynamics revolve around integrating sensors, mobile apps, and subscription-based data services to lock in recurring revenue and differentiate on usability.

Key Takeaways

• Current global soil testing market size (2024): US$ 5.94 billion

• Projected global market size (2032): US$ 9.69 billion at a 7.5 % CAGR

• Chemical test methods command the largest market share thanks to their role in nutrient management and pH optimization

• Semi-automatic systems remain the workhorse, yet fully automatic platforms post the fastest market growth as large agribusinesses scale precision programs

• Laboratories collect most revenue today, but on-site solutions are gaining double-digit momentum on the back of portable sensors and smartphone connectivity

• The Agricultural Testing Market perspective underscores soil diagnostics as the critical first step in sustainable crop planning

Market Dynamics

Drivers

• Rising food-demand pressure and the parallel boom in the broader Agricultural Testing Market compel growers to optimize every hectare through data-driven fertility plans.

• Government subsidies for soil-health monitoring and carbon-smart farming lower adoption barriers for smallholders.

• Rapid urbanization fuels construction projects that mandate rigorous soil stability and contamination checks.

Restraints

• Up-front equipment costs remain high for small and marginal farmers even after incentives.

• Skilled-labor shortages in sample preparation and data interpretation slow market penetration in emerging economies.

Opportunities

• Subscription-based soil data services and decision-support software open recurring revenue streams.

• Integration of remote sensing and AI-powered analytics offers predictive soil-health mapping at field scale.

Challenges

• Fragmented regulatory standards across regions complicate cross-border equipment certification.

• Data privacy concerns may limit cloud-based soil databases, requiring robust cybersecurity measures.

Regional Analysis

Asia-Pacific currently holds the largest market share, driven by vast agricultural acreage and rising awareness of resource-efficient farming. North America, however, shows the quickest percentage gains thanks to precision-ag adoption and stringent environmental regulations. Europe follows closely with strict soil-protection directives and strong research funding.

• North America – precision-farming leader; U.S. market estimated to surpass US$ 3 billion by 2032

• Europe – steady growth on the back of Common Agricultural Policy soil-quality mandates

• Asia-Pacific – dominant share; technology uptake in China and India propels volume

• Latin America – sugarcane and soybean expansion triggers demand for fertility profiling

• Middle East & Africa – emerging markets focus on salinity management and desert-soil rehabilitation

Segmentation Analysis

By Test Type

• Chemical – Core decision driver.

Precise NPK and pH data underpin fertilizer prescriptions, explaining the segment’s outsized market share and steady upgrade cycle toward handheld spectrometers.

• Residual – Fast-rising compliance need.

Growing concern over pesticide carryover and heavy-metal buildup is pushing regulators and exporters to mandate residual screening before crop marketing.

• Physical – Foundation for engineering safety.

Compaction, texture, and moisture tests remain indispensable in road, rail, and smart-city projects, anchoring demand from geotechnical consultants.

By Site

• Laboratory – High-accuracy standard.

Advanced instrumentation and strict QA/QC make labs indispensable for reference-grade market analysis and regulatory reporting.

• On-Site – Rapid decision-making edge.

Portable meters and IoT probes offer near-instant insights, letting users adjust irrigation or earthworks in real time and cutting rework costs.

By Degree of Automation

• Manual – Low-cost entry point.

Basic kits serve small farms and educational settings where budget outweighs speed.

• Semi-Automatic – Market mainstay.

Blending affordability with reliability, these systems dominate mid-volume operations and cooperative labs.

• Automatic – Double-digit growth frontier.

Sensor fusion, robotic handling, and AI analytics allow large enterprises to process thousands of samples daily with minimal human intervention.

By End-User

• Agriculture – Nearly half of revenue.

Yield optimization, fertilizer savings, and carbon-credit eligibility keep farming at the center of market trends.

• Construction – Fastest-growing.

Infrastructure booms and stricter building codes demand rigorous soil integrity assessments before ground is broken.

• Others – Landscaping, golf courses, and environmental agencies.

Specialty turf management and remediation projects rely on tailored soil diagnostics to maintain performance and compliance.

Industry Developments & Instances

• December 2023 – Martin Lishman rolled out digital N-P-K test kits aimed at replacing discontinued legacy products and reducing analysis time to under ten minutes.

• August 2023 – Thermo Fisher launched the iCAP RQplus ICP-MS with an automated sampler, bringing trace-element detection into routine Agricultural Testing Market workflows.

• March 2022 – Eurofins expanded into Australia via the acquisition of a precision-ag lab, strengthening its presence in high-value crop zones.

• November 2020 – A new GC/TQ method co-developed by a leading lab and an instrument maker gained EPA approval for dioxin detection, opening up soil-safety testing contracts.

Facts & Figures

• Chemical assays account for roughly 44 % of total market revenue.

• Semi-automatic equipment captures about 39 % market share.

• On-site systems post an estimated 11 % CAGR between 2025 and 2032.

• Asia-Pacific represents nearly 35 % of global revenue in 2024.

• Precision-ag users report up to 18 % fertilizer savings after adopting annual soil testing.

Analyst Review & Recommendations

Soil diagnostics are moving from periodic lab reports to continuous decision engines. Vendors that integrate multi-sensor kits with intuitive mobile apps and offer subscription analytics will capture outsized value. We recommend focusing R&D on automated sample prep, expanding service footprints in the Agricultural Testing Market, and partnering with carbon-credit platforms to embed soil-health verification into sustainability programs. Companies that balance accuracy, speed, and affordability stand to lead as soil stewardship becomes the linchpin of both food security and climate resilience.