Market Overview

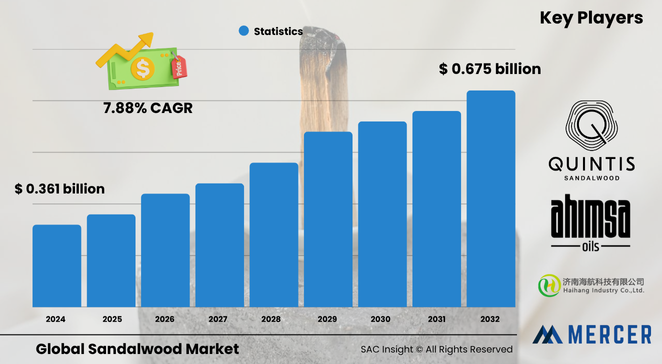

The global sandalwood market size is valued at roughly US$ 0.361 billion in 2024 and is projected to reach about US$ 0.675 billion by 2032, expanding at an average 7.88 % CAGR. SAC Insight's first-hand industry insights highlight three clear growth engines: a surge in demand for natural fragrances, wider therapeutic use in aromatherapy and topical remedies, and heavy investment in sustainable plantations to ease supply constraints. SAC Insight's deep market evaluation shows the United States sandalwood market alone could advance toward the US$ 0.12 billion mark by 2032 as premium personal-care brands push for traceable, high-purity oil.

Summary of Market Trends & Drivers

• Heightened consumer focus on clean-label beauty and wellness products is propelling sandalwood oil inclusion across perfumes, serums, and spa blends.

• Regulatory pressure on illegal logging is accelerating plantation projects in Australia, India, and Southeast Asia, stabilising long-term supply and market growth.

• Rising disposable income in Asia-Pacific and North America supports luxury incense, sculpture, and furniture segments that rely on certified heartwood.

Key Market Players

Global leadership rests with vertically integrated growers and specialist distillers. Quintis, Santanol Group, and WA Sandalwood Plantations manage extensive Australian estates and contract distillation capacity to guarantee consistent santalol yields. Indian champions such as KS&DL and Sandalwood Forest leverage government partnerships to secure raw wood and expand export-grade oil lines. On the formulation side, companies like Ahimsa Oils, G. Organica, Veda Oils, and Haihang Industry supply concentrates or blended compounds to personal-care and aromatherapy brands, often differentiating through organic certification and fair-trade programs.

Competitive dynamics increasingly revolve around sustainable sourcing and product innovation. Plantation owners are pairing rapid-growth host trees with precision irrigation to shorten harvest cycles, while downstream blenders experiment with fractionated oils for customised olfactory profiles. M&A activity—especially Australian growers acquiring Indian nurseries—aims to diversify genetics and hedge climate risk.

Key Takeaways

• Current global market size (2024): USD$ 0.361 billion

• Projected global market size (2032): USD$ 0.675 billion at a 7.88 % CAGR

• Asia-Pacific commands the largest market share, exceeding 37 % of revenue thanks to favourable growing conditions and deep cultural demand

• Indian sandalwood retains the premium price position due to higher santalol content, while Australian sandalwood leads volume trade

• Personal-care applications capture more than 40 % of total revenue and are set to exceed USD$ 0.29 billion by 2032

• Plantation expansions of over 5 000 hectares were announced in 2024, signalling investor confidence in long-range market trends

Market Dynamics

Drivers

• Accelerating shift toward natural ingredients in cosmetics and home fragrance lines

• Proven anti-inflammatory and antimicrobial benefits underpinning pharmaceutical and dermatology use

Restraints

• Long tree maturation periods and limited suitable land restrict immediate supply increases

• Price volatility driven by occasional illegal harvesting and export bans

Opportunities

• Biotechnological advances in tissue culture and micro-propagation can cut seedling lead times by up to 40 %

• Rising interest in carbon-credit income from well-managed sandalwood plantations offers an extra revenue stream

Challenges

• Climate change intensifies drought and pest risks, demanding greater agronomic investment

• Complex trade regulations and CITES compliance add administrative costs for exporters

Regional Analysis

Asia-Pacific dominates mainly because Australia, India, and Indonesia deliver the bulk of global supply and host strong local demand in personal care and religious rituals. North America shows the fastest relative gains as wellness brands incorporate sustainably sourced oil and consumers pay premiums for clean scents.

