Market Overview

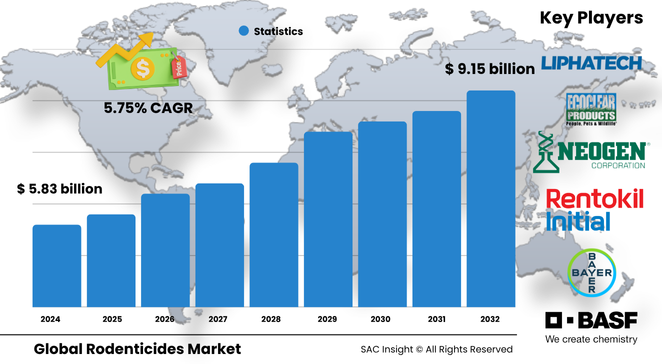

The global rodenticides market size is estimated at about US$ 5.83 billion in 2024 and is projected to reach roughly US$ 9.15 billion by 2032, reflecting a steady 5.75 % CAGR through the 2025-2032 forecast window. First-hand industry insights indicate market growth is propelled by persistent urbanisation, rising rodent-borne disease outbreaks, and tightening hygiene standards across commercial real estate and food supply chains. SAC Insight's deep market evaluation shows the United States rodenticides market alone could advance from around US$ 1.8 billion in 2024 to more than US$ 2.8 billion by 2032 as cities upgrade pest-control contracts and agriculture adopts integrated rodent management.

Summary of Market Trends & Drivers

• Plant-based and low-toxicity baits are gaining traction as regulators clamp down on secondary poison risks.

• Hospitality, healthcare, and logistics operators are signing multi-year service agreements, pushing demand for block and pellet formulations that withstand humidity and temperature swings.

• Technology-enabled monitoring—smart traps and data dashboards—helps pest-control firms optimise bait placement and shrink chemical use, underpinning sustainable market growth.

Key Market Players

The competitive landscape blends diversified chemical majors with specialist pest-management brands. Leaders such as BASF, Bayer, Syngenta, and UPL supply broad product portfolios and invest heavily in R&D for next-generation anticoagulants and biological actives. Service-centric groups—Rentokil Initial, Rollins, Anticimex, and Ecolab—leverage dense technician networks and analytics platforms to secure recurring revenue.

Niche innovators including Neogen, Bell Laboratories, Liphatech, JT Eaton, PelGar International, Senestech, Impex Europa, and EcoClear focus on targeted baits, contraceptive-based population control, and eco-friendly paste formulations. Consolidation, regional acquisitions, and co-development deals remain central to defending market share and expanding into high-growth Asia-Pacific corridors.

Key Takeaways

• Current global rodenticides market size (2024): about USD$ 5.83 billion

• Forecast global market size (2032): roughly USD$ 9.15 billion at a 5.75 % CAGR

• Asia-Pacific leads market share as erratic weather drives rodent surges and over 3 000 pest-control firms compete on service quality

• Anticoagulants dominate revenue today but non-anticoagulant and biological lines show the fastest market growth

• Blocks hold the largest form segment thanks to durability outdoors, while pellets are gaining as seed-like shape boosts uptake

• Data-driven rodent monitoring and hybrid bait stations are emerging market trends shaping procurement decisions

Market Dynamics

Drivers

• Rapid urban population growth heightens exposure to rodent infestations and related public-health risks.

• Rising food-wastage costs in agriculture and logistics push operators toward proactive rodent-proofing and baiting.

• Introduction of biodegradable, pet-safe baits broadens household adoption.

Restraints

• Stringent regulations on second-generation anticoagulants and concern over non-target species hamper unrestricted product rollout.

• Growing consumer preference for chemical-free solutions can defer purchases in favour of mechanical traps.

Opportunities

• Subscription-based pest-control services and IoT-enabled monitoring open new recurring-revenue channels.

• Emerging markets in Southeast Asia, Africa, and South America require scalable rodent solutions for expanding grain-storage infrastructure.

Challenges

• Resistance to conventional anticoagulants among Norway rats and house mice raises formulation costs.

