Market Overview

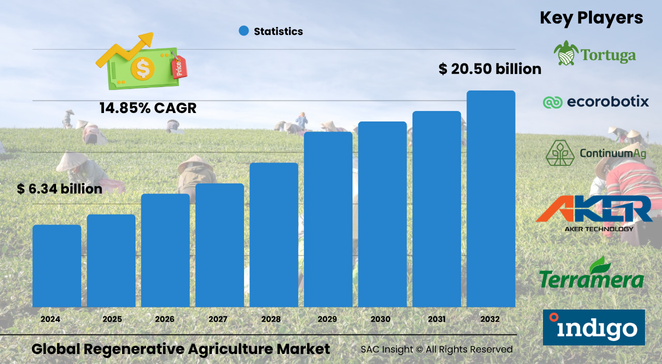

The global regenerative agriculture market size is currently valued at about US$ 6.34 billion in 2024 and is set to climb to nearly US$ 20.50 billion by 2032, reflecting an average 14.85 % CAGR. SAC Insight industry insights highlight three structural growth engines: government incentives rewarding soil-carbon gains, food brands race-marking “climate-positive” labels, and farm-level economics that cut input costs while raising long-term yields.

SAC Insight analysis shows the United States regenerative agriculture market alone could move from roughly US$ 1.8 billion in 2024 to around US$ 5.2 billion by 2032 as federal conservation programs expand and corporate supply-chain contracts lock in acreage.

Summary of Market Trends & Drivers

• Retail demand for transparent, low-impact food is mainstreaming regenerative certification, nudging agribusiness procurement toward outcome-based contracts.

• Digital agronomy tools—remote-sensing soil-carbon indices, AI-driven cover-crop decisions, and blockchain traceability—are turning regenerative promises into measurable metrics, accelerating market growth.

• Carbon-credit payouts and blended finance from climate funds are de-risking practice change for midsize producers, widening adoption beyond early adopters.

Key Market Players

The competitive landscape blends ag-tech start-ups with global food majors and sustainability investors. Companies such as Indigo Ag, Continuum Ag, Vayda, Terramera, Aker Technologies, Ruumi, Biotrex, Ecorobotix, and Tortuga Agricultural Technologies provide field-level data, biological inputs, and autonomous equipment that translate regenerative principles into scalable operations. Alongside them, multinational food groups are underwriting long-term offtake agreements to secure regenerative supply chains, while venture funds like Astanor channel capital into soil-health analytics and remote-sensing platforms.

Competition increasingly centers on integrated service bundles—combining satellite monitoring, agronomic advisory, and access to carbon markets—that lower entry barriers for farmers and lock in recurring revenue for providers.

Key Takeaways

• Current global regenerative agriculture market size (2024): roughly US$ 6.34 billion

• Projected global market size (2032): about US$ 20.50 billion at a 14.85% CAGR

• North America holds the largest market share, led by strong policy support and corporate sourcing commitments

• Solutions capture around two-thirds of revenue, but services are the faster-growing component as farmers outsource soil testing and certification

• Agroforestry is the leading practice segment, while aquaculture/ocean farming shows the quickest percentage gains

• First-generation digital MRV (measurement-reporting-verification) tools are reshaping market trends by monetising carbon and biodiversity outcomes

Market Dynamics

Drivers

• Expanding government cost-share and carbon-credit schemes improve return on investment for regenerative transitions

• Rising consumer willingness to pay for climate-smart food boosts downstream demand and contractual premiums

• Proven agronomic benefits—improved water retention, reduced fertiliser spend—strengthen the economic case for adoption

Restraints

• Limited farmer awareness of technical protocols and certification pathways slows conversion rates

• Upfront costs for specialised equipment and biological inputs strain cash-flow in low-margin operations

• Patchy regional research data creates uncertainty around best-fit practices for specific soils and climates

Opportunities

• Biological seed coatings and microbial inoculants that enhance carbon sequestration represent a high-margin product niche

• Fintech platforms bundling input finance with outcome-based repayment can open emerging-market acreage

• Food-service chains seeking verified low-footprint protein offer new offtake channels for regenerative aquaculture

Challenges

• Fragmented value chains force producers to manage processing, packaging, and distribution without mature local infrastructure

• Verification standards are still evolving, risking certification fatigue and buyer confusion

• Climate variability—droughts, floods—can undermine early yield gains, testing farmer confidence

Regional Analysis

North America dominates thanks to robust conservation funding, venture investment, and early retail adoption of regenerative labels. Europe follows closely, propelled by the Common Agricultural Policy’s eco-schemes and corporate biodiversity pledges. Asia-Pacific is the fastest-growing region as governments in India, China, and Australia seek scalable, low-input solutions for vast croplands.

