Market Overview

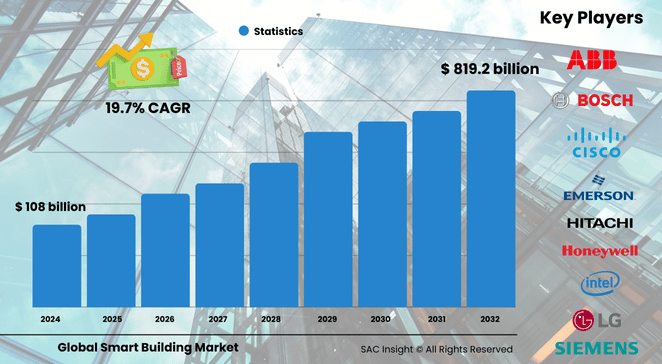

The global smart building market size is currently valued at about US$ 108 billion in 2024 and is set to accelerate to roughly US$ 819.25 billion by 2032, advancing at a healthy 19.7% CAGR throughout the 2025-2032 forecast window. First-hand industry insights confirm three structural drivers: energy-efficiency mandates across commercial real estate, rapid adoption of IoT-enabled building controls, and a decisive swing toward remote-friendly, sensor-rich workspaces.

SAC Insight's deep market evaluation also shows that North America commands nearly 35% market share, while the U.S. smart building market alone is on track to pass US$ 290 billion by 2032 as government incentives and ESG reporting push building owners to modernize portfolios.

Market Trends & Drivers

• Rising demand for integrated security, HVAC, and lighting controls is converging with AI-powered analytics to cut utility costs and carbon footprints.

• Edge computing and 5G connectivity are unlocking real-time building diagnostics, shortening response times for maintenance teams and elevating occupant comfort.

• Net-zero commitments from Fortune 500 tenants are accelerating investment in smart glazing, self-learning thermostats, and on-site renewables, reshaping landlord leasing strategies.

Key Market Players

Established technology majors such as ABB, Cisco Systems, Honeywell, Johnson Controls, Schneider Electric, and Siemens set the competitive tempo with full-suite automation platforms that combine hardware, software, and cloud analytics. They are joined by fast-moving specialists in edge AI, smart meters, and security devices—names like BOSCH, LG Electronics, Hitachi, and Legrand—who are stretching the innovation cycle through focused R&D and targeted acquisitions. Together, these firms shape product roadmaps, influence interoperability standards, and drive most large-scale deployments worldwide.

Key Takeaways

• Market value 2024: USD$ 108 billion

• Projected value 2032: USD$ 819.25 billion at a 19.7% CAGR

• Safety & security solutions account for about 35% of global revenue, reflecting growing focus on integrated video, access, and fire systems.

• Commercial buildings contribute more than half of all spending; offices, malls, and healthcare facilities lead retrofits and new builds.

• Implementation services capture the single-largest services slice (39%), underscoring the need for skilled system integration.

• Lighting controls, though only one subsystem, influence roughly 25% of a building’s energy bill, making smart LEDs and occupancy sensors a quick win for owners.

Market Dynamics

Drivers

• Stringent energy codes and green-building certifications are turning smart systems from optional upgrades into compliance essentials.

• Falling sensor and connectivity costs are lowering the entry barrier for mid-sized properties, broadening the addressable market.

• Government-backed smart-city programs in Asia Pacific and the Middle East are providing funding and pilot projects that boost adoption.

Restraints

• Perceived high upfront costs and integration complexity still deter some facility managers despite clear long-term savings.

• Cyber-security vulnerabilities in IoT devices remain a trust issue, particularly in critical infrastructure and healthcare environments.

Opportunities

• Edge-based AI for predictive maintenance presents a fresh revenue stream for vendors and service partners.

• Growing retrofit demand in Europe’s aging building stock opens a sizable market for plug-and-play wireless controls and analytics overlays.

Challenges

• Fragmented protocol landscape hinders seamless interoperability across legacy BAS, leading to integration delays.

• Shortage of skilled technicians capable of designing and servicing multi-vendor smart building ecosystems could slow project timelines.

