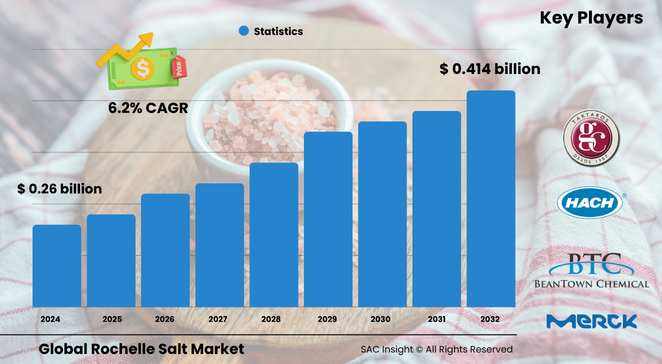

Market Overview

The global rochelle salt market size is valued at about US$ 0.26 billion in 2024 and, according to SAC Insight's deep market evaluation, is projected to reach almost US$ 0.414 billion by 2032, registering a steady 6.2% CAGR over 2025-2032. Growth rides on three pillars: rising demand for piezoelectric materials in sensors and medical devices, solid investment in clean-label food additives, and renewed interest in specialty electroplating chemistries. Market analysis indicates that the United States rochelle salt market alone could advance from around US$ 70 million in 2024 to roughly US$ 110 million by 2032 as domestic electronics and nutraceutical producers seek reliable, high-purity tartrate supplies.

Summary of Market Trends & Drivers

• Health-focused consumers are accelerating clean and multifunctional ingredient uptake, boosting food-grade sales.

• Miniaturized microphones, earpieces, and emerging haptic interfaces rely on tartrate-based piezo crystals, driving industrial-grade shipments.

• Regional supply chains are localizing after pandemic disruptions, spurring long-term offtake agreements between chemical distributors and device OEMs.

Key Market Players

Leadership rests with a blend of global chemical majors and nimble specialty producers. Firms such as Merck, Honeywell, Thermo Fisher Scientific, and Sigma-Aldrich anchor the high-purity segment, leveraging robust distribution and stringent quality systems. Meanwhile, European tartrate specialists like Novarina, Pahí, and Tártaros Gonzalo Castelló maintain an edge in food-grade and electroplating grades through vertical integration with winery by-products and flexible batch processing.

Competitive dynamics center on purity improvement, particle-size control, and faster lead times. Several players are investing in continuous crystallization lines and advanced drying technologies to trim costs and capture greater market share in premium applications.

Key Takeaways

• Current global market size (2024): about USD$ 0.26 billion

• Projected global market size (2032): USD$ 0.414 billion at a 6.2 % CAGR

• Food-grade Rochelle salt represents the largest revenue slice, aided by bakery and confectionery demand

• Piezoelectric device manufacturing is the fastest-growing application, adding over 35 % of incremental market growth by 2032

• Europe leads the market share due to entrenched tartrate processing hubs; Asia-Pacific shows the quickest percentage gains

• Ongoing purification upgrades are trimming heavy-metal impurities below 2 ppm, meeting stricter electronics standards

Market Dynamics

Drivers

• Expanding bakery and preserves production lifts food-grade usage as a stabilizer and pectin reactant

• Rising adoption of piezo-based sensors in automotive collision detection and consumer wearables accelerates industrial-grade demand

• Electroplating and silver-mirror processes recover in tandem with construction and luxury goods spending

Restraints

• Price pressure from unorganized suppliers in developing regions compresses margins for premium vendors

• Environmental regulations on tartrate extraction and disposal raise compliance costs for small producers

Opportunities

• Bio-based production routes using winery waste streams unlock circular-economy branding and cost savings

• Customized particle morphologies for additive-manufacturing feedstocks open a niche, high-value revenue stream

Challenges

• Supply-chain bottlenecks for potassium carbonate and other precursors can delay large-volume orders

• Limited profitability discourages new entrants, heightening dependence on a small group of established suppliers

Regional Analysis

Europe commands the largest market share owing to well-established tartaric acid refining clusters, diversified end-use bases, and rigorous quality standards demanded by pharmaceutical and electronics customers. Asia-Pacific is the clear growth hotspot as India, China, and Japan scale electronics output and convenience foods. North America follows, propelled by medical device manufacturing and a rebound in electroplating operations.