• Asia-Pacific – Largest producer and consumer, over 37 % share, buoyed by heritage use and plantation scale-up

• North America – Rapid adoption in luxury skincare; projected 7.4 % CAGR through 2032

• Europe – Steady high-end perfume demand; strict traceability rules favour certified suppliers

• Middle East & Africa – Religious and cultural incense applications sustain niche growth

• Latin America – Emerging cultivation trials in Brazil seek to diversify forestry income

Segmentation Analysis

By Type

• Indian Sandalwood – High-santalol, premium niche.

Cultivated largely in Karnataka and Tamil Nadu, it commands the highest prices because fragrance houses value its rich, creamy aroma for flagship perfumes.

• Australian Sandalwood – Volume leader, sustainable supply.

Harvests from Western Australia supply bulk oil for mid-tier cosmetics and incense, benefiting from shorter rotation cycles and government-backed sustainability audits.

• Others – Pacific and African species, cost-sensitive markets.

Vanuatu, Fiji, and Tanzania contribute small but rising output, feeding regional artisans and lower-priced aromatherapy blends.

By Form

• Powder – Traditional and industrial versatility.

Finely milled heartwood is popular in ayurvedic pastes, incense sticks, and natural colourants, retaining fragrance for years.

• Liquid – Core revenue engine.

Steam-distilled oil offers concentrated santalol, making it indispensable for luxury perfumes, diffuser blends, and therapeutic topicals.

By Application

• Personal Care – Core demand driver.

Cleansers, serums, and beard oils use sandalwood for soothing and anti-blemish claims, underpinning consistent double-digit market growth.

• Aromatherapy – Wellness momentum.

Stress-relief diffusion and massage blends rely on calming notes; certified organic oil fetches price premiums in specialist channels.

• Pharmaceuticals – Niche but rising.

Clinical research exploring anti-inflammatory and antiviral properties is stimulating demand from topical ointment makers.

• Sculpture & Furniture – Heritage craft.

Carved idols and luxury inlays in India and China sustain steady wood demand despite high prices, aided by affluent gifting culture.

• Others – Flavouring, religious offerings, R&D.

Food-grade extracts, temple rituals, and experimental bio-actives provide incremental volume.

Industry Developments & Instances

• August 2024 – Quintis initiated a 326-hectare Indian sandalwood plantation expansion in Western Australia, planting over 150 000 seedlings under drip irrigation.

• May 2024 – Santanol Group launched a carbon-neutral oil line certified by an international climate-finance body, catering to eco-conscious fragrance brands.

• February 2024 – KS&DL partnered with a biotech start-up to deploy tissue-culture labs aimed at doubling high-yield sapling output by 2025.

Facts & Figures

• Certified plantations now represent roughly 60 % of global harvested volume, up from 45 % in 2020.

• Average santalol content: Indian sandalwood > 4 % vs Australian sandalwood 2.5 %.

• Powder form accounts for nearly 25 % of market share, driven by incense production in India and China.

• Legal exports from India rose 8 % year-on-year in 2024 following streamlined permitting.

• Plantation yields reach 5-7 tonnes of heartwood per hectare at 15-20 years, depending on host-tree mix.

Analyst Review & Recommendations

Our market analysis confirms that sustainable cultivation is no longer optional; buyers increasingly audit supply chains before signing contracts. Producers should prioritise genotype selection and water-efficient farming to mitigate climate risks while accelerating tissue-culture propagation to compress lead times. Downstream brands will win by clearly communicating provenance and by developing differentiated scent profiles through fractionated oils and blends with complementary botanicals. Overall market growth looks resilient, but stakeholder collaboration on certification and reforestation will be critical to unlock full value through 2032.