Regional Analysis

The North America leads global smart building market growth on the back of robust digital infrastructure, progressive energy policies, and early corporate ESG adoption. Europe follows closely, driven by net-zero legislation and active retrofit programs. Asia Pacific is the fastest climber, propelled by urbanization, large-scale smart-city rollouts, and rising disposable incomes.

• North America – Mature market with strong federal and state incentives for efficiency upgrades.

• Europe – High retrofit activity, aggressive carbon-reduction targets, and strong demand for integrated workplace management systems.

• Asia Pacific – Rapid new-build pipeline, 5G rollouts, and government-backed smart-city pilots.

• Latin America – Gradual adoption led by commercial hubs seeking lower operating expenses.

• Middle East & Africa – Ambitious mega-projects and hospitality investments are anchoring early deployments.

Segmentation Analysis

By Solution

• Safety & Security Management – Largest revenue contributor Integrated access control, video analytics, and fire-life safety platforms form the backbone of risk mitigation strategies across commercial sites. Building owners favor IP-based devices that feed unified dashboards for real-time response.

• Energy Management – Fastest-growing segment Smart thermostats, self-learning HVAC controls, and AI-driven demand-response systems trim utility bills and support carbon targets, making this segment a magnet for new entrants.

• Building Infrastructure Management – Emerging value-add Smart elevators, water-use analytics, and waste-monitoring sensors enhance operational resilience and tenant satisfaction, especially in high-rise complexes.

• Integrated Workplace Management Systems (IWMS) – Rising adoption Cloud-based IWMS unify lease, space, and facilities data, enabling portfolio managers to optimize occupancy and streamline maintenance.

• Network Management – Foundational enabler Both wired and wireless networks support massive sensor deployments; Wi-Fi 6 and private 5G are becoming preferred backbones for latency-sensitive applications.

By Service

• Consulting – Sets strategy and ROI modeling Advisory teams map digital-transformation roadmaps that align with regulatory and ESG objectives, helping clients prioritize investments.

• Implementation – Largest service slice System integrators configure, program, and commission multi-vendor platforms, ensuring smooth handover and minimal downtime.

• Support & Maintenance – Rapid CAGR Always-on monitoring, software updates, and remote diagnostics keep building systems secure and efficient, anchoring recurring revenue for vendors.

By End-use

• Commercial – Over 50% market share Corporate offices, malls, airports, and hospitals adopt smart systems to lower operating expenses and enhance occupant experience.

• Residential – Accelerating upgrades Smart locks, lighting, and energy dashboards are moving from luxury condos into mainstream multifamily developments as costs fall.

• Industrial – Niche but expanding Factories and logistics hubs leverage smart building analysis to improve worker safety, indoor air quality, and equipment uptime.

Industry Developments & Instances

• May 2024 – A global automation leader acquired a Chinese electrical-fittings unit, broadening its smart home and door-locking portfolio.

• September 2023 – A building-technology giant teamed with a telco to bundle automation and connectivity services aimed at enterprise net-zero goals.

• July 2023 – A multinational signed an agreement with a European real-estate investor to outfit Greek developments with integrated building automation.

• January 2023 – A major energy-management firm launched a home energy suite featuring high-power solar inverters, battery storage, and EV chargers.

• March 2023 – A leading controls provider introduced a plug-and-play IoT box for small-to-medium properties, offering fast energy and air-quality optimization.

Facts & Figures

• Buildings account for nearly 40% of global energy consumption; lighting alone represents about 25% of that load.

• Predictive analytics tied to automated controls can deliver around 20% annual energy savings, according to field data.

• Implementation services captured roughly 38.9% of total services revenue in 2023.

• Commercial buildings commanded 53.6% of global smart building spending in 2023.

• Safety & security systems held a 35.2% share of solution revenue last year, underscoring the demand for integrated protection.

Analyst Review & Recommendations

The smart building landscape is shifting from isolated automation projects to fully connected, data-rich ecosystems. Vendors that pair edge AI with secure, open platforms will gain the confidence of owners seeking future-proof investments. Service providers should double down on cyber-security skills and cross-platform integration to capture the growing support and maintenance opportunity. Investors can expect sustained market growth as net-zero deadlines draw closer and operating-cost pressures mount across global real-estate portfolios.