• North America – Largest revenue base; strong policy and private-sector demand

• Europe – Rapid market share acceleration through eco-schemes and corporate carbon goals

• Asia-Pacific – Quickest CAGR driven by large arable land and government soil-health programs

• Latin America – Emerging growth led by agroforestry and silvopasture in Brazil and Mexico

• Middle East & Africa – Early-stage adoption focused on water-saving no-till and biochar practices

Segmentation Analysis

By Component

• Solutions – Portfolio workhorse, dominant share.

Solutions include cover-crop seed, compost, biochar, and digital MRV software that deliver immediate agronomic value and measurable outcomes, keeping this segment in the lead.

• Services – Fastest-growing, advisory-led.

Consulting, soil testing, certification, and carbon-market onboarding services are scaling as farmers seek turnkey guidance and audit support without hiring in-house experts.

By Practice

• Agroforestry – High biodiversity, stable income.

Intercropping trees with cash crops adds shade, windbreaks, and perennial revenue streams, making agroforestry the most widely adopted regenerative practice.

• Silvopasture – Livestock plus trees, soil boost.

Combining managed grazing with timber or fruit trees improves animal welfare and soil organic matter, attracting ranchers in temperate regions.

• Aquaculture/Ocean Farming – Coastal carbon sink.

Seaweed and shellfish farming sequester carbon, filter water, and diversify farmer revenue, driving double-digit market growth.

• No-Till & Pasture Cropping – Erosion defence.

Reducing soil disturbance and integrating perennial groundcovers cut fuel use and improve water infiltration, popular among grain producers.

• Holistically Managed Grazing – Rotational resilience.

High-density, short-duration grazing mimics natural herd movement, stimulating root growth and carbon drawdown across rangelands.

• Biochar – Long-term carbon storage.

Biochar incorporation stabilises organic carbon and improves nutrient cycling, gaining traction where biomass residues are abundant.

• Others – Agroecology, terra preta, mixed systems.

Specialised local practices adapt regenerative principles to micro-climates and cultural preferences, creating a diverse long-tail segment.

By End-User

• Service Organizations – Advisory backbone.

Consultancies, certifiers, and ag-tech firms capture the largest market share by guiding, measuring, and financing practice adoption for growers.

• Farmers – Accelerating adopters.

Producers embracing regenerative models gain input savings and new revenue through ecosystem-service payments, making them the fastest-growing user group.

• Financial Institutions – Carbon-credit financiers.

Banks and impact funds bundle loans with outcome-based repayment linked to soil-carbon gains, embedding finance deeper into the value chain.

• Advisory Bodies – Policy and extension hubs.

Universities and NGOs translate research into field protocols and lobby for supportive policy.

• Consumer Packaged Goods Manufacturers – Demand catalysts.

Brands commit acreage targets and long-term contracts to secure regenerative supply, anchoring downstream pull.

By Application

• Soil and Crop Management – Core demand engine.

Cover-cropping, composting, and nutrient cycling practices dominate spend as they deliver quick soil-health gains.

• Carbon Sequestration – Monetisable outcome.

Projects quantifying below-ground carbon stock change tap voluntary-carbon-market revenue, creating a fast-growing sub-segment.

• Biodiversity & Ecosystem Services – Emerging premium.

Pollinator strips, riparian buffers, and habitat corridors attract eco-credit finance and CSR budgets.

• Water Retention & Nitrogen Fixation – Agronomic ROI.

Higher infiltration and biological nitrogen reduce irrigation and synthetic fertiliser bills, reinforcing farmer economics.

• Operations Management & Others – Digital oversight.

Software-driven grazing plans, drone scouting, and predictive analytics streamline regenerative operations and document impact.

Industry Developments & Instances

• April 2025 – A global food major committed USD$ 30 million to a multi-stakeholder fund incentivising U.S. corn and soy growers to transition 250 000 acres to regenerative practices.

• November 2024 – A venture-backed start-up launched an AI-powered soil-carbon MRV platform, halving verification time for carbon-credit issuers.

• June 2024 – A leading ag-equipment maker introduced an autonomous cover-crop seeder targeting mid-sized farms, reducing labour needs by 40 %.

• January 2024 – A European retailer unveiled a private-label range sourced entirely from certified regenerative farms across Spain and France.

Facts & Figures

• Agroforestry accounts for roughly 19 % of current practice revenue.

• Solutions hold about 64 % market share, while services are expanding at over 16 % CAGR.

• North America commands close to 36 % of global revenue today.

• Verified carbon-credit payouts average 30 – 45 USD$ per tonne of CO2e sequestered.

• Farms adopting no-till report up to 25 % fuel savings and a 15 % cut in synthetic nitrogen usage within three seasons.

Analyst Review & Recommendations

Regenerative agriculture is shifting from pilot plots to mainstream supply-chain strategy. Providers that couple biological inputs with data-rich verification and outcome-based finance will outpace average market growth. Farmers should prioritise low-cost, high-impact practices—cover crops, rotational grazing—before layering advanced MRV. Policy makers can accelerate adoption by standardising credit protocols and funding region-specific research. Overall, the market presents a compelling trifecta: agronomic resilience, measurable climate impact, and expanding consumer pull."