• Supply-chain volatility for key active ingredients can delay production and inflate input prices.

Regional Analysis

Asia-Pacific commands the largest revenue share thanks to dense urban centres, variable climates that trigger rodent outbreaks, and an expanding middle class demanding higher hygiene standards. North America follows closely, buoyed by strong safety regulations and mature service networks, while Europe faces slower market growth amid stricter chemical bans and secondary-kill concerns.

• North America – High service penetration; renovation activities displace rodents into urban cores.

• Europe – Fragmented pest-control landscape; regulations favour low-toxicity alternatives.

• Asia-Pacific – Fastest growth; extreme weather and intensive rice and grain farming amplify rodent pressure.

• Central & South America – Crop losses and warehouse infestations spur steady demand.

• Middle East & Africa – Gradual uptake tied to expanding hospitality and retail sectors.

Segmentation Analysis

By Product

• Anticoagulant – Backbone of the market.

Anticoagulants command the majority share because they offer proven, broad-spectrum efficacy and flexible bait formats. Second-generation actives require only a single feed, making them popular for severe infestations, although regulatory scrutiny is increasing.

• Non-anticoagulant – Fastest-rising niche.

Rapid-action chemistries such as bromethalin and cholecalciferol find favour where swift knock-down or resistance management is critical. Growth is accelerated by integrated pest-management protocols that rotate active ingredients.

By Form

• Blocks – Outdoor durability leader.

Weather-proof coatings and mould resistance make blocks the preferred choice for sewers, farms, and perimeter bait stations.

• Pellets – High uptake in agriculture and household.

Seed-like appearance and easy broadcast application entice rodents in storage bins and residential lofts, driving robust volume gains.

• Powder – Specialist, controlled use.

Powder dusts are applied in voids and burrows but face limited market growth due to inhalation and pet-safety concerns.

By Application

• Urban Centers – Core demand engine.

Dense housing, restaurant clusters, and aging infrastructure concentrate infestations, prompting municipalities to budget for routine baiting and trapping.

• Pest Control Companies – Largest commercial slice.

Service firms buy in bulk and standardise on multi-season block baits, supporting predictable market analysis and procurement cycles.

• Household – Rapid CAGR.

Rising consumer awareness of zoonotic diseases and availability of pet-friendly products stimulate retail sales.

• Agriculture – Critical for grain protection.

Field rodents threaten yields and stored crops; growers integrate baiting with habitat management to reduce losses.

• Warehouses – High-risk nodes.

Rodents shelter in pallets and containers; integrated monitoring and bait placement mitigate product contamination.

Industry Developments & Instances

• April 2023 – Strike MAX CITO soft-bait paste launched for rapid knock-down in commercial sites.

• January 2022 – Acquisition of bio-insecticides UniSpore and NemaTrident bolstered biological pest-control portfolios.

• June 2022 – Butik S eco-friendly anticoagulant debuted for Malaysian paddy fields, designed for barn-owl integration.

• July 2021 – Harmonix Rodent Paste introduced as the first professional cholecalciferol bait cleared for open-air use.

• September 2021 – Contrac California Bromethalin single-feed bait gained new state registration, widening non-anticoagulant options.

Facts & Figures

• Current anticoagulants account for roughly 77 % of product revenue.

• Urban nationwide surveys show over 14 % of US homes report rodent sightings each year.

• Blocks represent close to 46 % of global sales value owing to durability.

• Asia-Pacific market expected to post a 7.6 % CAGR between 2025 and 2032, outpacing all regions.

• Household rodenticide demand is projected to climb at around 7 % annually as pet-safe formulations expand retail shelves.

Analyst Review & Recommendations

Market analysis signals a pivot toward integrated, data-driven rodent management that combines smart monitoring with lower-toxicity baits. Suppliers should accelerate R&D into resistance-breaking actives and biodegradable carriers while partnering with service firms to embed digital sensors in bait stations. For sustained market growth, prioritise education campaigns that highlight public-health benefits and safe usage, and invest in rapid-registration pathways for biological or contraceptive solutions to diversify revenue and meet tightening regulatory expectations."