• Europe – Largest revenue base, supported by integrated wine-industry feedstock and advanced processing know-how

• Asia-Pacific – Fastest CAGR, driven by electronics exports and expanding bakery chains

• North America – Stable demand from medical sensors, silver-mirror production, and specialty chemicals

• Latin America – Moderate growth tied to regional beverage and confectionery expansion

• Middle East & Africa – Niche demand in analytical reagents and emerging food-processing industries

Segmentation Analysis

By Type

• Food Grade – Core volume driver.

Rising consumption of jams, jellies, and low-sugar confectionery keeps food-grade tartrate in steady demand. Clean-label positioning and its GRAS status strengthen its role as a sequestering agent in processed foods.

• Industrial Grade – High-margin niche.

Industrial grade fetches premium pricing because tight control of metal ions and water content is critical for piezoelectric crystal growth and high-precision electroplating baths.

By Application

• F&B – Dominant share.

Nearly half of global shipments serve stabilizing, buffering, and leavening functions in bakery mixes, gelatin desserts, and meat preservation. Consistent snack and convenience-food trends underpin this pillar.

• Electroplating – Technical growth pocket.

Rochelle salt’s chelating ability enhances silver deposition and mirror finishing, supporting demand from automotive trim, decorative hardware, and specialty optics producers.

• Pharmaceuticals – Emerging opportunity.

Use as a mild laxative and reagent in diagnostic formulations is limited but rises steadily with generics output and research reagent consumption.

By Product Form

• Powder – Widest adoption.

Fine powders offer easy dispersion in aqueous systems, making them the default format for most food and lab uses.

Extensive sieving and spray-drying upgrades are ensuring uniform particle distribution, cutting batch-to-batch variability for ingredient blenders.

• Crystal – Specialized piezo feedstock.

Large, well-defined crystals remain critical for acoustic transducers and heritage gramophone pick-ups.

Dedicated growth chambers with controlled temperature gradients are improving yield and cutting waste in crystal cropping.

• Solution – Convenience-driven.

Ready-to-use liquid solutions simplify titration and plating bath make-up for smaller labs and plating shops.

Suppliers are rolling out stabilized formulations that extend shelf life and reduce residue build-up in reagent dispensers.

Industry Developments & Instances

• April 2025 – A leading European tartrate refiner commissioned a continuous crystallization unit, boosting food-grade capacity by 15 %.

• February 2025 – A U.S. specialty-chemicals firm signed a multi-year supply pact with a medical-sensor OEM for high-purity industrial grade.

• November 2024 – An Indian bakery-ingredients player launched premixes featuring Rochelle salt for low-sodium dough conditioning.

• August 2024 – A joint R&D project in Japan achieved sub-5 ppm iron levels in crystal tartrate, targeting high-frequency piezo discs.

• May 2024 – A Spanish electroplating additive supplier unveiled a silver-mirror kit using stabilized Rochelle salt solution for artisan producers.

Facts & Figures

• Food-grade tartrate accounts for roughly 55 % of global market revenue in 2024.

• Piezoelectric applications are projected to post a 9 % CAGR from 2025-2032, outpacing overall market growth.

• Continuous-process refiners can cut energy consumption by up to 18 % compared with traditional batch crystallizers.

• Europe represents about 34 % of 2024 global sales, while Asia-Pacific contributes close to 29 %.

• Average spot price for high-purity Rochelle salt rose nearly 6 % year-on-year between 2023 and 2024 due to logistics tightness.

Analyst Review & Recommendations

The Rochelle salt market growth outlook is positive yet measured. Suppliers that invest in ultra-low-impurity processing, secure circular raw-material streams, and offer application-specific grades stand to capture outsized market share. We recommend prioritizing technical partnerships with sensor makers, expanding food-grade capacities in emerging markets, and cultivating on-site regeneration services for electroplating baths to lock in customer loyalty and diversify revenue through 2032."